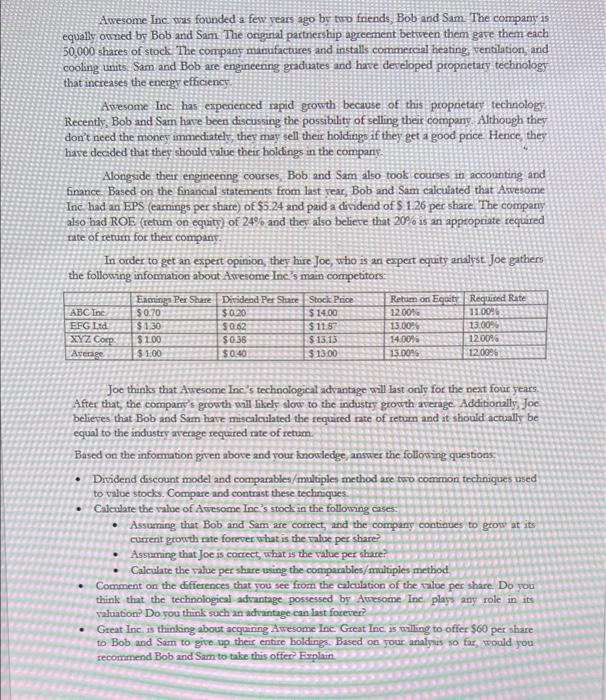

Awesome Inc. was founded a few years ago by to friends, Bob and Sam. The company is equally owned by Bob and Sam. The original partnership agreement between them gave them each 50,000 shares of stock. The company manufactures and installs commercial heating, ventilation, and cooling units. Sam and Bob are engineenng graduates and have developed prophetary technology that increases the energy efficiency Awesome Inc. has experienced rapid growth because of this proprietary technology Recently, Bob and Sarn have been discussing the possibility of selling their company. Although they don't need the money immediately, they may sell their holdings if they get a good price. Hence they have decided that they should value their holdings in the company Alongside their engineering courses, Bob and Sam also took courses in accounting and finance. Based on the financial statements from last year, Bob and Sam calculated that Awesome Inc had an EPS (earnings per share) of $5,24 and paid a dividend of $ 1.26 per share. The company also had ROE (retuim on equaty) of 24% and they also believe that 20% is an appropriate required rate of retum for their company, In order to get an expert opinion, they hire Joe, who is an expert equity analyst Joe gathers the following information about Awesome Ine's main competitors Eating Per Share Dividend Per Share Stock Price Retum on Equity Regused Rate ABC Inc 30.70 $ 0120 $14.00 1200) 11.00 EFG Lid $1.30 $0.62 $11.57 13.00% 13.00 $ 100 $0.36 14.00% 12.00% Average $1.00 50:40 $ 13.00 15.0096 12.00% XYZ Corp $ 1313 . Joe thinks that Awesome Inc.'s technological advantage will last only for the next four years, After that, the company's growth will likely slow to the industry growth average Additionally, Joc believes that Bob and Sam have miscalculated the required rate of return and it should actually be equal to the industry average requred rate of retuam Based on the information given above and your knowledge answer the following questions Dividend discount model and comparables/multiples method are two common techniques used to value stocks. Compare and contrast these techniques Calculate the value of Awesome Inc's stock in the following cases. Assuming that Bob and Sam are correct, and the company continues to grow at its current growth rate forever what is the value per share? Assuming that Joc is correct, what is the value per share? Calculate the value per share using the comparables/multiples method Comment on the differences that you see from the calculation of the value per share. Do you think that the technological advantage possessed by Awesome Inc plays any role in its valuation? Do you think such an advantage can last forever? Great Inc. is thinking about acquaning Awesome In Great Inc. is willing to offer $60 per share to Bob and Sam to give up the entire boldings Based on your analysis so far, would you recommend Bob and Sam to take this offer Explain. . General Guidelines: A case is described below and then some questions are asked based on the information presented in the case. This case pertains to valuation of stocks. You need to answer all questions within the given deadline to receive any credit. You can use any source that you want but you should not indulge in plagiarism and must cite your source (if you use any). If I discover that your report has been plagiarized, then strict action will be taken against youl