Question: a.) You are required to construct two amortization tables for the financing of an asset (one with deposit and residual and one with deposit

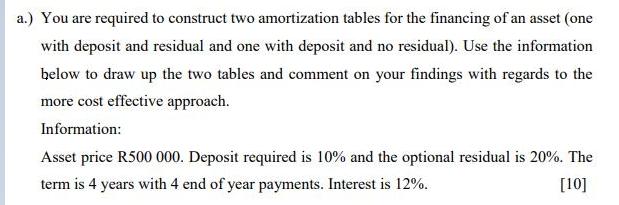

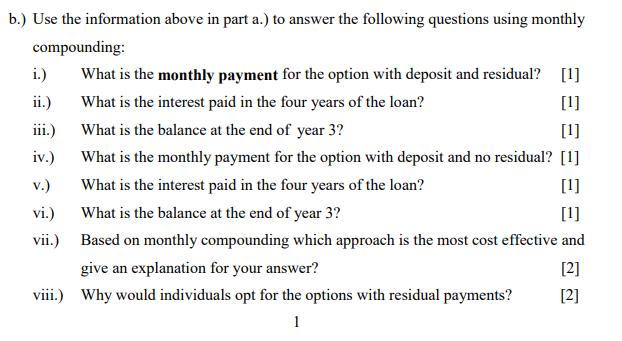

a.) You are required to construct two amortization tables for the financing of an asset (one with deposit and residual and one with deposit and no residual). Use the information below to draw up the two tables and comment on your findings with regards to the more cost effective approach. Information: Asset price R500 000. Deposit required is 10% and the optional residual is 20%. The term is 4 years with 4 end of year payments. Interest is 12%. [10] b.) Use the information above in part a.) to answer the following questions using monthly compounding: i.) What is the monthly payment for the option with deposit and residual? [1] ii.) What is the interest paid in the four years of the loan? [1] iii.) What is the balance at the end of year 3? [1] iv.) What is the monthly payment for the option with deposit and no residual? [1] v.) What is the interest paid in the four years of the loan? [1] vi.) What is the balance at the end of year 3? [1] vii.) Based on monthly compounding which approach is the most cost effective and give an explanation for your answer? [2] viii.) Why would individuals opt for the options with residual payments? [2] 1

Step by Step Solution

3.48 Rating (165 Votes )

There are 3 Steps involved in it

No residual Year Asset Price Deposit Required Interest Total Amortized Value 1 500000 50000 6000 560... View full answer

Get step-by-step solutions from verified subject matter experts