Question

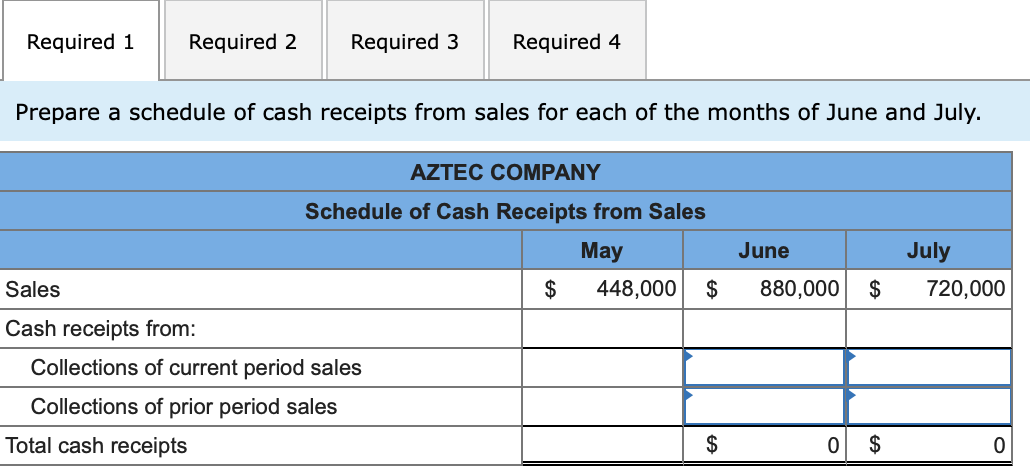

Aztec Company sells its product for $160 per unit. Its actual and budgeted sales follow. May (Actual) June (Budget) July (Budget) August (Budget) Sales units

Aztec Company sells its product for $160 per unit. Its actual and budgeted sales follow.

