Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Avenger Sdn Bhd (Avenger), a company with an issued share capital of RM2 million, makes up its accounts annually to 31 December. The company

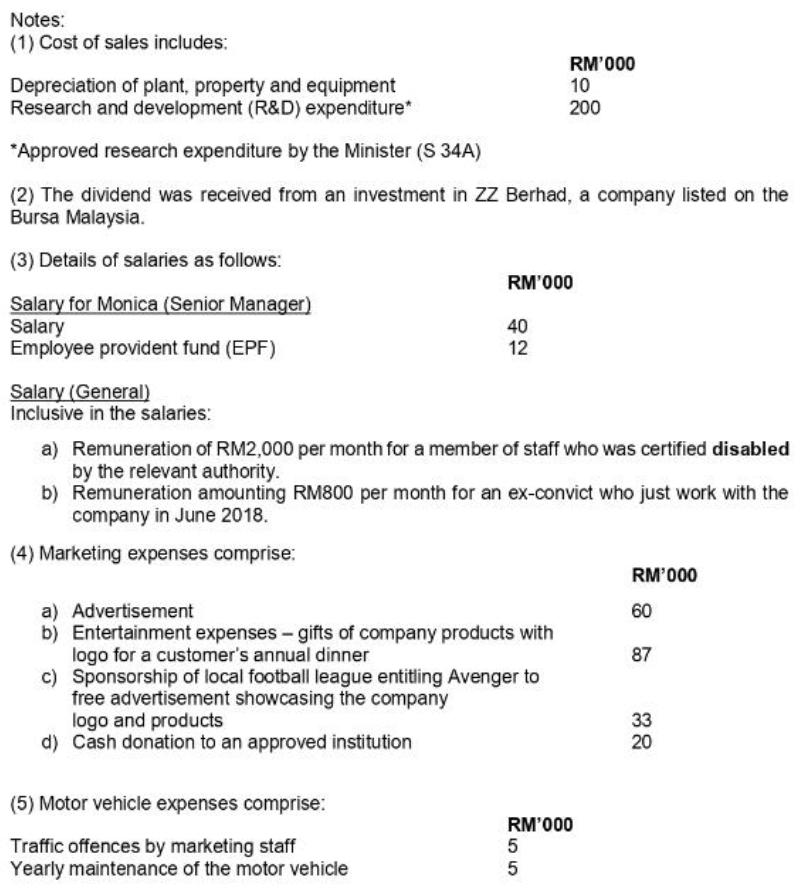

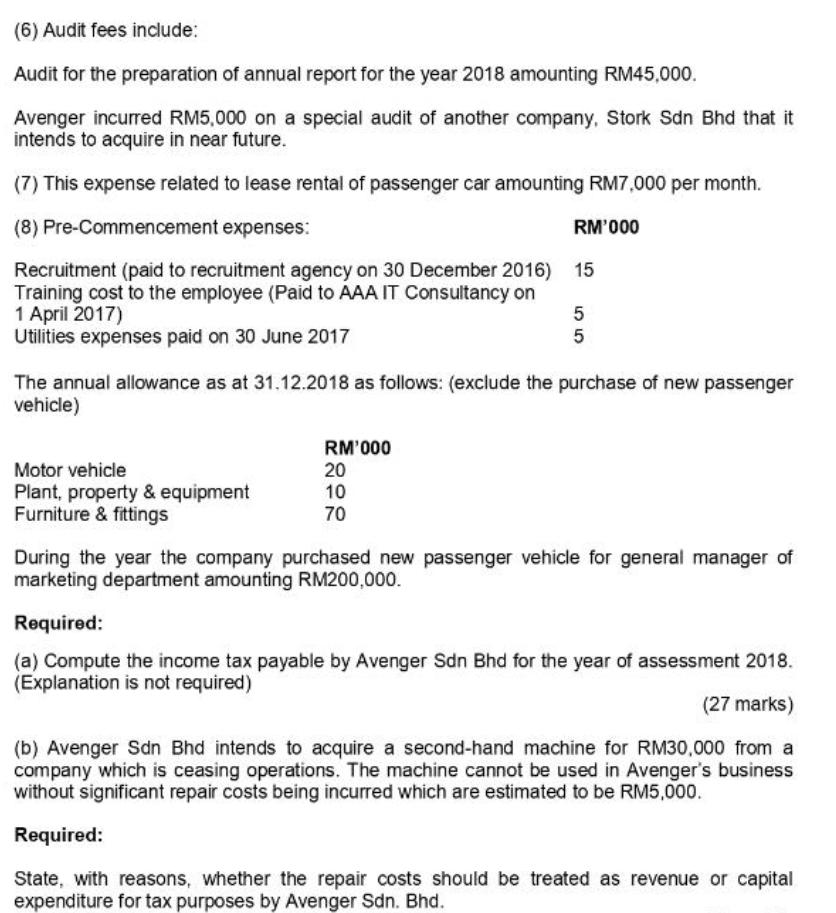

Avenger Sdn Bhd (Avenger), a company with an issued share capital of RM2 million, makes up its accounts annually to 31 December. The company just commenced the business in January 2018 and this is the first year of the company preparing its tax computation. Avenger main business is manufacturing technology equipment for local market. Avenger's statement of profit or loss for the financial year ended 31 December 2018 is as follows: Note RM ('000) RM ('000) Sales 15,000 Less: Cost of sales 1 Gross profit (8,000) 7,000 Add: Other income Dividend income 2 10 Interest on overdue trade receivables 15 7,025 Less: Expenses Salaries 3 1,000 Marketing expenses Motor vehicle expenses 4 200 10 Audit fees 50 Lease rental 7 84 Pre-commencement expenses 8 25 Secretarial fees 20 Tax filing fees Depreciation (Motor vehicle & furniture & fittings) 63 100 (1,552) 5,473 Net profit before tax Notes: (1) Cost of sales includes: RM'000 10 Depreciation of plant, property and equipment Research and development (R&D) expenditure* 200 *Approved research expenditure by the Minister (S 34A) (2) The dividend was received from an investment in ZZ Berhad, a company listed on the Bursa Malaysia. (3) Details of salaries as follows: RM'000 Salary for Monica (Senior Manager) Salary Employee provident fund (EPF) 40 12 Salary (General) Inclusive in the salaries: a) Remuneration of RM2,000 per month for a member of staff who was certified disabled by the relevant authority. b) Remuneration amounting RM800 per month for an ex-convict who just work with the company in June 2018. (4) Marketing expenses comprise: RM'000 a) Advertisement b) Entertainment