Answered step by step

Verified Expert Solution

Question

1 Approved Answer

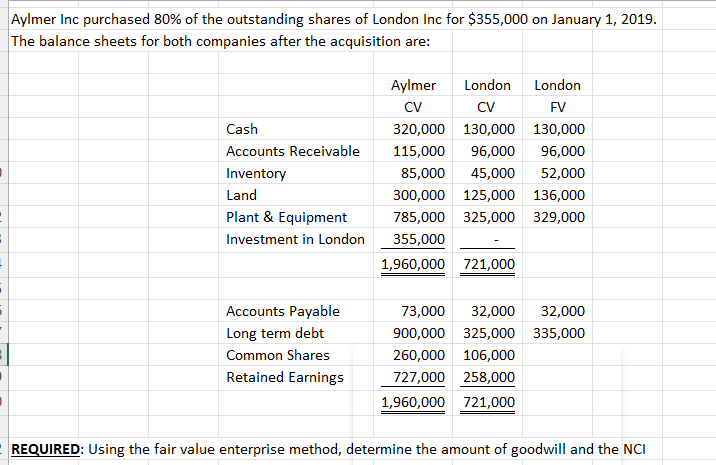

Aylmer Inc purchased 80% of the outstanding shares of London Inc for $355,000 on January 1, 2019. The balance sheets for both companies after

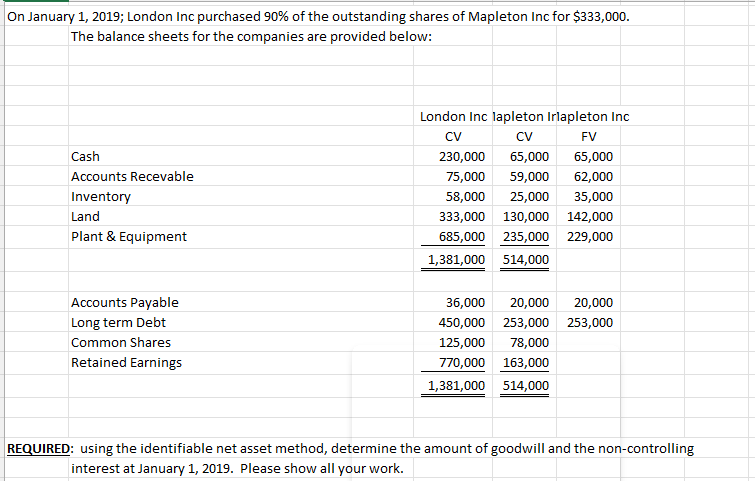

Aylmer Inc purchased 80% of the outstanding shares of London Inc for $355,000 on January 1, 2019. The balance sheets for both companies after the acquisition are: Cash Accounts Receivable Inventory Aylmer CV CV FV 320,000 130,000 130,000 115,000 96,000 96,000 London London 85,000 45,000 52,000 Land 300,000 125,000 136,000 Plant & Equipment Investment in London Accounts Payable Long term debt Common Shares Retained Earnings 785,000 325,000 329,000 355,000 1,960,000 721,000 73,000 32,000 32,000 900,000 325,000 335,000 260,000 106,000 727,000 258,000 1,960,000 721,000 REQUIRED: Using the fair value enterprise method, determine the amount of goodwill and the NCI On January 1, 2019; London Inc purchased 90% of the outstanding shares of Mapleton Inc for $333,000. The balance sheets for the companies are provided below: London Inc lapleton Irlapleton Inc CV CV FV Cash Accounts Recevable Inventory Land Plant & Equipment 230,000 65,000 65,000 75,000 59,000 62,000 58,000 25,000 35,000 333,000 130,000 142,000 685,000 235,000 229,000 1,381,000 514,000 Accounts Payable Long term Debt Common Shares Retained Earnings 36,000 20,000 20,000 450,000 253,000 253,000 125,000 78,000 770,000 163,000 1,381,000 514,000 REQUIRED: using the identifiable net asset method, determine the amount of goodwill and the non-controlling interest at January 1, 2019. Please show all your work.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started