Answered step by step

Verified Expert Solution

Question

1 Approved Answer

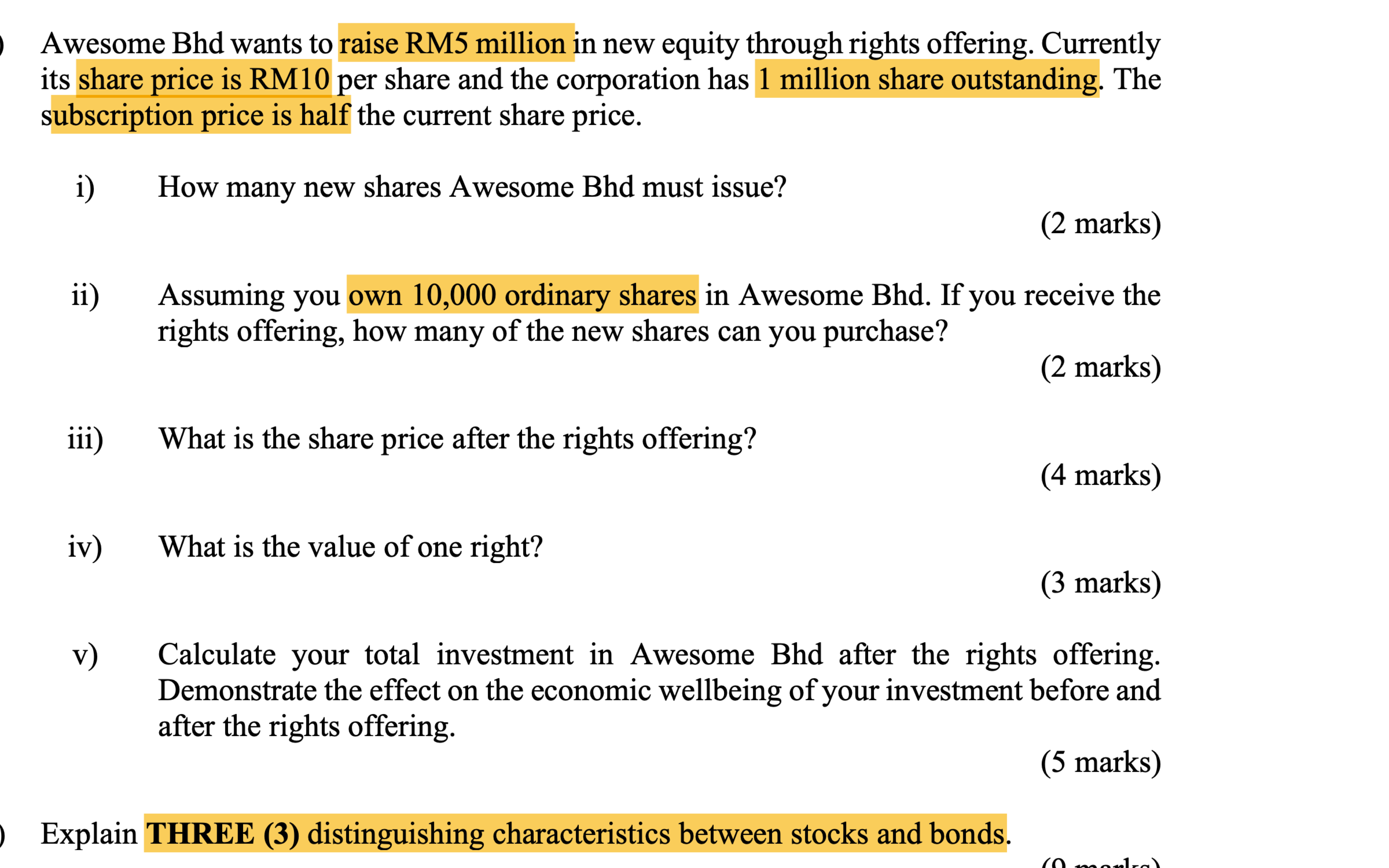

Awesome Bhd wants to raise RM 5 million in new equity through rights offering. Currently its share price is RM 1 0 per share and

Awesome Bhd wants to raise RM million in new equity through rights offering. Currently

its share price is RM per share and the corporation has million share outstanding. The

subscription price is half the current share price.

i How many new shares Awesome Bhd must issue?

marks

ii Assuming you own ordinary shares in Awesome Bhd If you receive the

rights offering, how many of the new shares can you purchase?

marks

iii What is the share price after the rights offering?

marks

iv What is the value of one right?

marks

v Calculate your total investment in Awesome Bhd after the rights offering.

Demonstrate the effect on the economic wellbeing of your investment before and

after the rights offering.

marks

Explain THREE distinguishing characteristics between stocks and bonds.Awesome Bhd wants to raise RM million in new equity through rights offering. Currently its share price is RM per share and the corporation has million share outstanding. The subscription price is half the current share price.

i How many new shares Awesome Bhd must issue?

marks

ii Assuming you own ordinary shares in Awesome Bhd If you receive the rights offering, how many of the new shares can you purchase?

iii What is the share price after the rights offering?

iv What is the value of one right?

marks marks marks

v Calculate your total investment in Awesome Bhd after the rights offering. Demonstrate the effect on the economic wellbeing of your investment before and after the rights offering.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started