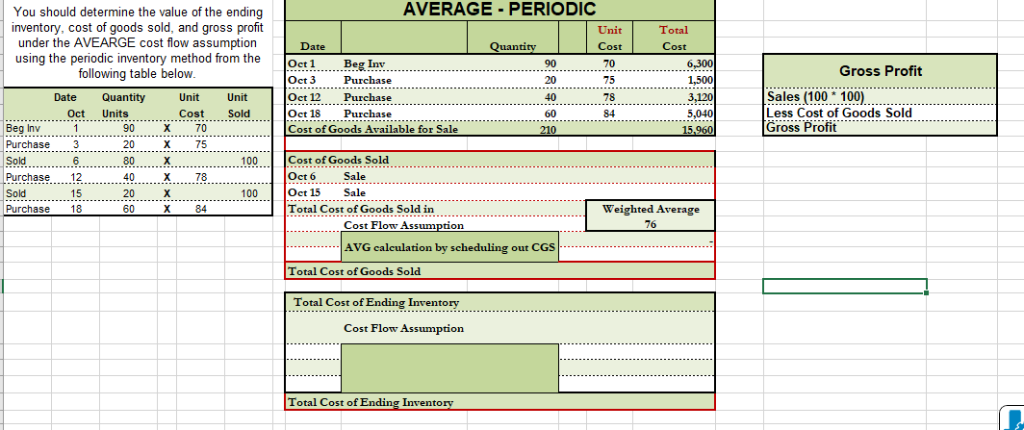

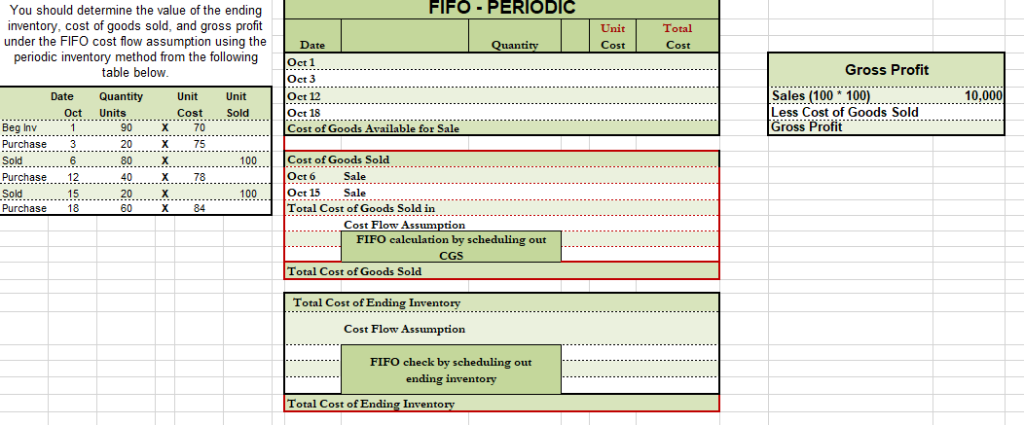

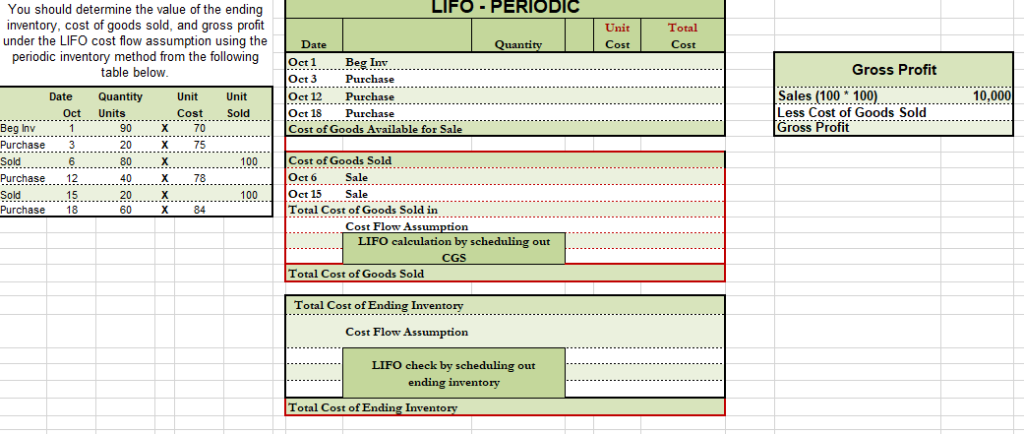

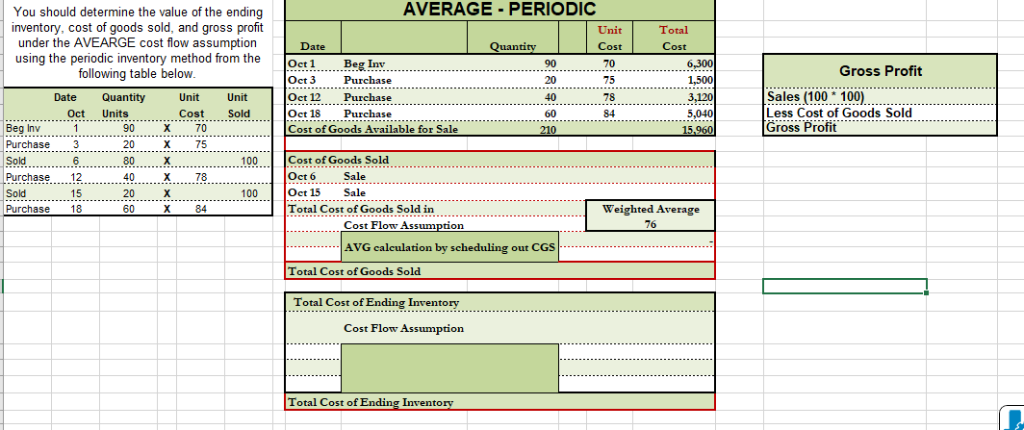

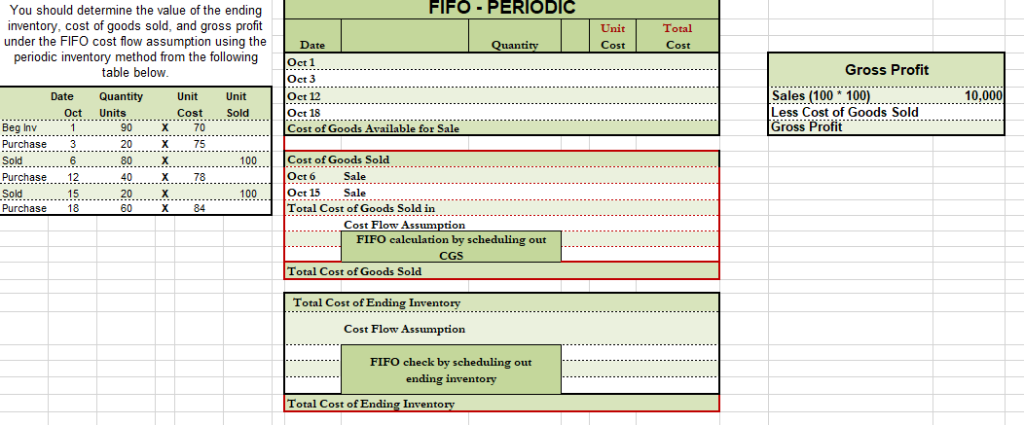

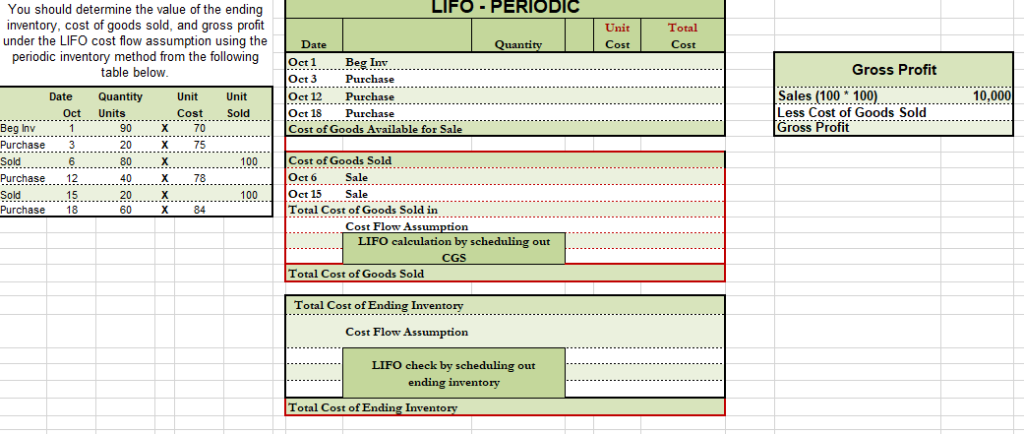

AVERAGE- PERIODIC You should determine the value of the ending inventory, cost of goods sold, and gross profit under the AVEARGE cost flow assumption using the periodic inventory method from the following table below. Total Unit Date Quantity Cost Cost Oct 1 Oct 3 Beg Inv 70 6,300 90 Gross Profit chase Purchase 1,500 Sales (100- 100) Cost of Gross ProfGoods Sold Oct 12 Oct 18 Cost of Goods Available for Sale Quantity 3.120 Date Unit Unit 78 Oct Units Cost Sold Purchase 5,040 15.960 Beg Inv Purchase Sold Purchase Sold Purchase 5 20 100 Cost of Goods Sold Sale Sale 80 12 .40 100 Total Cost of Goods Sold in Weighted Average 