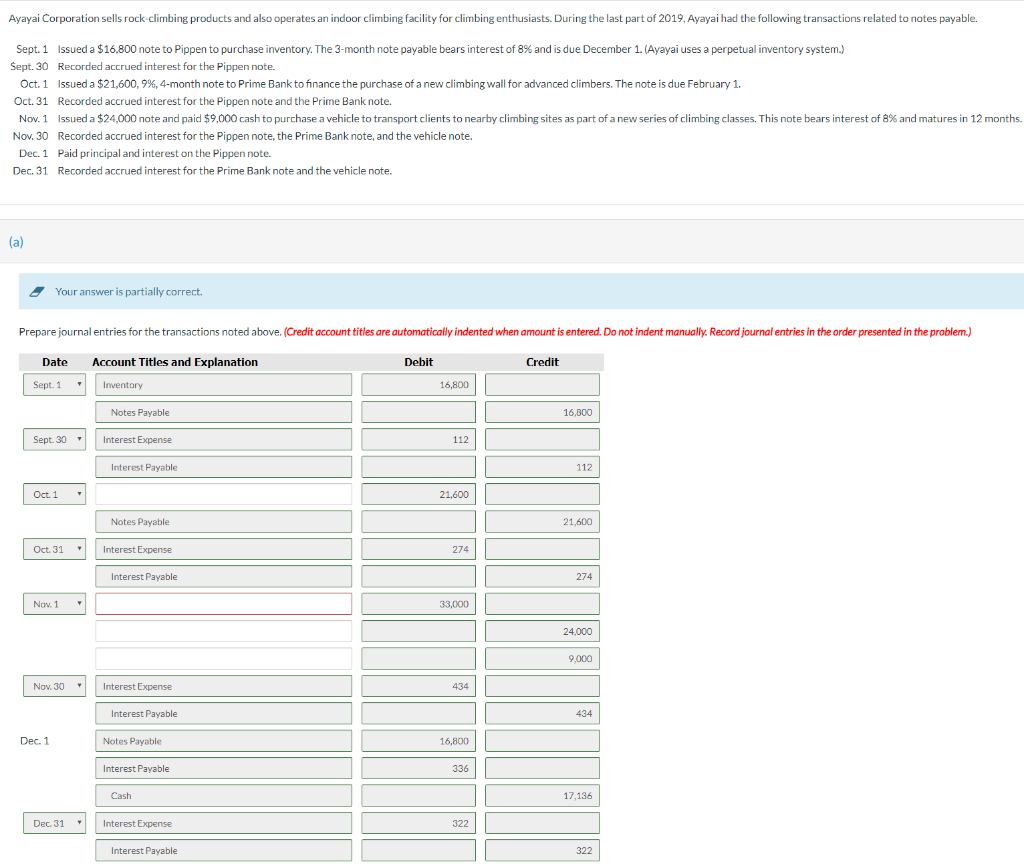

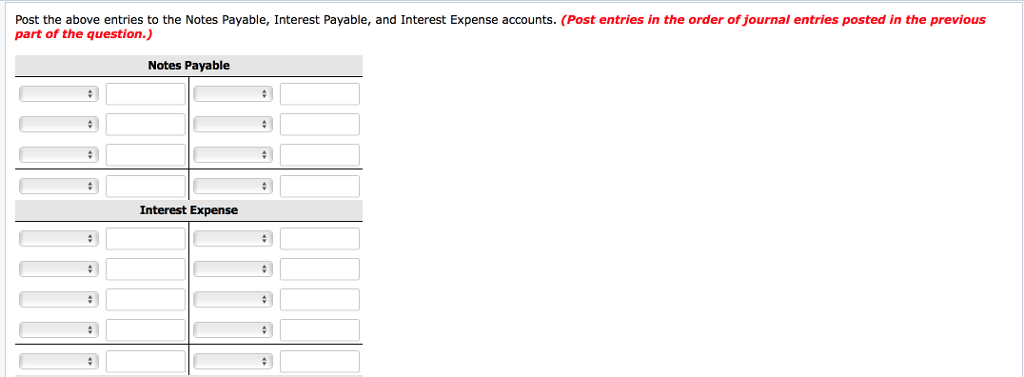

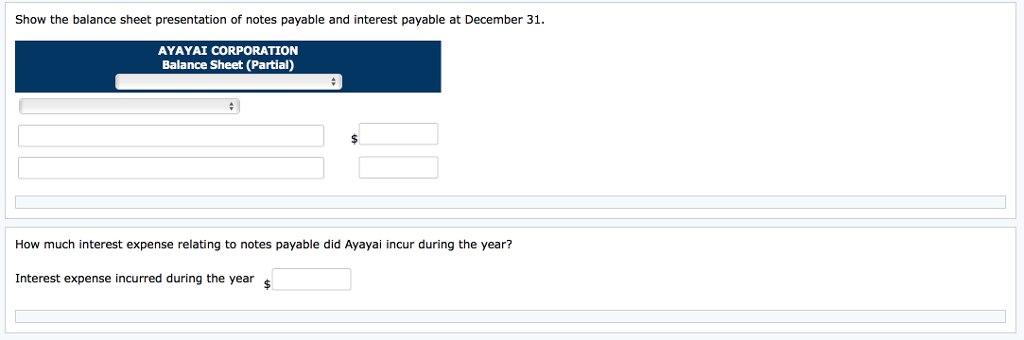

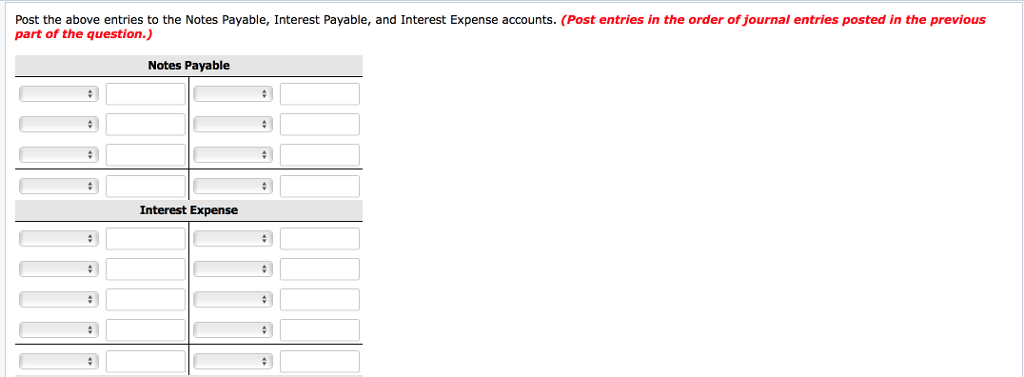

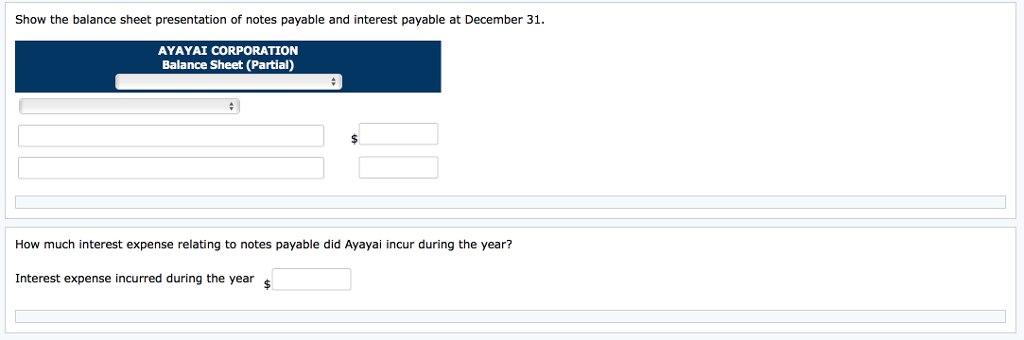

Ayayai Corporation sells rock-climbing products and also operates an indoor climbing facility for climbing enthusiasts. During the last part of 2019. Ayayai had the following transactions related to notes payable. Sept. 1 issued a $16,800 note to Pippen to purchase inventory. The 3-month note payable bears interest of 8% and is due December 1. (Ayayai uses a perpetual inventory system.) Sept. 30 Recorded accrued interest for the Pippen note. Oct. 1 Issued a $21,600,9%, 4-month note to Prime Bank to finance the purchase of a new climbing wall for advanced climbers. The note is due February 1. Oct. 31 Recorded accrued interest for the Pippen note and the Prime Bank note. Nov. 1 Issued a $24,000 note and paid $9,000 cash to purchase a vehicle to transport clients to nearby climbing sites as part of a new series of climbing classes. This note bears interest of 8% and matures in 12 months. rded accrued interest for the Pippen note, the Prime Bank note, and the vehicle note. Dec. 1 Paid principal and interest on the Pippen note. Dec. 31 Recorded accrued interest for the Prime Bank note and the vehicle note. (a) Your answer is partially correct. Prepare journal entries for the transactions noted above. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Debit Credit Date Sept. 1 Account Titles and Explanation Inventory 16,800 Notes Payable 16,800 Sept.30 Interest Expense Interest Payable Oct. 1 . 21,600 Notes Payable Oct 31 Interest Expense Interest Payable Nov. 1 33,000 24,000 9,000 Nov 30 Interest Expense Interest Payable Dec. 1 Notes Payable Interest Payable Cash Dec 31 1 Interest Expense Interest Payable Post the above entries to the Notes Payable, Interest Payable, and Interest Expense accounts. (Post entries in the order of journal entries posted in the previous part of the question.) Notes Payable Interest Expense Show the balance sheet presentation of notes payable and interest payable at December 31. AYAYAI CORPORATION Balance Sheet (Partial) How much interest expense relating to notes payable did Ayayai incur during the year? Interest expense incurred during the years