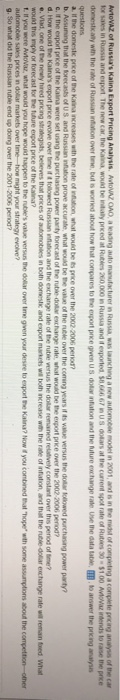

AvtoVAZ of Russia's Kalina Export Pricing Analysis. ALVAZONO a leading automontacturer in Russia was launching a new automobile model in 2001, and is in the midst of completing a complete pricing analysis of the car for sales in and export. The new car, the Kain would be a priced at Rules 200.000 in Russia and exported. 58.60667 in US dollars at the current spot rate of Ruties 30 31.00. Avtovar intends to raise the price domestically with the mate of Russian Infonen over time, but is worried about how that compares to the export price given U. dolar mation and reture exchange rate. Use the datatable to answer the pricing any questions are domestic price of the Kaina norases the rate of inflation, what would be a price over the 2002-2006 peror? c. If the export price of the Kama were set using the purchasing power party forecast of the bor exchange rate what would be the export price over the 2000-2006 period? d. How would the Katinas export price evolve over time towed Russian Inflation and the exchange rate of the rule versus the dollar remained relatively constant over this period of time? Vad, one of the newy wed pricing strateguts, believes that proes of automobiles in both domestic and export markets wil both increase with the rate of inflation, and that me te collar exchange rate will remained. What would you were AvtoVaz, what would you hope would happen to the rule's value versus the dollar over time given your desire to export te Katra? Now if you combined at "hope" with some assumptions about the competition-other 9. So what did the Russian ruble end up doing over the 2001-2005 period? AvtoVAZ of Russia's Kalina Export Pricing Analysis. AVTOVAZOAD, a leading to manufacturer in Russia was launching a new automobile model in 2001, and is in the midst of completing a complete pricing analysis of the car for sales in Russia and export. The new car, the King would be priced at Rubles 200.000 Russia and it exported 60667 in US dollars at the current spot rate of Rubies 30 - $1.00 Antends to raise the price domestic with the rate of Russia infation over time, but is worried about how that comes to the export price given U.S. doiration and the future exchange rate. Use the datatable to answer the pricing analysis questions the domestic price of the Kannaincreases with the rate of inflation, what would be price over the 2000-2005 pod b. Assuming that the forecast of US and Russian fortion prove accurate, what would be the value of the rule over the coming years its value versus the dollar followed purchasing power party? e. If the export price of the Kina were set using the purchasing power party forecast of the ruble-doar exchange rate what would be the sport price over the 2002-2006 period? d. How would the Kara's export price evolve over time it followed Russian tanion and the exchange rate of the reversus the dollar remainedvely constant over this period of time? e. Viad, one of the newly red pricing strategies, believes that prices of tomobiles in bon domestic and exportmants will both increase with the rate of inflation, and that the door exchange rate will remained What would this t. if you were AvtoVaz, what would you hope would happen to the rules au versus the door over time given your desire to export Kaina? Now if you combined that hope with some assumptions about the competitioner auto sale price in dollar markets vermehow might your strategy evolve? 9. So what the Russian ruble end up cong over the 2001-2006 period AVTOVAZ of Russia's Kalina Export Pricing Analysis AOWAZ OAD, a leading auto manufacturer in Russia was launching a new automobile model in 2001, and is in the midst of completing a compile pricing analysis of the for sale in Russia and export. The new car, the would be inaly priced at Rules 200,000 in Russia and if exported. 8,667 in US dotars at the current spot rate of Rutes 65100 Avaz intends to raise the price domestically win the rate of Russian won over time, but is worried about how that compares to the export price given US dolariation and the future exchange rate Use the data to answer the pricing analysis questions a. If the domestic price of the maincreases with the rate of what would be s price over the 2002-2006 pero b. Assuming that the forecasts of US and Russian Wation prove accurate, what would be the value of the rule over the coming years if its we versus the doodowed purchasing power party c. If the export price of the Kaina were senge purchasing power party forecast of the ruble do exchange rate what would be the export price over the 2002-2006 period? d. How would the Kaina's export pre evolve over time followed Russian nation and the exchange rate of the nutre versus the door romaned relatively constant over this period of time? wout les mpy of forecast for the future export price of the Kana? Vind one of the newly red ping strategist, beves that prices of automobiles in both domestic and export markets we both increase with the rate of inflation, and that the recoltar exchange rate will remained What Lif you were dove what would you hope would happen to the beste versus the dollar over time given your desire to export the Kaina? Now you combined wat hope with some assumption about the competition-other automobile sale price in dolar markets over time-how might your strategy evolve? 