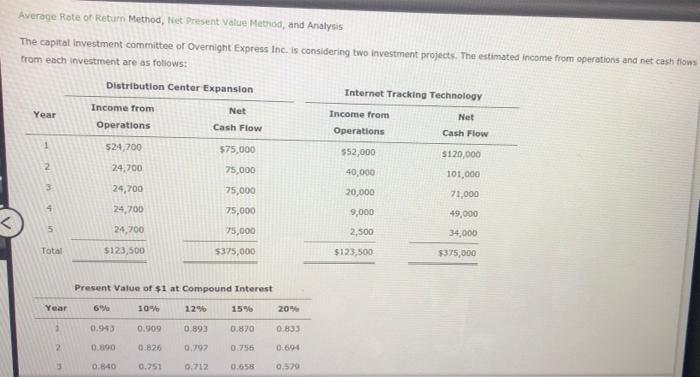

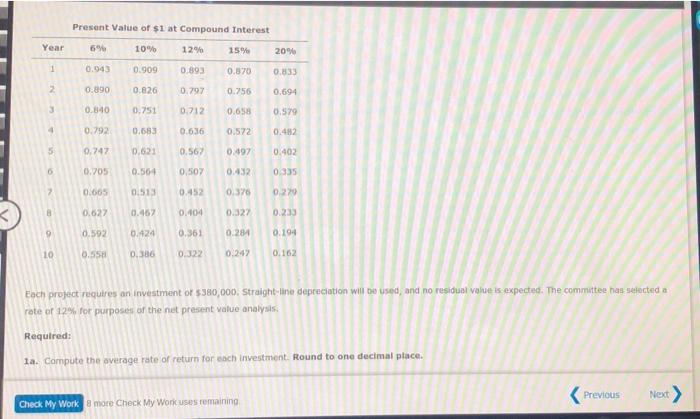

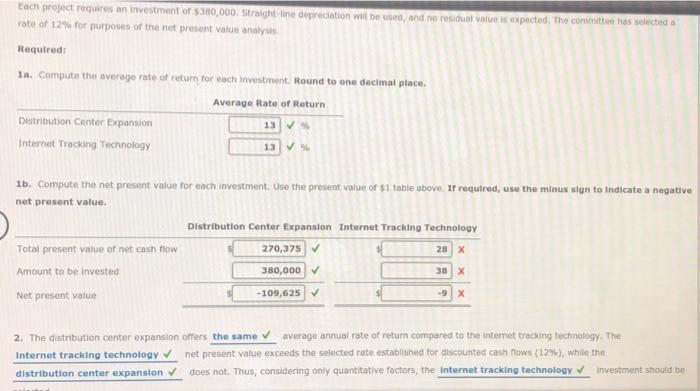

Average rate of Return Method, Net Present Value Method, and Analysis The capital investment committee of Overnight Express Inc. is considering two investment projects. The estimated income from operations and net cash Homs from each investment are as follows: Distribution Center Expansion Internet Tracking Technology Year Income from Operations Net Cash Flow Net Income from Operations Cash Flow 1 524,700 $75,000 $120,000 552,000 40,000 24,700 75,000 101,000 24,700 75,000 20,000 71,000 24,700 75,000 9,000 49,000 5 24,700 75,000 2,500 34,000 Total 5123,500 $375,000 $123,500 $375,000 Present Value of $1 at Compound Interest Year 69% 10% 12% 15% 20% 1 0.953 0.909 0.893 0.870 0.833 2 0.890 0826 0.797 0.756 0.694 3 0.840 0.251 0.712 0.658 0.570 Present Value of $1 at Compound Interest Year 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.340 0.751 0.712 0.658 0.579 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 0.56 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 2 0.005 0.513 0.452 0.37 020 0.627 0.467 0.404 0.327 0.233 0.592 0.424 0.363 0.284 0.194 10 0.55 0.386 0.322 0.242 0.162 Each project requires an investment of $380,000. Straight line depreciation will be used, and no residual value is expected. The committee has selected a rate of 12% for purpose of the net present value analysis Required: 1a. Compute the average rate of return for each investment. Round to one decimal place. Previous Next Check My Work more Check My Worcuses remaining Each project requires an investment or $380,000. Straight line depreciation will be used, and no residual value is expected. The committee has telected a rate of 12% for purposes of the net present value analysis Required: 11. Compute the average rate of return for each Investment. Round to one decimal place. Average Rate of Return Distribution Center Expansion 13 Internet Tracking Technology 13 1b. Compute the net present value for each investment, Use the present value of $1 table above. If required, use the minus sign to indicate a negative net present value. Distribution Center Expansion Internet Tracking Technology Total present value of net cash flow 270,375 28 X 380,000 38 X Amount to be invested Net present value -109,625 -9 X 2. The distribution center expansion offers the same average annual rate of return compared to the internet trading technology. The Internet tracking technology net present value exceeds the selected rate established for discounted cash rows (12%), while the distribution center expansion does not. Thus, considering only quantitative factors, the Internet tracking technology Investment should be