Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Awnsers needed for 4-5 Awnsers needed for part 4 and 5 of this page These are the first answers I need that last two now

Awnsers needed for 4-5

Awnsers needed for part 4 and 5 of this page

These are the first answers I need that last two now

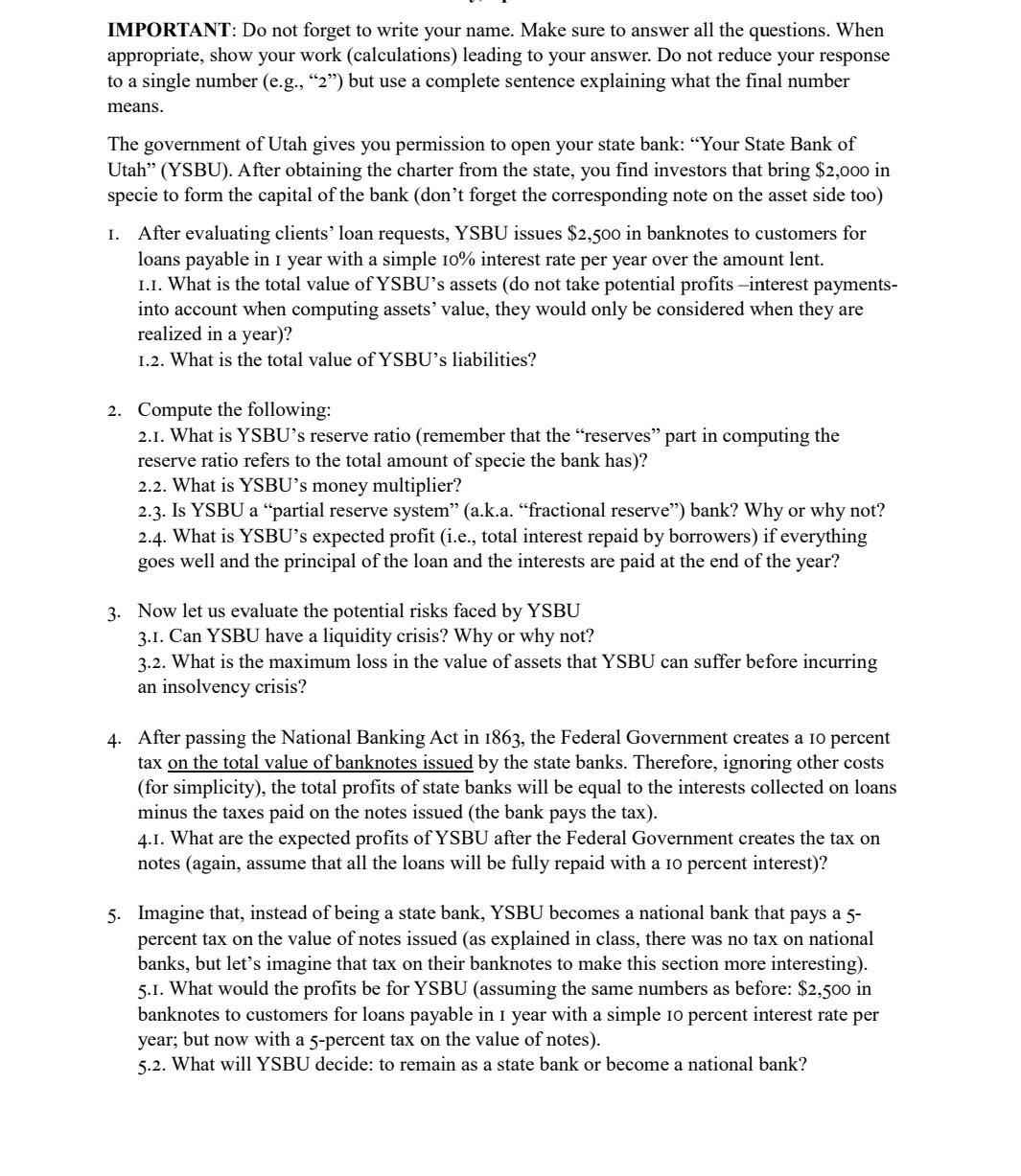

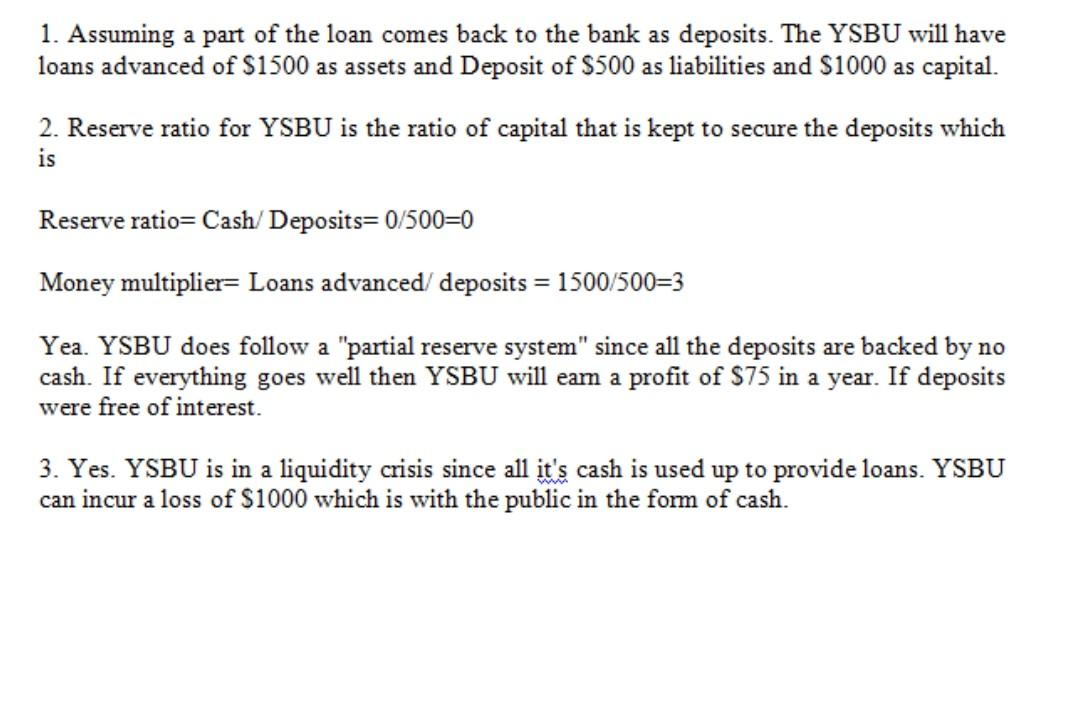

IMPORTANT: Do not forget to write your name. Make sure to answer all the questions. When appropriate, show your work (calculations) leading to your answer. Do not reduce your response to a single number (e.g., "2") but use a complete sentence explaining what the final number means. The government of Utah gives you permission to open your state bank: Your State Bank of Utah (YSBU). After obtaining the charter from the state, you find investors that bring $2,000 in specie to form the capital of the bank (don't forget the corresponding note on the asset side too) I. After evaluating clients' loan requests, YSBU issues $2,500 in banknotes to customers for loans payable in 1 year with a simple 10% interest rate per year over the amount lent. 1.1. What is the total value of YSBU's assets (do not take potential profits -interest payments- into account when computing assets' value, they would only be considered when they are realized in a year)? 1.2. What is the total value of YSBU's liabilities? 2. Compute the following: 2.1. What is YSBU's reserve ratio (remember that the reserves part in computing the reserve ratio refers to the total amount of specie the bank has)? 2.2. What is YSBU's money multiplier? 2.3. Is YSBU a partial reserve system (a.k.a. "fractional reserve) bank? Why or why not? 2.4. What is YSBU's expected profit (i.e., total interest repaid by borrowers) if everything goes well and the principal of the loan and the interests are paid at the end of the year? 3. Now let us evaluate the potential risks faced by YSBU 3.1. Can YSBU have a liquidity crisis? Why or why not? 3.2. What is the maximum loss in the value of assets that YSBU can suffer before incurring an insolvency crisis? 