9. So what did the Russian ruble end up doing over the 2001-2006 period? AVTOVAZ of Russia's Kalina Export Pricing Analysis. AVOVAZ OAO, a leading auto manufacturer in Russia, was launching a new automobile model in 2001, and is in the midst of completing a complete pricing analysis of the car for sales in Russia and export. The new car, the Kalina, would be initially priced at Rubles 200,000 in Russia and if exported, $8,666.67 in U.S. dollars at the current spot rate of Rubles 30 - $1.00. AvtoVaz intends to raise the price domestically with the rate of Russian inflation over time, but is worried about how that compares to the export price given U.S. dollar inflation and the future exchange rate. Use the data table, to answer the pricing analysis questions. a. If the domestic price of the Kalina increases with the rate of inflation, what would be its price over the 2002-2006 period? b. Assuming that the forecasts of U.S. and Russian inflation prove accurate, what would be the value of the ruble over the coming years if its value versus the dollar followed purchasing power party? c. If the export price of the Kalina were set using the purchasing power parity forecast of the ruble-dollar exchange rate, what would be the export price over the 2002-2006 period? d. How would the Kalina's export price evolve over time if it followed Russian Inflation and the exchange rate of the ruble versus the dollar remained relatively constant over this period of time? e. Viad, one of the newly hired pricing strategists, believes that prices of automobiles in both domestic and export markets will both increase with the rate of inflation, and that the ruble-dollar exchange rate will remain fixed. What would this imply or forecast for the future export price of the Kalina? t. If you were AvtoVaz, what would you hope would happen to the ruble's value versus the dollar over time given your desire to export the Kalina? Now if you combined that "hope" a. If the domestic price of the Kalina increases with the rate of inflation, what would be its price over the 2002-2006 period? The domestic price of the Kalina in 2002 is Ruble (Round to the nearest ruble.) Enter your answer in the answer box and then click Check Answer. AvtoVAZ of Russia's Kalina Export Pricing Analysis. ALVAZONO a leading automontacturer in Russia was launching a new automobile model in 2001, and is in the midst of completing a complete pricing analysis of the car for sales in and export. The new car, the Kain would be a priced at Rules 200.000 in Russia and exported. 58.60667 in US dollars at the current spot rate of Ruties 30 31.00. Avtovar intends to raise the price domestically with the mate of Russian Infonen over time, but is worried about how that compares to the export price given U. dolar mation and reture exchange rate. Use the datatable to answer the pricing any questions are domestic price of the Kaina norases the rate of inflation, what would be a price over the 2002-2006 peror? c. If the export price of the Kama were set using the purchasing power party forecast of the bor exchange rate what would be the export price over the 2000-2006 period? d. How would the Katinas export price evolve over time towed Russian Inflation and the exchange rate of the rule versus the dollar remained relatively constant over this period of time? Vad, one of the newy wed pricing strateguts, believes that proes of automobiles in both domestic and export markets wil both increase with the rate of inflation, and that me te collar exchange rate will remained. What would you were AvtoVaz, what would you hope would happen to the rule's value versus the dollar over time given your desire to export te Katra? Now if you combined at "hope" with some assumptions about the competition-other 9. So what did the Russian ruble end up doing over the 2001-2005 period? AvtoVAZ of Russia's Kalina Export Pricing Analysis. AVTOVAZOAD, a leading to manufacturer in Russia was launching a new automobile model in 2001, and is in the midst of completing a complete pricing analysis of the car for sales in Russia and export. The new car, the King would be priced at Rubles 200.000 Russia and it exported 60667 in US dollars at the current spot rate of Rubies 30 - $1.00 Antends to raise the price domestic with the rate of Russia infation over time, but is worried about how that comes to the export price given U.S. doiration and the future exchange rate. Use the datatable to answer the pricing analysis questions the domestic price of the Kannaincreases with the rate of inflation, what would be price over the 2000-2005 pod b. Assuming that the forecast of US and Russian fortion prove accurate, what would be the value of the rule over the coming