Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Aveng to raise R300m through rights offer Infrastructure and mining group will pay off debt and pursue growth opportunities. Infrastructure and mining group Aveng

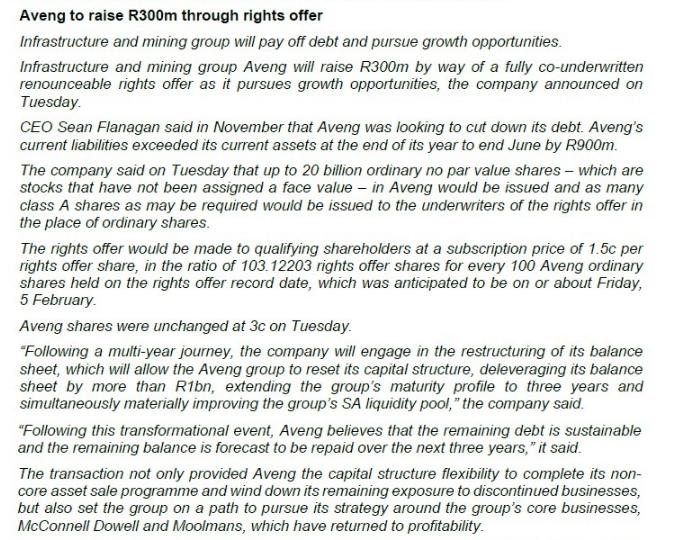

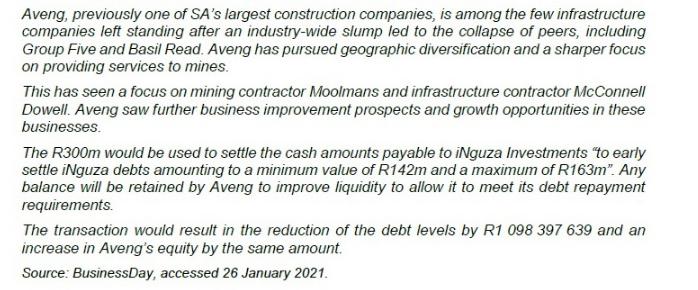

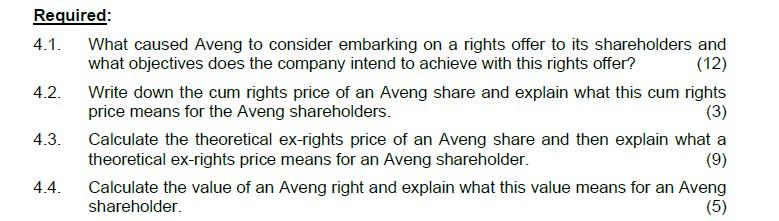

Aveng to raise R300m through rights offer Infrastructure and mining group will pay off debt and pursue growth opportunities. Infrastructure and mining group Aveng will raise R300m by way of a fully co-underwritten renounceable rights offer as it pursues growth opportunities, the company announced on Tuesday. CEO Sean Flanagan said in November that Aveng was looking to cut down its debt. Aveng's current liabilities exceeded its current assets at the end of its year to end June by R900m. The company said on Tuesday that up to 20 billion ordinary no par value shares - which are stocks that have not been assigned a face value - in Aveng would be issued and as many class A shares as may be required would be issued to the underwriters of the rights offer in the place of ordinary shares. The rights offer would be made to qualifying shareholders at a subscription price of 1.5c per rights offer share, in the ratio of 103.12203 rights offer shares for every 100 Aveng ordinary shares held on the rights offer record date, which was anticipated to be on or about Friday, 5 February. Aveng shares were unchanged at 3c on Tuesday. "Following a multi-year journey, the company will engage in the restructuring of its balance sheet, which will allow the Aveng group to reset its capital structure, deleveraging its balance sheet by more than Ribn, extending the group's maturity profile to three years and simultaneously materially improving the group's SA liquidity pool," the company said. "Following this transformational event, Aveng believes that the remaining debt is sustainable and the remaining balance is forecast to be repaid over the next three years," it said. The transaction not only provided Aveng the capital structure flexibility to complete its non- core asset sale programme and wind down its remaining exposure to discontinued businesses, but also set the group on a path to pursue its strategy around the group's core businesses, McConnell Dowell and Moolmans, which have returned to profitability. Aveng, previously one of SA's largest construction companies, is among the few infrastructure companies left standing after an industry-wide slump led to the collapse of peers, including Group Five and Basil Read. Aveng has pursued geographic diversification and a sharper focus on providing services to mines. This has seen a focus on mining contractor Moolmans and infrastructure contractor McConnell Dowell. Aveng saw further business improvement prospects and growth opportunities in these businesses. The R300m would be used to settle the cash amounts payable to iNguza Investments "to early settle iNguza debts amounting to a minimum value of R142m and a maximum of R163m". Any balance will be retained by Aveng to improve liquidity to allow it to meet its debt repayment requirements. The transaction would result in the reduction of the debt levels by R1 098 397 639 and an increase in Aveng's equity by the same amount. Source: BusinessDay, accessed 26 January 2021. Required: 4.1. What caused Aveng to consider embarking on a rights offer to its shareholders and what objectives does the company intend to achieve with this rights offer? (12) 4.2. 4.3. 4.4. Write down the cum rights price of an Aveng share and explain what this cum rights price means for the Aveng shareholders. (3) Calculate the theoretical ex-rights price of an Aveng share and then explain what a theoretical ex-rights price means for an Aveng shareholder. (9) Calculate the value of an Aveng right and explain what this value means for an Aveng shareholder. (5)

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

41 Reasons for Rights Offer and Objectives Aveng is undertaking the rights offer to raise R300m with ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started