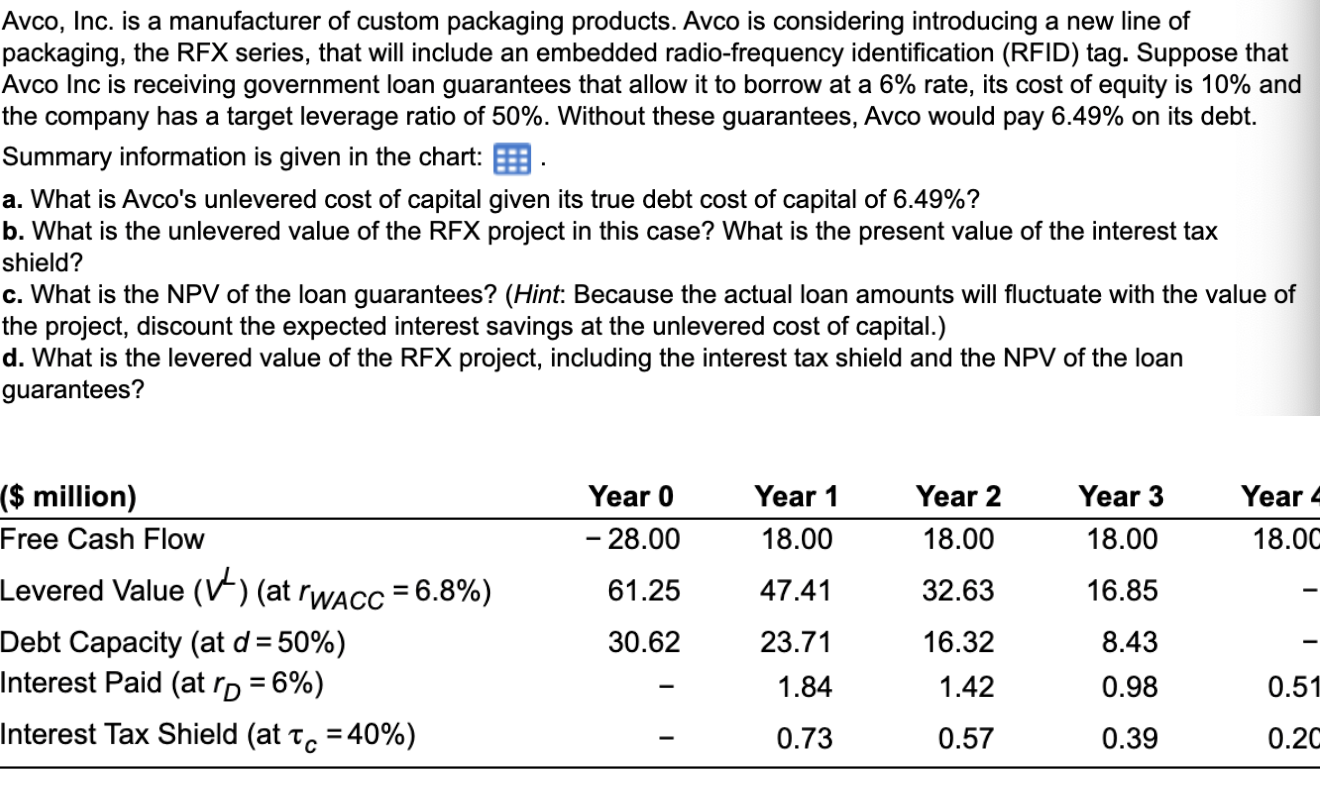

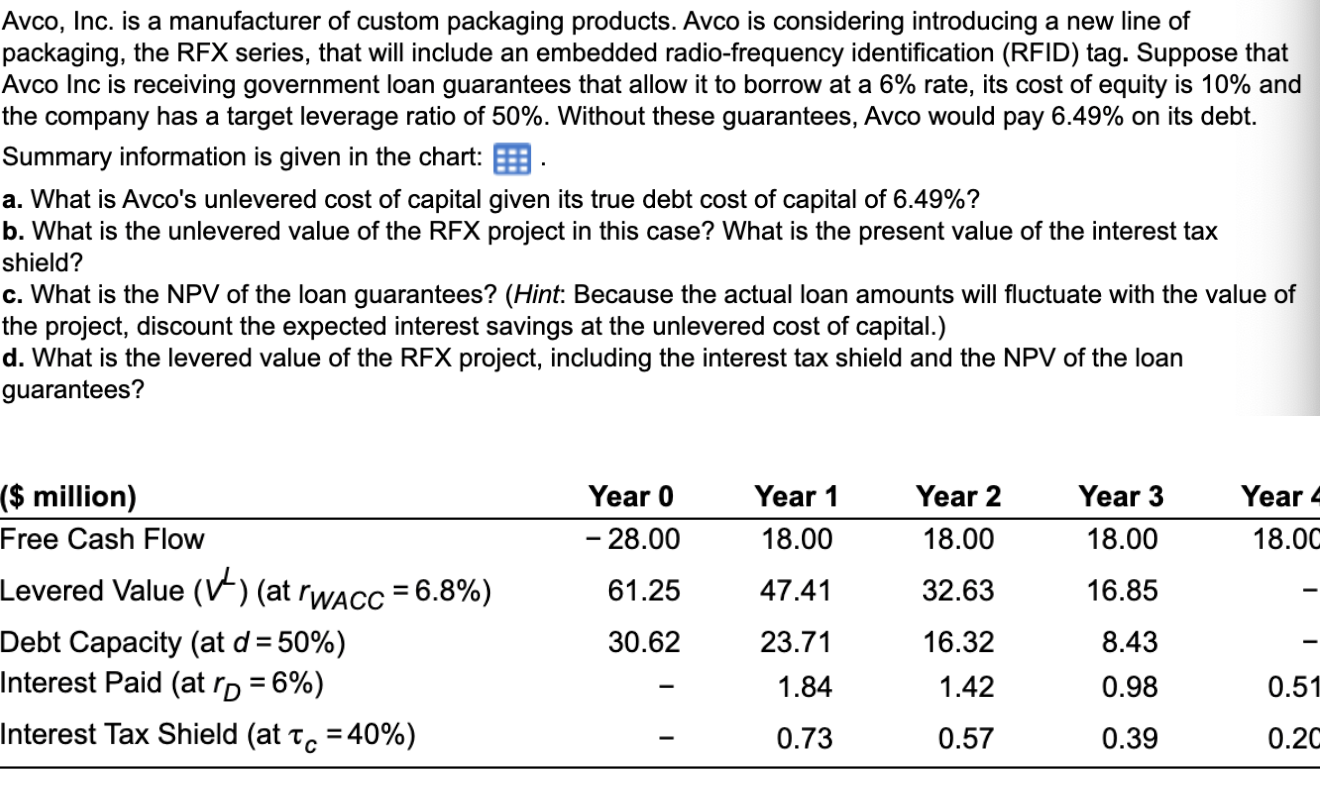

Avco, Inc. is a manufacturer of custom packaging products. Avco is considering introducing a new line of packaging, the RFX series, that will include an embedded radio-frequency identification (RFID) tag. Suppose that Avco Inc is receiving government loan guarantees that allow it to borrow at a 6% rate, its cost of equity is 10% and the company has a target leverage ratio of 50%. Without these guarantees, Avco would pay 6.49% on its debt. Summary information is given in the chart: a. What is Avco's unlevered cost of capital given its true debt cost of capital of 6.49%? b. What is the unlevered value of the RFX project in this case? What is the present value of the interest tax shield? c. What is the NPV of the loan guarantees? (Hint: Because the actual loan amounts will fluctuate with the value of the project, discount the expected interest savings at the unlevered cost of capital.) d. What is the levered value of the RFX project, including the interest tax shield and the NPV of the loan guarantees? Year 0 - 28.00 Year 1 18.00 Year 2 18.00 Year 3 18.00 Year 4 18.00 61.25 47.41 32.63 16.85 ($ million) Free Cash Flow Levered Value (M_) (at rwacc = 6.8%) Debt Capacity (at d = 50%) Interest Paid (at rp = 6%) Interest Tax Shield (at Tc = 40%) 30.62 23.71 16.32 