Answered step by step

Verified Expert Solution

Question

1 Approved Answer

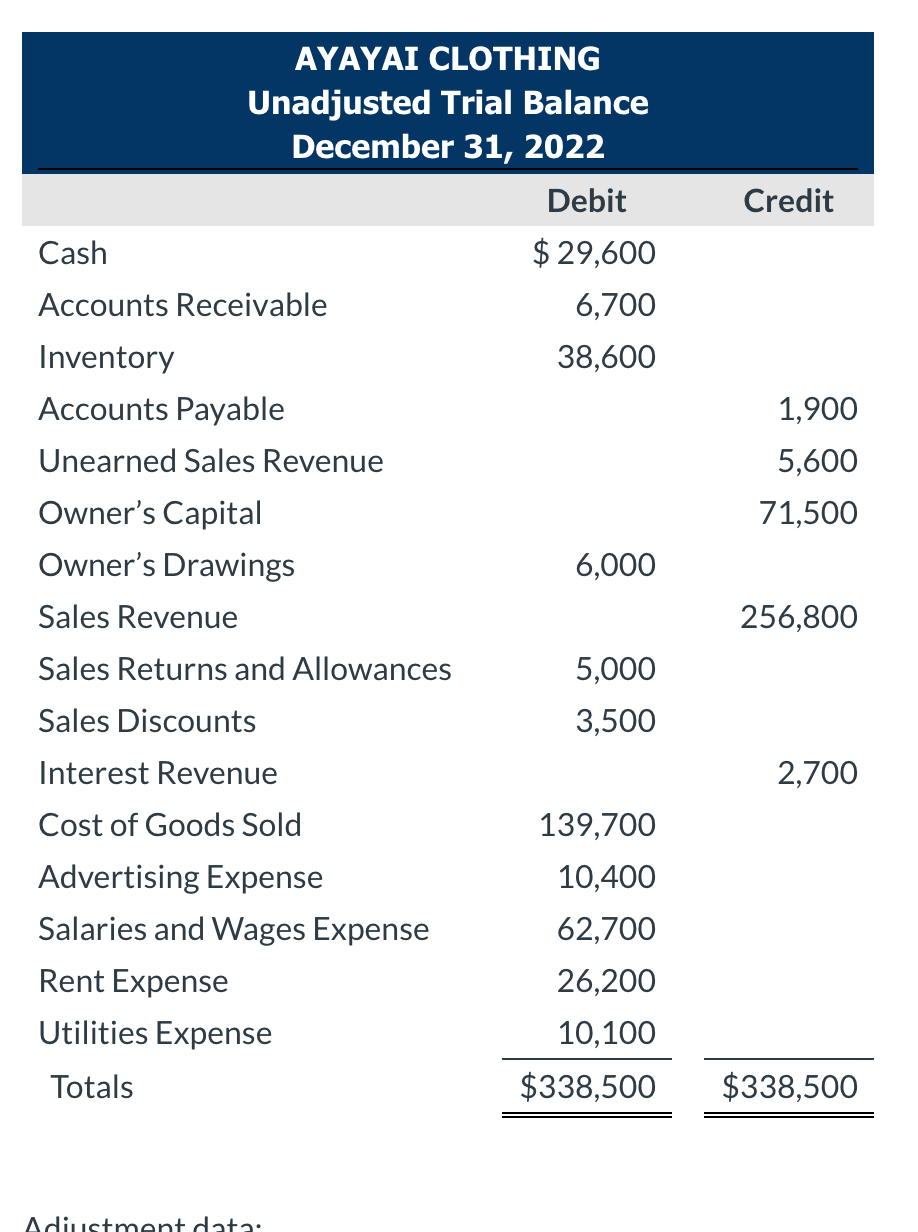

Ayayai Clothing is a retailer in Atlanta, Georgia. The company sells gift cards and records the cash received in the Unearned Sales Revenue account. Presented

