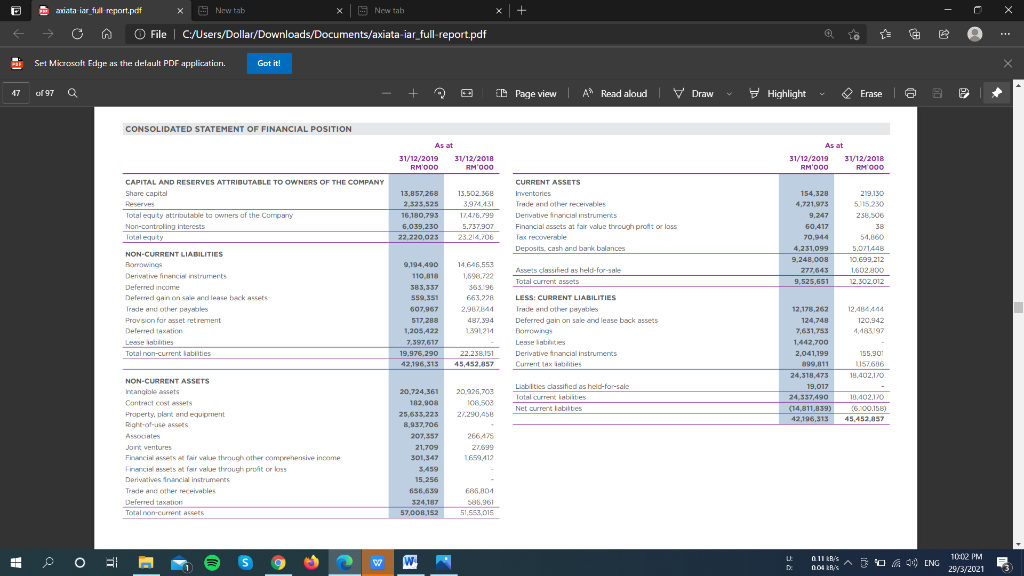

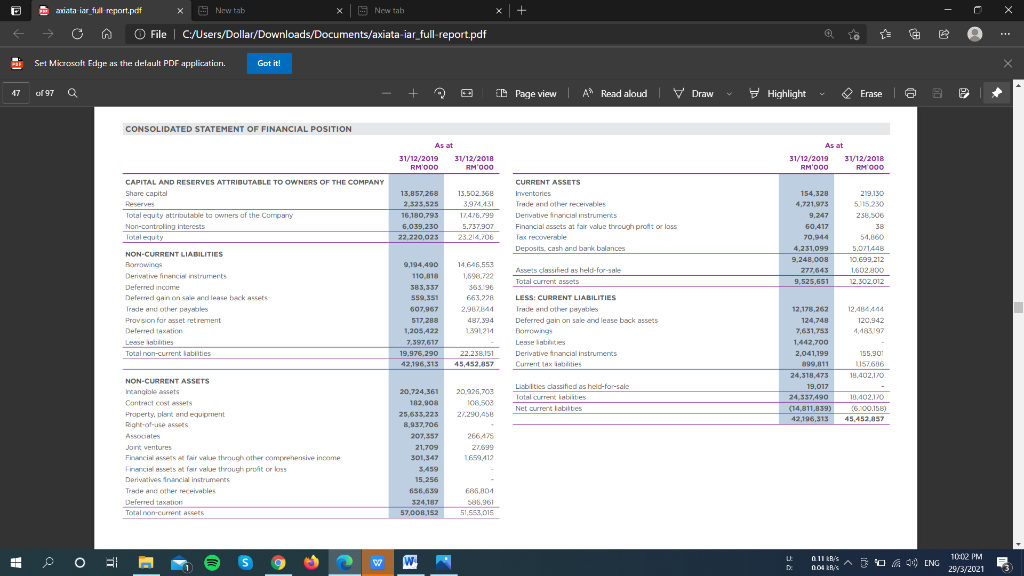

avata iar full report.pdf C New tab x S New tab + o O File C:/Users/Dollar/Downloads/Documents/axiata-iar_full-report.pdf to 31 Set Microsoft Edge as the default PDF application. Got it! 47 of 97 0 CD Page view A* Read aloud | V Draw Highlight Erase a CONSOLIDATED STATEMENT OF FINANCIAL POSITION As at 31/12/2019 RM'ODO 31/12/2018 RM OOO As at 31/12/2019 31/12/2018 RM'000 RM 000 CAPITAL AND RESERVES ATTRIBUTABLE TO OWNERS OF THE COMPANY Share capital Total equity attributable to owners of the Company Non-controling interests Total equty 13,857,268 2.523,525 16.180,793 6,039,230 22,220,025 13.502.568 3.97431 17.478.799 5.737.907 23.214./06 CURRENT ASSETS Inventores Trade and other receivables Derivative financial instruments Financial assets at fair value through profit or loss Tax recoverable Deposits. cash and bank balances 154.328 4.721,973 9,247 60.417 70,944 4,231,099 9,248.000 277,643 9,525,651 219.130 5.115.230 256.500 38 54.360 5.071448 10.699.212 1,602.900 12.902.012 Assets classified as held-for-sale Total Total current assets NON-CURRENT LIABILITIES Borrowings Derivative financial instruments Deferred income Deferred gain on sale and lease back Assets Trade and other payables Provision for asset retrement Deferred taxation Leesettes Total non-current labiities 9,194,490 110,818 385,357 559,351 607.967 517,288 1,205,422 7.597,617 19,976.290 42,196,315 14,546,552 1.898.722 365.96 663,728 2.967.844 487.394 1391214 LESS: CURRENT LIABILITIES Trade and other payables Deferred gain on sale and lease back assets Romowing: Lesse abilities Derivative inancial instruments Current tax istilities 12.44444 120.942 1,483197 22,238.151 45,452,857 12.171.262 124,748 7,631,753 1.442.700 2,041,199 899,811 24,318,475 19,017 24,337,490 (14,811,839) 42,196,315 155.901 1157,636 19,402.120 NON-CURRENT ASSETS Intangible assets Contract cost assets Property, plant and equipment Right-of-use Acces Associates 10,4021) Liabilities classified as held for sale Total current liabilities Net current abilities 20.926,703 108.50 27.290458 (6.100.158) 45.452857 Jont ventures 20.724,361 182,908 25,635,223 8,937,706 207,357 21,709 301,347 3.459 15.256 656.639 324.187 57,00R 152 266.75 27.099 1699412 Financial assets et fair value through other comprehensive income Financial assets of fair value through profit or loss Derivatives financial instruments Trade and other receivables Deferred taxation Total non-current assets 685,804 586,961 51,5EROIS POEL w W DE D Q11 