Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Zubeir Engineering Limited is one of top high-speed boat Manufacturer in the Middle Eastern Region. The capital budgeting strategies in the company involves a

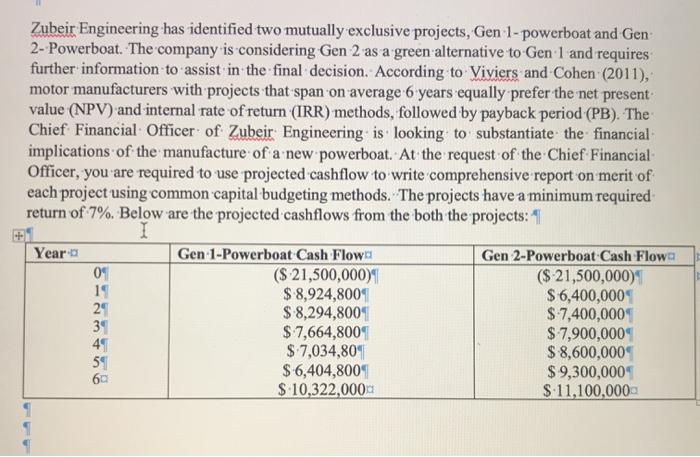

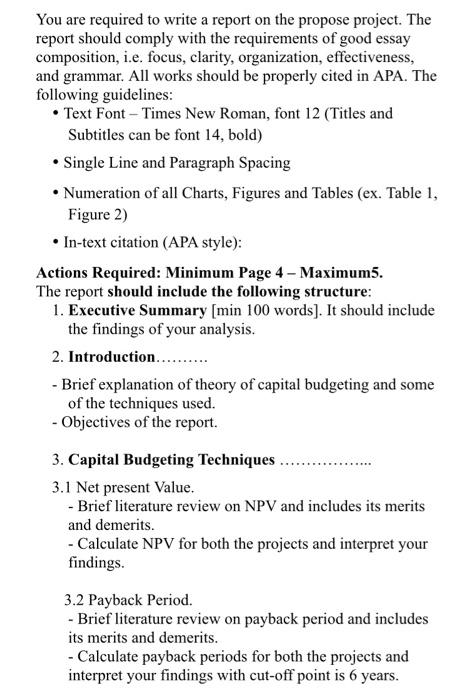

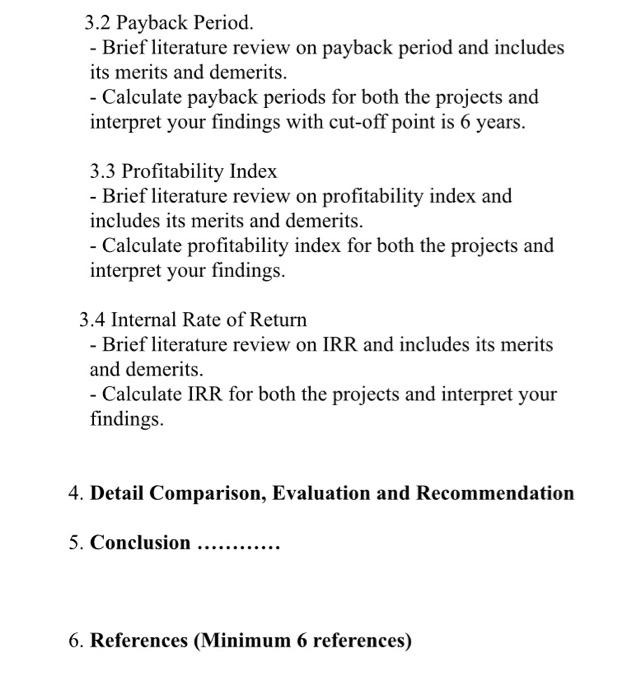

Zubeir Engineering Limited is one of top high-speed boat Manufacturer in the Middle Eastern Region. The capital budgeting strategies in the company involves a three-phase approach: planning or budgeting, evaluation, and post completion reviews. The first phase involves identification of likely projects at strategic planning time. These are selected to support the strategic objectives of the corporation. This identification is generally broad in scope with minimal financial evaluation attached. Projects are classified as new product, cost savings, capacity expansion, etc. As the planning process focuses more closely on the short-term plans (or budgets), major capital expenditures are scrutinized more rigorously. Project costs are more closely honed, and specific projects may be reconsidered. Each project is then individually reviewed and authorized. Planning, developing, and refining cash flows underlie capital analysis at Zubeir Engineering. Once the cash flows have been determined, the application of capital evaluation techniques such as those using net present value, internal rate of return, profitability index and payback period is routine. Presentation of the results is enhanced using sensitivity analysis, which plays a major role for management in assessing the critical assumptions and resulting impact. The final phase relates to post completion reviews in which the original forecasts of the project's performance are compared to actual results and/or revised expectations. Zubeir Engineering has identified two mutually exclusive projects, Gen 1-powerboat and Gen 2-Powerboat. The company is considering Gen 2 as a green alternative to Gen 1 and requires further information to assist in the final decision. According to Viviers and Cohen (2011), motor manufacturers with projects that span on average 6 years equally prefer the net present value (NPV) and internal rate of return (IRR) methods, followed by payback period (PB). The- Chief Financial Officer of Zubeir Engineering is looking to substantiate the financial implications of the manufacture of a new powerboat. At the request of the Chief Financial- Officer, you are required to use projected cashflow to write comprehensive report on merit of each project using common capital budgeting methods. The projects have a minimum required return of 7%. Below are the projected cashflows from the both the projects: I Year- 01 19 29 3 41 59 60 Gen 1-Powerboat Cash Flow ($ 21,500,000) $ 8,924,800 $ 8,294,800 $7,664,800 $ 7,034,80 $6,404,800 $ 10,322,000 Gen 2-Powerboat Cash Flow ($ 21,500,000) $6,400,000 $-7,400,000 $ 7,900,000 $ 8,600,000 $9,300,000 $ 11,100,000 You are required to write a report on the propose project. The report should comply with the requirements of good essay composition, i.e. focus, clarity, organization, effectiveness, and grammar. All works should be properly cited in APA. The following guidelines: Text Font - Times New Roman, font 12 (Titles and Subtitles can be font 14, bold) Single Line and Paragraph Spacing Numeration of all Charts, Figures and Tables (ex. Table 1, Figure 2) In-text citation (APA style): Actions Required: Minimum Page 4 - Maximum5. The report should include the following structure: 1. Executive Summary [min 100 words]. It should include the findings of your analysis. 2. Introduction........ - Brief explanation of theory of capital budgeting and some of the techniques used. - Objectives of the report. 3. Capital Budgeting Techniques. 3.1 Net present Value. - Brief literature review on NPV and includes its merits and demerits. - Calculate NPV for both the projects and interpret your findings. 3.2 Payback Period. - Brief literature review on payback period and includes its merits and demerits. - Calculate payback periods for both the projects and interpret your findings with cut-off point is 6 years. 3.2 Payback Period. - Brief literature review on payback period and includes its merits and demerits. - Calculate payback periods for both the projects and interpret your findings with cut-off point is 6 years. 3.3 Profitability Index - Brief literature review on profitability index and includes its merits and demerits. - Calculate profitability index for both the projects and interpret your findings. 3.4 Internal Rate of Return - Brief literature review on IRR and includes its merits and demerits. - Calculate IRR for both the projects and interpret your findings. 4. Detail Comparison, Evaluation and Recommendation 5. Conclusion .... 6. References (Minimum 6 references)

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started