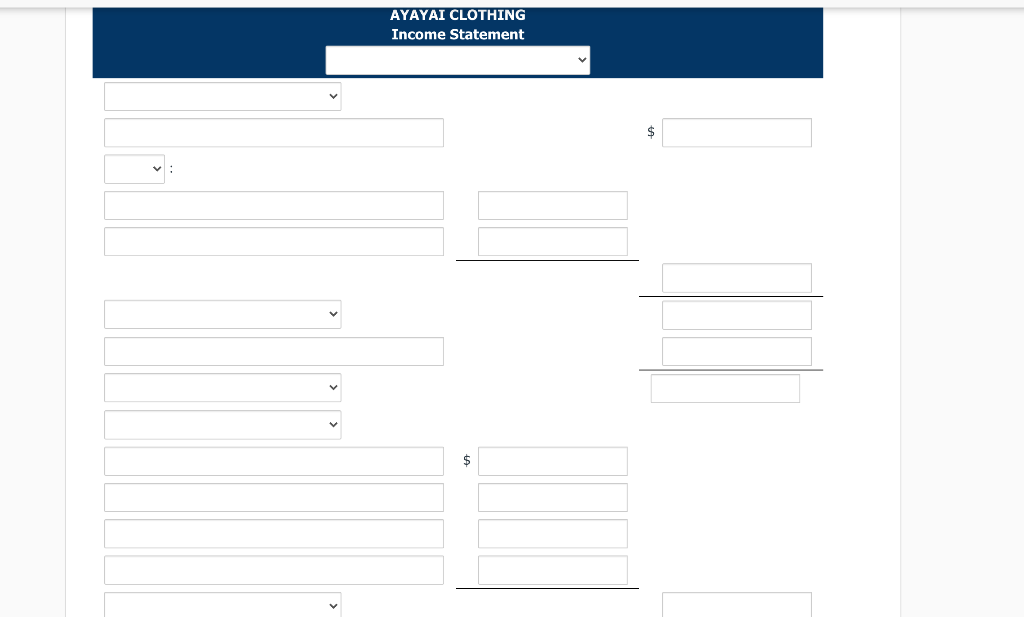

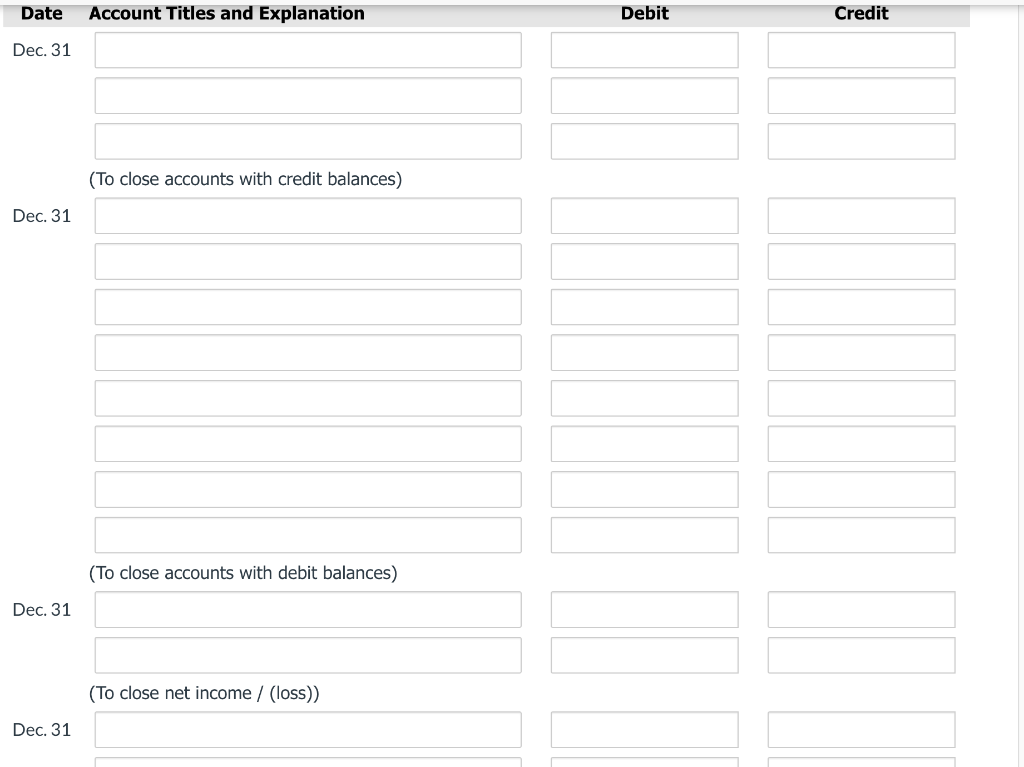

Ayayai Clothing is a retailer in Atlanta, Georgia. The company sells gift cards and records the cash received in the Unearned Sales Revenue account. Presented below is the unadjusted trial balance for Ayayai Clothing as of December 31, 2022.