1.42 8.43 0.98 1.84 0.51 0.73 0.57 0.39 0.20 Avco, Inc. is a manufacturer of custom packaging products. Avco is considering introducing a new line of packaging, the RFX series, that will include an embedded radio-frequency identification (RFID) tag. Suppose that Avco Inc is receiving government loan guarantees that allow it to borrow at a 6% rate, its cost of equity is 10% and the company has a target leverage ratio of 50%. Without these guarantees, Avco would pay 6.49% on its debt. Summary information is given in the chart: a. What is Avco's unlevered cost of capital given its true debt cost of capital of 6.49%? b. What is the unlevered value of the RFX project in this case? What is the present value of the interest tax shield? c. What is the NPV of the loan guarantees? (Hint: Because the actual loan amounts will fluctuate with the value of the project, discount the expected interest savings at the unlevered cost of capital.) d. What is the levered value of the RFX project, including the interest tax shield and the NPV of the loan guarantees? Year 0 - 28.00 Year 1 18.00 Year 2 18.00 Year 3 18.00 Year 4 18.00 61.25 47.41 32.63 16.85 ($ million) Free Cash Flow Levered Value (M_) (at rwacc = 6.8%) Debt Capacity (at d = 50%) Interest Paid (at rp = 6%) Interest Tax Shield (at Tc = 40%) 30.62 23.71 16.32 1.42 8.43 0.98 1.84 0.51 0.73 0.57 0.39 0.20