years its value versus the dollar followed purchasing power party? e. If the export price of the Kina were set using the purchasing power party forecast of the ruble-doar exchange rate what would be the sport price over the 2002-2006 period? d. How would the Kara's export price evolve over time it followed Russian tanion and the exchange rate of the reversus the dollar remainedvely constant over this period of time? e. Viad, one of the newly red pricing strategies, believes that prices of tomobiles in bon domestic and exportmants will both increase with the rate of inflation, and that the door exchange rate will remained What would this t. if you were AvtoVaz, what would you hope would happen to the rules au versus the door over time given your desire to export Kaina? Now if you combined that hope with some assumptions about the competitioner auto sale price in dollar markets vermehow might your strategy evolve? 9. So what the Russian ruble end up cong over the 2001-2006 period AVTOVAZ of Russia's Kalina Export Pricing Analysis AOWAZ OAD, a leading auto manufacturer in Russia was launching a new automobile model in 2001, and is in the midst of completing a compile pricing analysis of the for sale in Russia and export. The new car, the would be inaly priced at Rules 200,000 in Russia and if exported. 8,667 in US dotars at the current spot rate of Rutes 65100 Avaz intends to raise the price domestically win the rate of Russian won over time, but is worried about how that compares to the export price given US dolariation and the future exchange rate Use the data to answer the pricing analysis questions a. If the domestic price of the maincreases with the rate of what would be s price over the 2002-2006 pero b. Assuming that the forecasts of US and Russian Wation prove accurate, what would be the value of the rule over the coming years if its we versus the doodowed purchasing power party c. If the export price of the Kaina were senge purchasing power party forecast of the ruble do exchange rate what would be the export price over the 2002-2006 period? d. How would the Kaina's export pre evolve over time followed Russian nation and the exchange rate of the nutre versus the door romaned relatively constant over this period of time? wout les mpy of forecast for the future export price of the Kana? Vind one of the newly red ping strategist, beves that prices of automobiles in both domestic and export markets we both increase with the rate of inflation, and that the recoltar exchange rate will remained What Lif you were dove what would you hope would happen to the beste versus the dollar over time given your desire to export the Kaina? Now you combined wat hope with some assumption about the competition-other automobile sale price in dolar markets over time-how might your strategy evolve? 9. So what did the Russian ruble end up doing over the 2001-2006 period? AVTOVAZ of Russia's Kalina Export Pricing Analysis. AVOVAZ OAO, a leading auto manufacturer in Russia, was launching a new automobile model in 2001, and is in the midst of completing a complete pricing analysis of the car for sales in Russia and export. The new car, the Kalina, would be initially priced at Rubles 200,000 in Russia and if exported, $8,666.67 in U.S. dollars at the current spot rate of Rubles 30 - $1.00. AvtoVaz intends to raise the price domestically with the rate of Russian inflation over time, but is worried about how that compares to the export price given U.S. dollar inflation and the future exchange rate. Use the data table, to answer the pricing analysis questions. a. If the domestic price of the Kalina increases with the rate of inflation, what would be its price over the 2002-2006 period? b. Assuming that the forecasts of U.S. and Russian inflation prove accurate, what would be the value of the ruble over the coming years if its value versus the dollar followed purchasing power party? c. If the export price of the Kalina were set using the purchasing power parity forecast of the ruble-dollar exchange rate, what would be the export price over the 2002-2006 period? d. How would the Kalina's export price evolve over time if it followed Russian Inflation and the exchange rate of the ruble versus the dollar remained relatively constant over this period of time? e. Viad, one of the newly hired pricing strategists, believes that prices of automobiles in both domestic and export markets will both increase with the rate of inflation, and that the ruble-dollar exchange rate will remain fixed. What would this imply or forecast for the future export price of the Kalina? t. If you were AvtoVaz, what would you hope would happen to the ruble's value versus the dollar over time given your desire to export the Kalina? Now if you combined that "hope" a. If the domestic price of the Kalina increases with the rate of inflation, what would be its price over the 2002-2006 period? The domestic price of the Kalina in 2002 is Ruble (Round to the nearest ruble.) Enter your answer in the answer box and then click Check