expenses - gifts of company products with logo for a customer's annual dinner c) Sponsorship of local football league entitling Avenger to free advertisement showcasing the company logo and products d) Cash donation to an approved institution 60 87 33 20 (5) Motor vehicle expenses comprise: RM'000 Traffic offences by marketing staff Yearly maintenance of the motor vehicle 55 (6) Audit fees include: Audit for the preparation of annual report for the year 2018 amounting RM45,000. Avenger incurred RM5,000 on a special audit of another company, Stork Sdn Bhd that it intends to acquire in near future. (7) This expense related to lease rental of passenger car amounting RM7,000 per month. (8) Pre-Commencement expenses: RM'000 Recruitment (paid to recruitment agency on 30 December 2016) 15 Training cost to the employee (Paid to AAA IT Consultancy on 1 April 2017) Utilities expenses paid on 30 June 2017 5 5 The annual allowance as at 31.12.2018 as follows: (exclude the purchase of new passenger vehicle) RM'000 20 10 70 Motor vehicle Plant, property & equipment Furniture & fittings During the year the company purchased new passenger vehicle for general manager of marketing department amounting RM200,000. Required: (a) Compute the income tax payable by Avenger Sdn Bhd for the year of assessment 2018. (Explanation is not required) (27 marks) (b) Avenger Sdn Bhd intends to acquire a second-hand machine for RM30,000 from a company which is ceasing operations. The machine cannot be used in Avenger's business without significant repair costs being incurred which are estimated to be RM5,000. Required: State, with reasons, whether the repair costs should be treated as revenue or capital expenditure for tax purposes by Avenger Sdn. Bhd.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Avenge Sdn Bhd Avenger Company Sound stos che Co 0 Company Net ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started