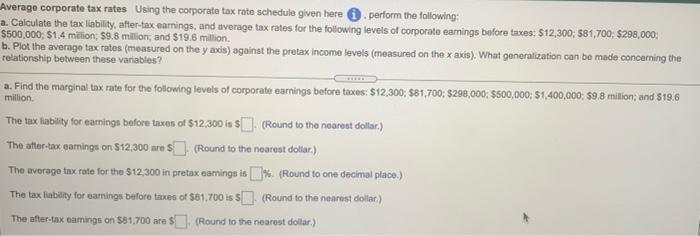

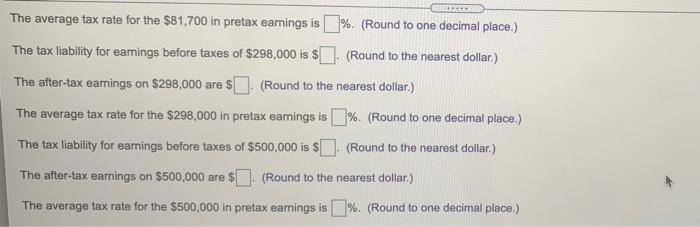

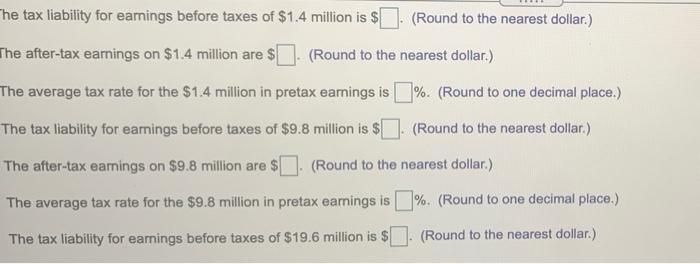

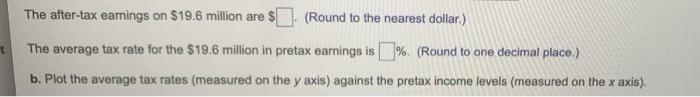

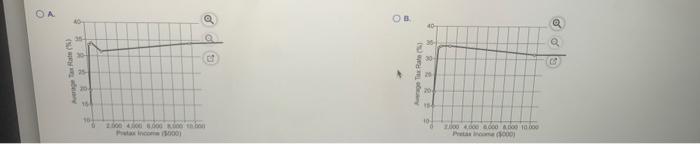

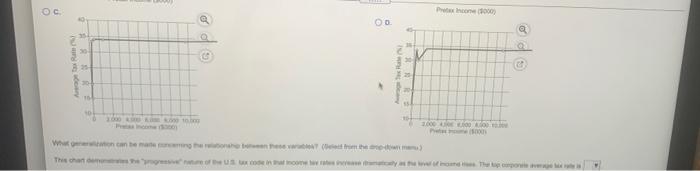

Average corporate tax rates Using the corporate tax rate schedule given here perform the following: a. Calculate the tax liability, after-tax earrings, and average tax rates for the following levels of corporate eamings before taxes: $12,300; $81,700: $298,000: b. Plot the average tax rates (measured on the yacis) against the pretax income levels (measured on the x axis). What generalization can be made concerning the relationship between these e variables? a. Find the marginal tax rate for the following levels of corporate earnings before taxes: $12,300; $81,700, $298,000; $500,000; 1,400,000 $9.8 million; and 519.6 million The tax Hability for camninga before taxes of $12,300 is $]). (Round to the nearest dollar:) The after-tax eamings on $12,300 are $(Round to the nearest dottar) The average tax rate for the $12,300 in pretax earnings is % (Round to one decimal place.) The tax liability for samnings before taxes of $81.700 is 5 (Round to the nearest doltar) The after-tax eatings on $81,700 are $(Round to the nearest dollar) The average tax rate for the $81,700 in pretax earnings is %. (Round to one decimal place.) The tax liability for eamings before taxes of $298,000 is $. (Round to the nearest dollar.) The after-tax earnings on $298,000 are $ . (Round to the nearest dollar.) The average tax rate for the $298,000 in pretax earnings is % (Round to one decimal place.) The tax liability for earnings before taxes of $500,000 is $. (Round to the nearest dollar.) The after-tax earnings on $500,000 are $ . (Round to the nearest dollar) The average tax rate for the $500,000 in pretax earnings is % (Round to one decimal place.) The tax liability for earnings before taxes of $1.4 million is $. (Round to the nearest dollar.) The after-tax earnings on $1.4 million are $ (Round to the nearest dollar.) The average tax rate for the $1.4 million in pretax earnings is %. (Round to one decimal place.) The tax liability for earnings before taxes of $9.8 million is $ (Round to the nearest dollar.) The after-tax earnings on $9.8 million are $ (Round to the nearest dollar) The average tax rate for the $9.8 million in pretax earnings is %. (Round to one decimal place.) The tax liability for earnings before taxes of $19.6 million is $ (Round to the nearest dollar.) The after-tax earnings on $19.6 million are $ (Round to the nearest dollar.) The average tax rate for the $19.6 million in pretax earnings is % (Round to one decimal place.) b. Plot the average tax rates (measured on the y axis) against the pretax income levels (measured on the x axis). OB 10 35 35 2 30 3 13 100.000 ton to inc10001 00000000100 P0001 con 1000 OD 2000 to 100 The chance to Average corporate tax rates Using the corporate tax rate schedule given here perform the following: a. Calculate the tax liability, after-tax earrings, and average tax rates for the following levels of corporate eamings before taxes: $12,300; $81,700: $298,000: b. Plot the average tax rates (measured on the yacis) against the pretax income levels (measured on the x axis). What generalization can be made concerning the relationship between these e variables? a. Find the marginal tax rate for the following levels of corporate earnings before taxes: $12,300; $81,700, $298,000; $500,000; 1,400,000 $9.8 million; and 519.6 million The tax Hability for camninga before taxes of $12,300 is $]). (Round to the nearest dollar:) The after-tax eamings on $12,300 are $(Round to the nearest dottar) The average tax rate for the $12,300 in pretax earnings is % (Round to one decimal place.) The tax liability for samnings before taxes of $81.700 is 5 (Round to the nearest doltar) The after-tax eatings on $81,700 are $(Round to the nearest dollar) The average tax rate for the $81,700 in pretax earnings is %. (Round to one decimal place.) The tax liability for eamings before taxes of $298,000 is $. (Round to the nearest dollar.) The after-tax earnings on $298,000 are $ . (Round to the nearest dollar.) The average tax rate for the $298,000 in pretax earnings is % (Round to one decimal place.) The tax liability for earnings before taxes of $500,000 is $. (Round to the nearest dollar.) The after-tax earnings on $500,000 are $ . (Round to the nearest dollar) The average tax rate for the $500,000 in pretax earnings is % (Round to one decimal place.) The tax liability for earnings before taxes of $1.4 million is $. (Round to the nearest dollar.) The after-tax earnings on $1.4 million are $ (Round to the nearest dollar.) The average tax rate for the $1.4 million in pretax earnings is %. (Round to one decimal place.) The tax liability for earnings before taxes of $9.8 million is $ (Round to the nearest dollar.) The after-tax earnings on $9.8 million are $ (Round to the nearest dollar) The average tax rate for the $9.8 million in pretax earnings is %. (Round to one decimal place.) The tax liability for earnings before taxes of $19.6 million is $ (Round to the nearest dollar.) The after-tax earnings on $19.6 million are $ (Round to the nearest dollar.) The average tax rate for the $19.6 million in pretax earnings is % (Round to one decimal place.) b. Plot the average tax rates (measured on the y axis) against the pretax income levels (measured on the x axis). OB 10 35 35 2 30 3 13 100.000 ton to inc10001 00000000100 P0001 con 1000 OD 2000 to 100 The chance to