Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Aves Treats, Incorporated produces birdseeds. All direct materials used in the production process are added at the beginning of the manufacturing process. Labor and

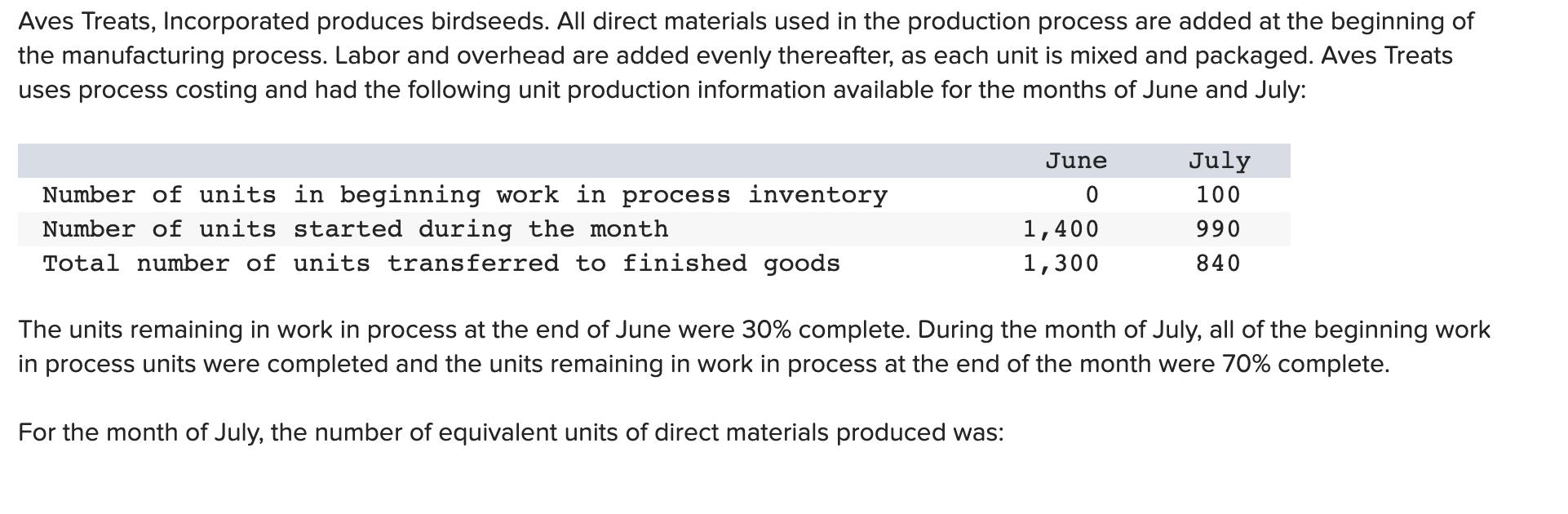

Aves Treats, Incorporated produces birdseeds. All direct materials used in the production process are added at the beginning of the manufacturing process. Labor and overhead are added evenly thereafter, as each unit is mixed and packaged. Aves Treats uses process costing and had the following unit production information available for the months of June and July: June July Number of units in beginning work in process inventory Number of units started during the month Total number of units transferred to finished goods 100 1,400 990 1,300 840 The units remaining in work in process at the end of June were 30% complete. During the month of July, all of the beginning work in process units were completed and the units remaining in work in process at the end of the month were 70% complete. For the month of July, the number of equivalent units of direct materials produced was:

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

The answer is 1277 Equivalent units produced in Ju...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started