| May (Actual) | June (Budget) | July (Budget) | August (Budget) | |

|---|---|---|---|---|

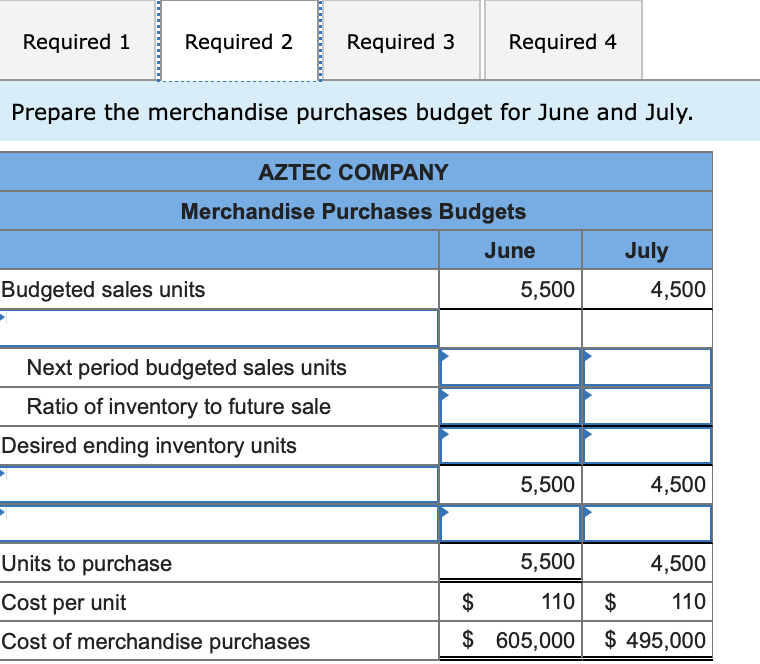

| Sales units | 2,800 | 5,500 | 4,500 | 3,700 |

| Sales dollars | $ 448,000 | $ 880,000 | $ 720,000 | $ 592,000 |

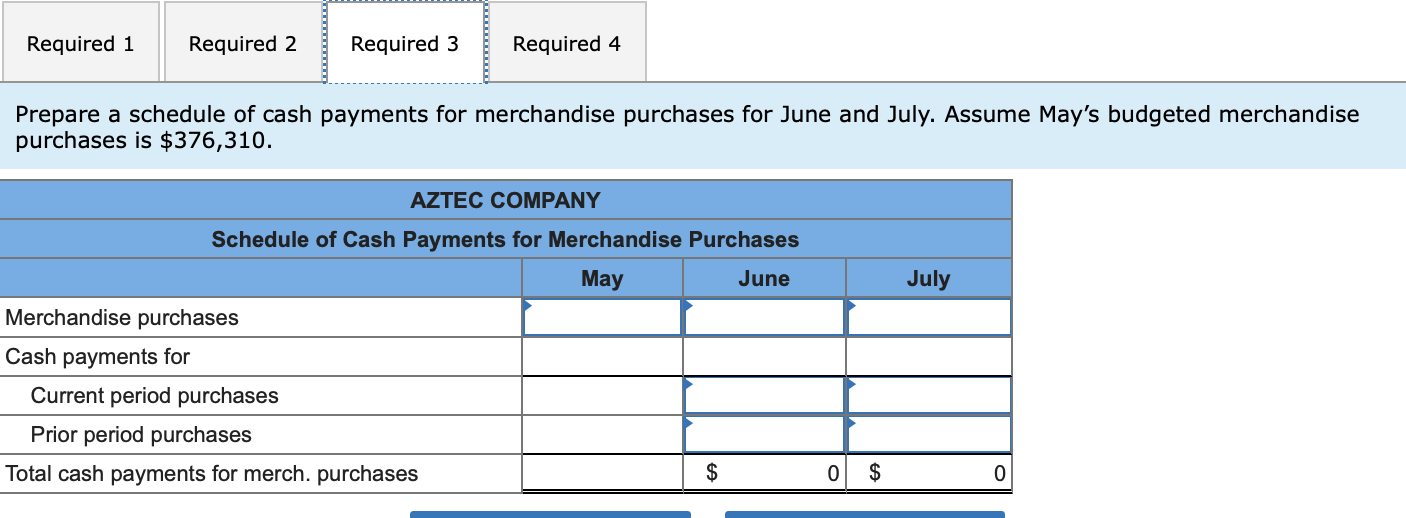

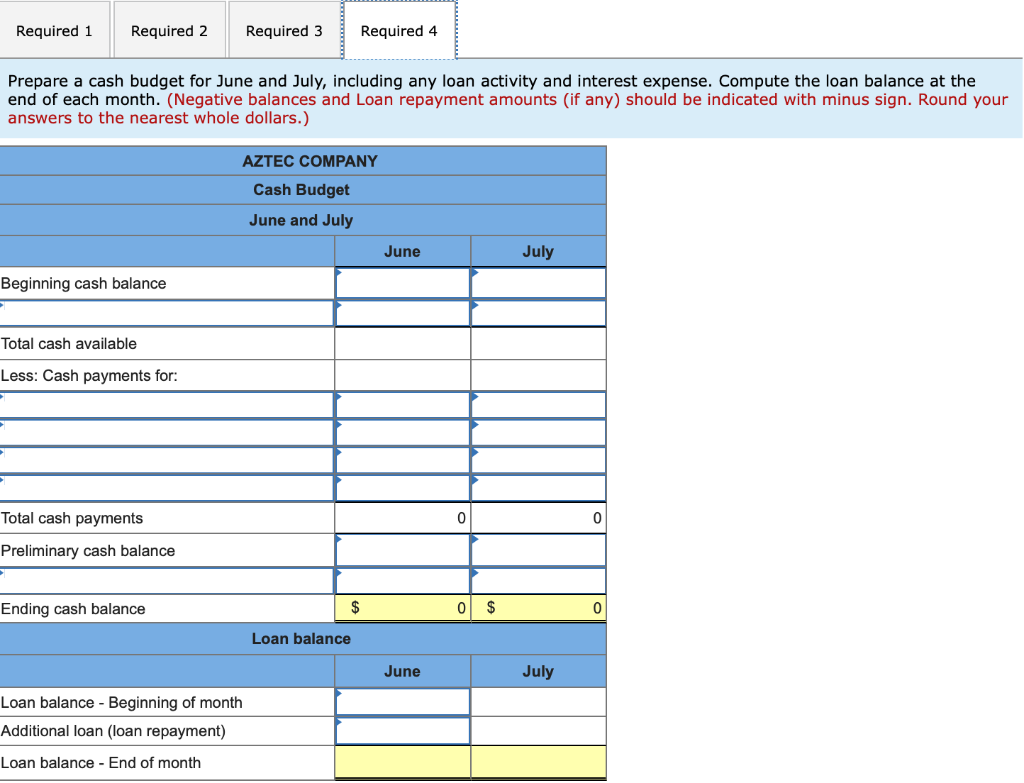

All sales are on credit. Collections are as follows: 28% is collected in the month of the sale, and the remaining 72% is collected in the month following the sale. Merchandise purchases cost $110 per unit. For those purchases, 60% is paid in the month of purchase and the other 40% is paid in the month following purchase. The company has a policy to maintain an ending monthly inventory of 23% of the next months unit sales. The May 31 actual inventory level of 1,265 units is consistent with this policy. Selling and administrative expenses of $105,000 per month are paid in cash. The companys minimum cash balance at month-end is $110,000. Loans are obtained at the end of any month when the preliminary cash balance is below $110,000. Any preliminary cash balance above $110,000 is used to repay loans at month-end. This loan has a 1.0% monthly interest rate. On May 31, the loan balance is $38,000, and the companys cash balance is $110,000. Required: 1. Prepare a schedule of cash receipts from sales for each of the months of June and July. 2. Prepare the merchandise purchases budget for June and July. 3. Prepare a schedule of cash payments for merchandise purchases for June and July. Assume Mays budgeted merchandise purchases is $376,310. 4. Prepare a cash budget for June and July, including any loan activity and interest expense. Compute the loan balance at the end of each month.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started