AXA Ltd has recently decided to expand the range of products. To produce a new product, the company will need to purchase a new

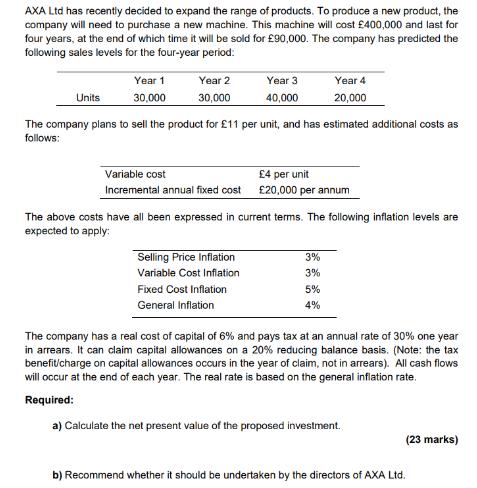

AXA Ltd has recently decided to expand the range of products. To produce a new product, the company will need to purchase a new machine. This machine will cost 400,000 and last for four years, at the end of which time it will be sold for 90,000. The company has predicted the following sales levels for the four-year period: Units Year 1 30,000 Year 2 30,000 Variable cost Incremental annual fixed cost Year 3 40,000 The company plans to sell the product for 11 per unit, and has estimated additional costs as follows: Selling Price Inflation Variable Cost Inflation Fixed Cost Inflation General Inflation Year 4 20,000 4 per unit 20,000 per annum The above costs have all been expressed in current terms. The following inflation levels are expected to apply: 3% 3% 5% 4% The company has a real cost of capital of 6% and pays tax at an annual rate of 30% one year in arrears. It can claim capital allowances on a 20% reducing balance basis. (Note: the tax benefit/charge on capital allowances occurs in the year of claim, not in arrears). All cash flows will occur at the end of each year. The real rate is based on the general inflation rate. Required: a) Calculate the net present value of the proposed investment. (23 marks) b) Recommend whether it should be undertaken by the directors of AXA Ltd.

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Net Present Value Calculation Year 0 Cost of Machine 400000 Year 1 Revenue 30000 x 11 330000 Varia...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started