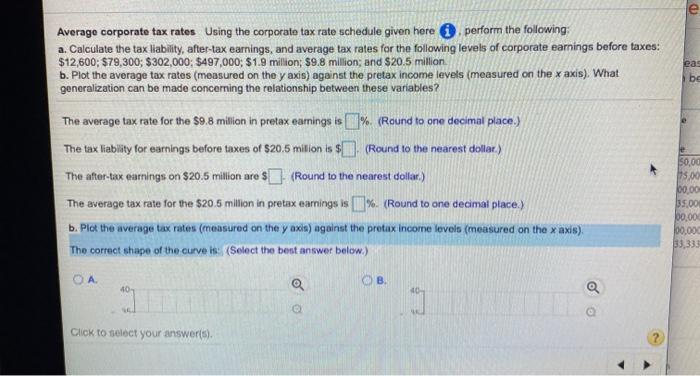

Average corporate tax rates Using the corporate tax rate schedule given here perform the following: a. Calculate the tax liability, after-tax earnings, and average tax rates for the following levels of corporate earnings before taxes: $12,600; $79,300; $302,000: $497,000; $1.9 million; 59.8 million; and $20.5 million b. Plot the average tax rates (measured on the y axis) against the pretax income levels (measured on the x axis). What generalization can be made concerning the relationship between these variables ? eas be The average tax rate for the $9.8 million in pretax earnings is (% (Round to one decimal place.) The tax liability for earnings before taxes of $20.5 million is $1. (Round to the nearest dollar) The after-tax earnings on $20.5 million are $_- (Round to the nearest dollar) The average tax rate for the $20.5 million in pretax earnings is 1%. (Round to one decimal place.) b. Plot the average tax rates (measured on the yaxin) against the pretax income levels (measured on the x axis) The correct shape of the curve is: (Select the best answer below) 50,00 115,00 00.00 35,00 00.000 00.000 33,333 OA 40 Q OB Q Click to select your answer(s) Average corporate tax rates Using the corporate tax rate schedule given here perform the following: a. Calculate the tax liability, after-tax earnings, and average tax rates for the following levels of corporate earnings before taxes: $12,600; $79,300; $302,000: $497,000; $1.9 million; 59.8 million; and $20.5 million b. Plot the average tax rates (measured on the y axis) against the pretax income levels (measured on the x axis). What generalization can be made concerning the relationship between these variables ? eas be The average tax rate for the $9.8 million in pretax earnings is (% (Round to one decimal place.) The tax liability for earnings before taxes of $20.5 million is $1. (Round to the nearest dollar) The after-tax earnings on $20.5 million are $_- (Round to the nearest dollar) The average tax rate for the $20.5 million in pretax earnings is 1%. (Round to one decimal place.) b. Plot the average tax rates (measured on the yaxin) against the pretax income levels (measured on the x axis) The correct shape of the curve is: (Select the best answer below) 50,00 115,00 00.00 35,00 00.000 00.000 33,333 OA 40 Q OB Q Click to select your answer(s)