RB'S 004 KRAS TO ) ENG 10:02 PM 29/3/2021 avata iar full report.pdf C New tab x S New tab + o O File C:/Users/Dollar/Downloads/Documents/axiata-iar_full-report.pdf to 31 Set Microsoft Edge as the default PDF application. Got it! 47 of 97 0 CD Page view A* Read aloud | V Draw Highlight Erase a CONSOLIDATED STATEMENT OF FINANCIAL POSITION As at 31/12/2019 RM'ODO 31/12/2018 RM OOO As at 31/12/2019 31/12/2018 RM'000 RM 000 CAPITAL AND RESERVES ATTRIBUTABLE TO OWNERS OF THE COMPANY Share capital Total equity attributable to owners of the Company Non-controling interests Total equty 13,857,268 2.523,525 16.180,793 6,039,230 22,220,025 13.502.568 3.97431 17.478.799 5.737.907 23.214./06 CURRENT ASSETS Inventores Trade and other receivables Derivative financial instruments Financial assets at fair value through profit or loss Tax recoverable Deposits. cash and bank balances 154.328 4.721,973 9,247 60.417 70,944 4,231,099 9,248.000 277,643 9,525,651 219.130 5.115.230 256.500 38 54.360 5.071448 10.699.212 1,602.900 12.902.012 Assets classified as held-for-sale Total Total current assets NON-CURRENT LIABILITIES Borrowings Derivative financial instruments Deferred income Deferred gain on sale and lease back Assets Trade and other payables Provision for asset retrement Deferred taxation Leesettes Total non-current labiities 9,194,490 110,818 385,357 559,351 607.967 517,288 1,205,422 7.597,617 19,976.290 42,196,315 14,546,552 1.898.722 365.96 663,728 2.967.844 487.394 1391214 LESS: CURRENT LIABILITIES Trade and other payables Deferred gain on sale and lease back assets Romowing: Lesse abilities Derivative inancial instruments Current tax istilities 12.44444 120.942 1,483197 22,238.151 45,452,857 12.171.262 124,748 7,631,753 1.442.700 2,041,199 899,811 24,318,475 19,017 24,337,490 (14,811,839) 42,196,315 155.901 1157,636 19,402.120 NON-CURRENT ASSETS Intangible assets Contract cost assets Property, plant and equipment Right-of-use Acces Associates 10,4021) Liabilities classified as held for sale Total current liabilities Net current abilities 20.926,703 108.50 27.290458 (6.100.158) 45.452857 Jont ventures 20.724,361 182,908 25,635,223 8,937,706 207,357 21,709 301,347 3.459 15.256 656.639 324.187 57,00R 152 266.75 27.099 1699412 Financial assets et fair value through other comprehensive income Financial assets of fair value through profit or loss Derivatives financial instruments Trade and other receivables Deferred taxation Total non-current assets 685,804 586,961 51,5EROIS POEL w W DE D Q11 RB'S 004 KRAS TO ) ENG 10:02 PM 29/3/2021