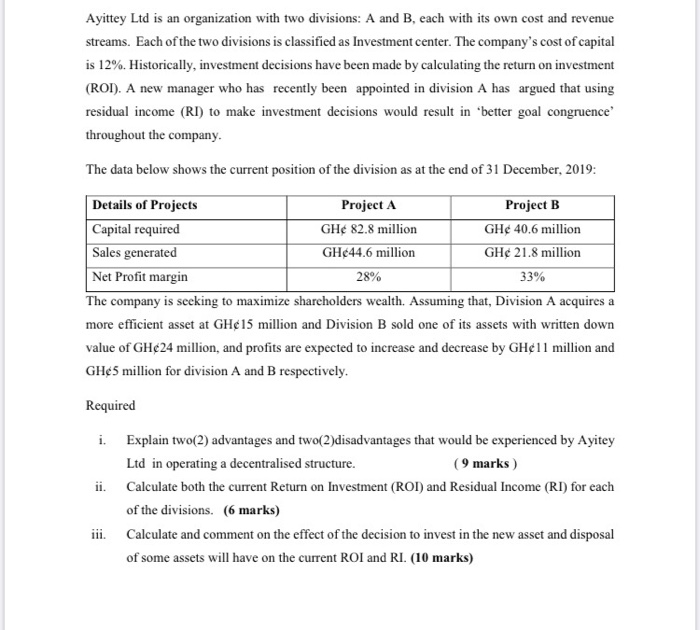

Ayittey Ltd is an organization with two divisions: A and B, each with its own cost and revenue streams. Each of the two divisions is classified as Investment center. The company's cost of capital is 12%. Historically, investment decisions have been made by calculating the return on investment (ROI). A new manager who has recently been appointed in division A has argued that using residual income (RI) to make investment decisions would result in 'better goal congruence throughout the company. The data below shows the current position of the division as at the end of 31 December, 2019: Details of Projects Project A Project B Capital required GH 82.8 million GH 40.6 million Sales generated GH44.6 million GH 21.8 million Net Profit margin 28% 33% The company is seeking to maximize shareholders wealth. Assuming that, Division A acquires a more efficient asset at GH15 million and Division B sold one of its assets with written down value of GH24 million, and profits are expected to increase and decrease by GH11 million and GH5 million for division A and B respectively. Required i. Explain two(2) advantages and two(2)disadvantages that would be experienced by Ayitey Ltd in operating a decentralised structure. (9 marks) ii. Calculate both the current Return on Investment (ROI) and Residual Income (RI) for each of the divisions. (6 marks) iii. Calculate and comment on the effect of the decision to invest in the new asset and disposal of some assets will have on the current ROI and RI. (10 marks) Ayittey Ltd is an organization with two divisions: A and B, each with its own cost and revenue streams. Each of the two divisions is classified as Investment center. The company's cost of capital is 12%. Historically, investment decisions have been made by calculating the return on investment (ROI). A new manager who has recently been appointed in division A has argued that using residual income (RI) to make investment decisions would result in 'better goal congruence throughout the company. The data below shows the current position of the division as at the end of 31 December, 2019: Details of Projects Project A Project B Capital required GH 82.8 million GH 40.6 million Sales generated GH44.6 million GH 21.8 million Net Profit margin 28% 33% The company is seeking to maximize shareholders wealth. Assuming that, Division A acquires a more efficient asset at GH15 million and Division B sold one of its assets with written down value of GH24 million, and profits are expected to increase and decrease by GH11 million and GH5 million for division A and B respectively. Required i. Explain two(2) advantages and two(2)disadvantages that would be experienced by Ayitey Ltd in operating a decentralised structure. (9 marks) ii. Calculate both the current Return on Investment (ROI) and Residual Income (RI) for each of the divisions. (6 marks) iii. Calculate and comment on the effect of the decision to invest in the new asset and disposal of some assets will have on the current ROI and RI. (10 marks)