Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ayayai Company estimates that it will produce 6,000 units of product IOA during the current month. Budgeted variable manufacturing costs per unit are direct

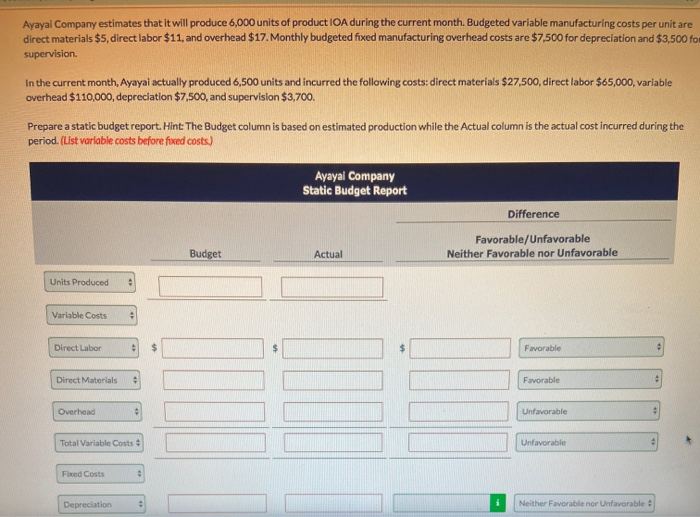

Ayayai Company estimates that it will produce 6,000 units of product IOA during the current month. Budgeted variable manufacturing costs per unit are direct materials $5, direct labor $11, and overhead $17. Monthly budgeted fixed manufacturing overhead costs are $7,500 for depreciation and $3,500 for supervision. In the current month, Ayayai actually produced 6,500 units and incurred the following costs: direct materials $27,500, direct labor $65,000, variable overhead $110,000, depreciation $7,500, and supervision $3,700. Prepare a static budget report. Hint: The Budget column is based on estimated production while the Actual column is the actual cost incurred during the period. (List variable costs before fixed costs.) Units Produced Variable Costs Direct Labor Direct Materials Overhead 0 Total Variable Costs Fixed Costs Depreciation Ayayal Company Static Budget Report Budget Actual Difference Favorable/Unfavorable Neither Favorable nor Unfavorable Favorable Favorable Unfavorable O Unfavorable Neither Favorable nor Unfavorable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started