Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Avon's Foreign-Source Income. Avon is a U.S.-based direct seller of a wide array of products. Avon markets leading beauty, fashion, and home products in more

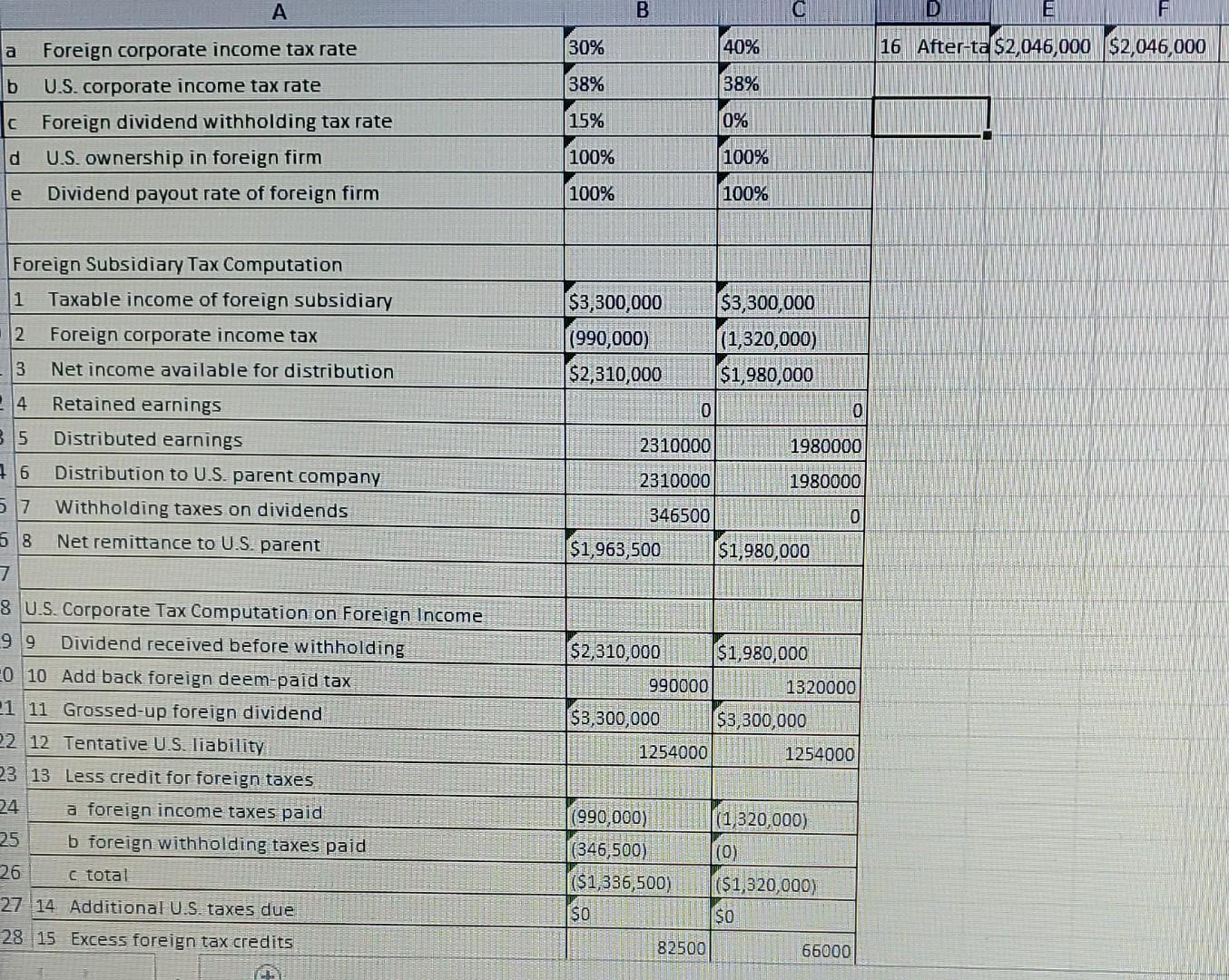

Avon's Foreign-Source Income. Avon is a U.S.-based direct seller of a wide array of products. Avon markets leading beauty, fashion, and home products in more than 100 countries. As part of the training in its corporate treasury offices, it has its interns build a spreadsheet analysis of the following hypothetical subsidiary earnings/distribution analysis. Use the tax analysis presented in the popup window for your basic structure, a. What is the total tax payment, foreign and domestic combined, for this income? b. What is the effective tax rate paid on this income by the U.S.-based parent company? C. What would be the total tax payment and effective tax rate if the foreign corporate tax rate was 40% and there were no withholding taxes on dividends? d. What would be the total tax payment and effective tax rate if the income was earned by a branch of the U.S. corporation? B a 30% 40% 16 After-ta $2,046,000 $2,046,000 b 38% 38% IC Foreign corporate income tax rate U.S. corporate income tax rate Foreign dividend withholding tax rate U.S. ownership in foreign firm Dividend payout rate of foreign firm 15% 0% d 100% 100% e 100% 100% Foreign Subsidiary Tax Computation 1 Taxable income of foreign subsidiary 2 Foreign corporate income tax 3 Net income available for distribution 24 Retained earnings 35 Distributed earnings 16 Distribution to U.S. parent company 57 Withholding taxes on dividends $3,300,000 (990,000) $2,310,000 $3,300,000 |(1,320,000) $1,980,000 0 0 2310000 1980000 2310000 1980000 346500 0 6 8 Net remittance to U.S. parent $1,963,500 $1,980,000 7 8 U.S. Corporate Tax Computation on Foreign Income 9 9 Dividend received before withholding 0 10 Add back foreign deem-paid tax 21 11 Grossed-up foreign dividend 22 12 Tentative U.S. liability 23 13 Less credit for foreign taxes 24 a foreign income taxes paid 25 b foreign withholding taxes paid 26 c total $2,310,000 $1,980,000 990000 1320000 $3,300,000 $3,300,000 1254000 1254000 (1,320,000) (0) (990,000) (346,500) ($1,336,500) $0 ($1,320,000) 27 14 AdditionalU.S. taxes due 28 15 Excess foreign tax credits SO 82500 66000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started