Adjustment data:

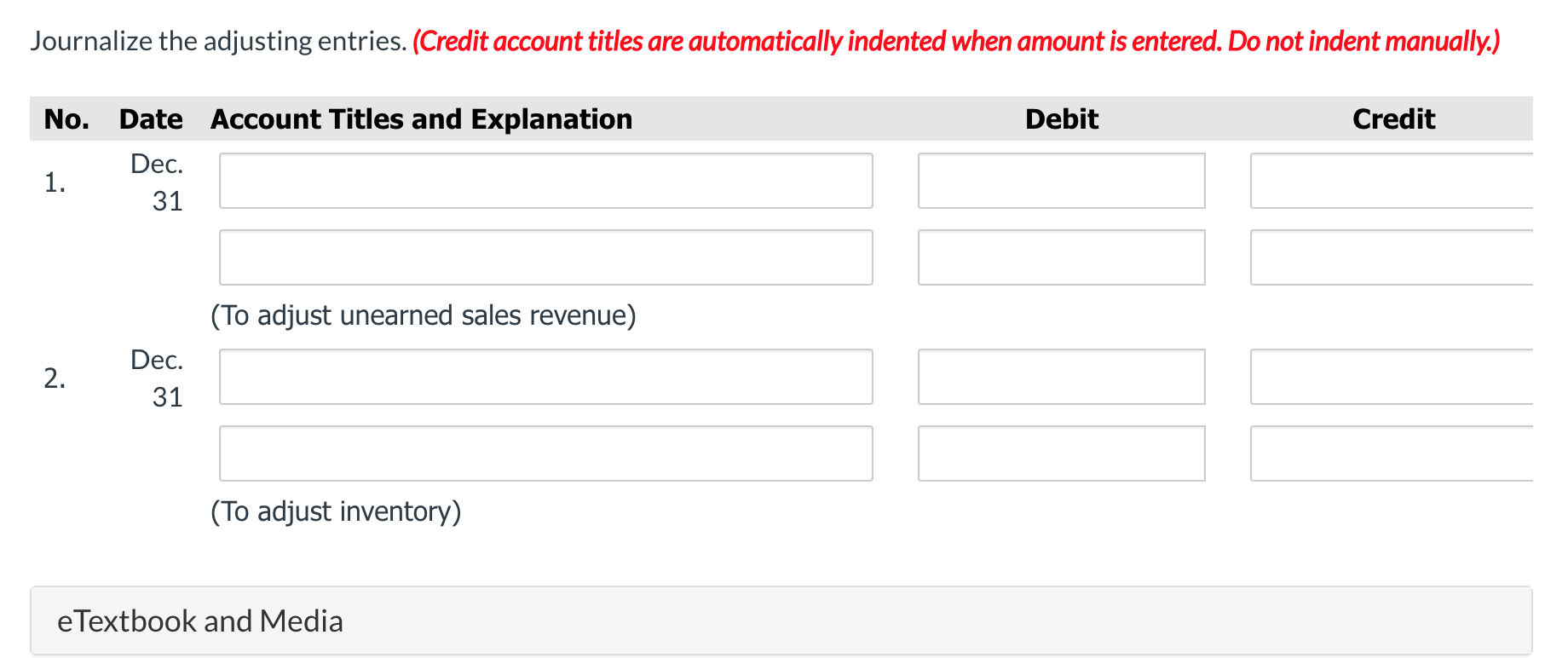

| 1. | Customers used gift cards to purchase merchandise totaling $5,700. | |

| 2. | Inventory actually on hand is $37,900. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started