Answered step by step

Verified Expert Solution

Question

1 Approved Answer

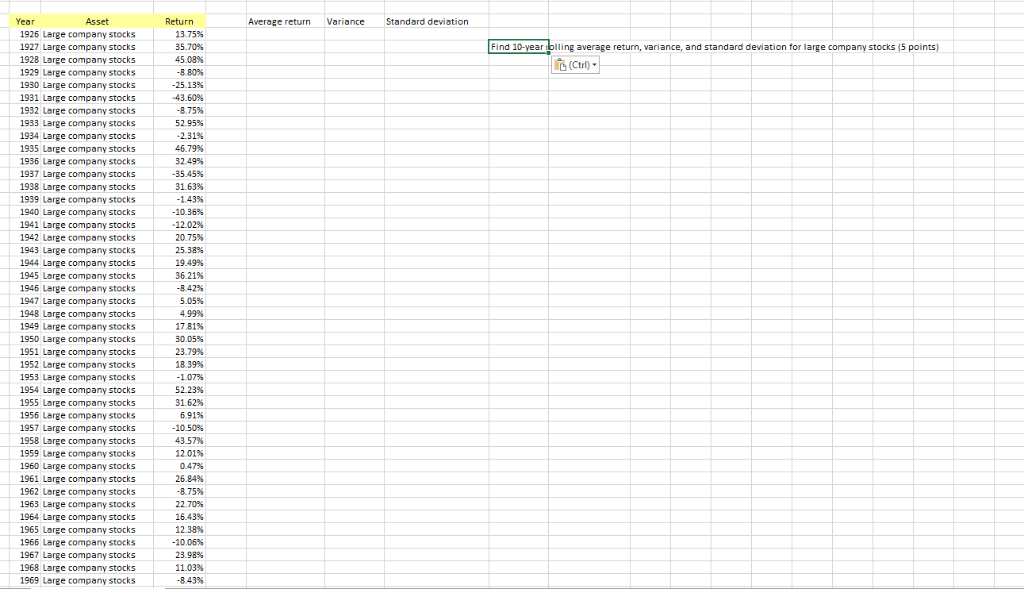

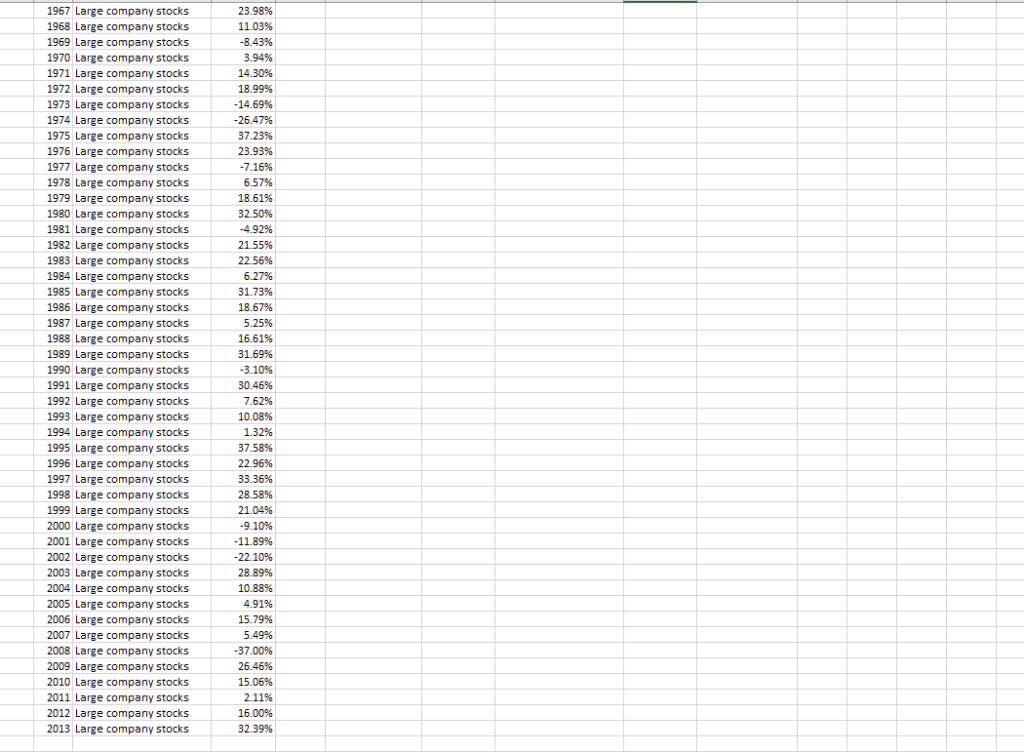

Average return Variance Standard deviation Find 30-year bolling average return, variance, and standard devlation for large company stocks (5 points) (Ctrl) e company stocks stocks

Average return Variance Standard deviation Find 30-year bolling average return, variance, and standard devlation for large company stocks (5 points) (Ctrl) e company stocks stocks 23.98% 11.03% -8.43% 3.94% 14.30% 18.99% 14.69% 26.47% 37.23% 23.93% 7.16% 6.57% 18.61% 32.50% 4.92% 21.55% 22.56% 6.27% 31.73% 18.67% 5 .25% 16.61% 31.69% 3.10% 30.46% 7.62% 10.08% 1.32% 37.58% 22.96% 33.36% 28.58% 21.04% -9.10% 11.89% 22.10% 28.89% 10.88% 4.91% 15.79% 5.49% 37.00% 26.46% 15.06% 2.11% 16.00% 32.39% 1967 Large company stocks 1968 Large company stocks 1969 Large company stocks 1970 Large company stocks 1971 Large company stocks 1972 Large company stocks 1973 Large company stocks 1974 Large company stocks 1975 Large company stocks 1976 Large company stocks 1977 Large company stocks 1978 Large company stocks 1979 Large company stocks 1980 Large company stocks 1981 Large company stocks 1982 Large company stocks 1983 Large company stocks 1984 Large company stocks 1985 Large company stocks 1986 Large company stocks 1987 Large company stocks 1988 Large company stocks 1989 Large company stocks 1990 Large company stocks 1991 Large company stocks 1992 Large company stocks 1993 Large company stocks 1994 Large company stocks 1995 Large company stocks 1996 Large company stocks 1997 Large company stocks 1998 Large company stocks 1999 Large company stocks 2000 Large company stocks 2001 Large company stocks 2002 Large company stocks 2003 Large company stocks 2004 Large company stocks 2005 Large company stocks 2006 Large company stocks 2007 Large company stocks 2008 Large company stocks 2009 Large company stocks 2010 Large company stocks 2011 Large company stocks 2012 Large company stocks 2013 Large company stocks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started