4. After passing the National Banking Act in 1863, the Federal Government creates a 10 percent tax on the total value of banknotes issued by the state banks. Therefore, ignoring other costs (for simplicity), the total profits of state banks will be equal to the interests collected on loans minus the taxes paid on the notes issued (the bank pays the tax). 4.1. What are the expected profits of YSBU after the Federal Government creates the tax on notes (again, assume that all the loans will be fully repaid with a 10 percent interest)? 5. Imagine that, instead of being a state bank, YSBU becomes a national bank that pays a 5- percent tax on the value of notes issued (as explained in class, there was no tax on national banks, but let's imagine that tax on their banknotes to make this section more interesting). 5.1. What would the profits be for YSBU (assuming the same numbers as before: $2,500 in banknotes to customers for loans payable in 1 year with a simple 10 percent interest rate per year; but now with a 5-percent tax on the value of notes). 5.2. What will YSBU decide: to remain as a state bank or become a national bank? 1. Assuming a part of the loan comes back to the bank as deposits. The YSBU will have loans advanced of $1500 as assets and Deposit of $500 as liabilities and $1000 as capital. 2. Reserve ratio for YSBU is the ratio of capital that is kept to secure the deposits which is Reserve ratio=Cash/Deposits=0/500=0 Money multiplier=Loans advanced deposits = 1500/500=3 = Yea. YSBU does follow a "partial reserve system" since all the deposits are backed by no cash. If everything goes well then YSBU will eam a profit of $75 in a year. If deposits were free of interest. a 3. Yes. YSBU is in a liquidity crisis since all it's cash is used up to provide loans. YSBU can incur a loss of $1000 which is with the public in the form of cashStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started