Answered step by step

Verified Expert Solution

Question

1 Approved Answer

available: Maturity 0.5 1.5 1.5 2.0 Coupon Rate 0% 8% 0% 0% Imagine that currently in the market the following bonds are Price $

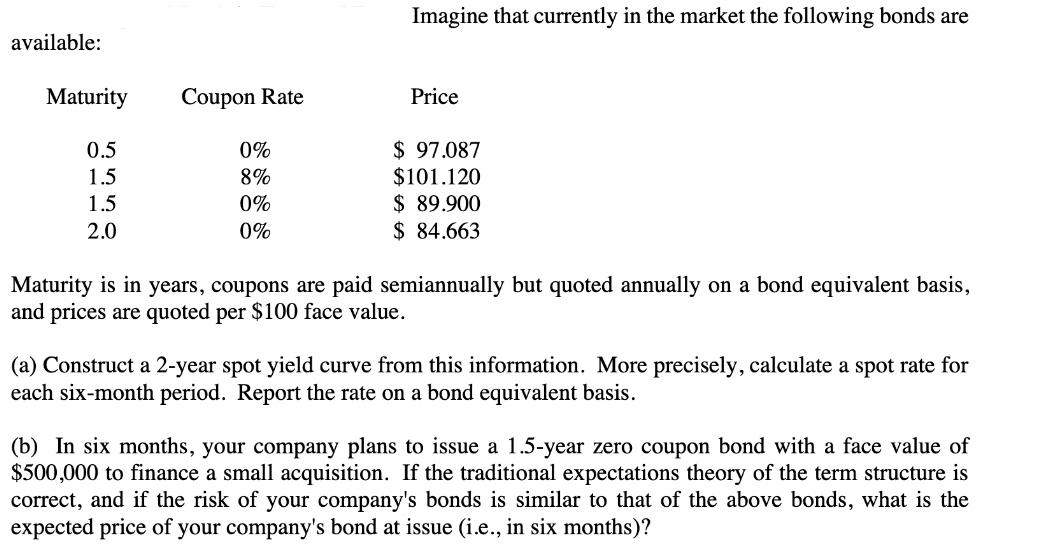

available: Maturity 0.5 1.5 1.5 2.0 Coupon Rate 0% 8% 0% 0% Imagine that currently in the market the following bonds are Price $ 97.087 $101.120 $89.900 $ 84.663 Maturity is in years, coupons are paid semiannually but quoted annually on a bond equivalent basis, and prices are quoted per $100 face value. (a) Construct a 2-year spot yield curve from this information. More precisely, calculate a spot rate for each six-month period. Report the rate on a bond equivalent basis. (b) In six months, your company plans to issue a 1.5-year zero coupon bond with a face value of $500,000 to finance a small acquisition. If the traditional expectations theory of the term structure is correct, and if the risk of your company's bonds is similar to that of the above bonds, what is the expected price of your company's bond at issue (i.e., in six months)?

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started