18 60 84 Cost Flow Assumption AVG calculation by scheduling out CGS Total Cost of Goods Sold Total Cost of Ending Inventory Cost Flow Assumption Total Cost of Ending Inventory FIFO - PERIODIC You should determine the value of the ending inventory, cost of goods sold, and gross profit under the FIFO cost flow assumption using the periodic inventory method from the following table below. Unit Total Cost Date Quantity Cost Oct 1 Oct 3 Gross Profit Sales (100 * 100) iess Cost of Goods Sold Gross Profit 10.000 Oct 12 Date Quantity Unit Unit Sold t Units Cs .. Cost of Goods Available for Sale Purchase Sold Purchase Sold 20 3 Cost of Goods Sold Sale 100 12 78 40 .100.. Sale Total Cost of Goods Sold in Purchase 84 60 Ce .- FIFO calculation by scheduling out CGS Total Cost of Goods Sold Total Cost of Ending Inventory Cost Flow Assumption FIFO check by scheduling out ending inventory Total Cost of Ending Inventory LIFO - PERIODIC You should determine the value of the ending inventory, cost of goods sold, and gross profit under the LIFO cost flow assumption using the periodic inventory method from the following table below Unit Total Date Quantity Cost Cost Oct 1 Oct 3 Oct 12 Beg Inv Gross Profit Purchase Sales (100* 100 iess Cost of Goods Sold 10,000 Quantity Purchase Date Unit Unit .. Oct Uni s Cos Sold Oct 18 .Purchase Cost of Goods Available for Sale Gross Profit Beg Inv .. Purchase Sold 20 100 Cost of Goods Sold Oct 6 80 Sale Purchase 12 78 40 Sold Purchase Oct 15 Sale 15 20 100 ... 18 60 Total Cost of Goods Sold in X 84 Cost Flow Assumption LIFO calculation by scheduling out CGS Total Cost of Goods Sold Total Cost of Ending Inventory Cost Flow Assumption LIFO check by scheduling out ending inventory Total Cost of Ending Inventory