Answered step by step

Verified Expert Solution

Question

1 Approved Answer

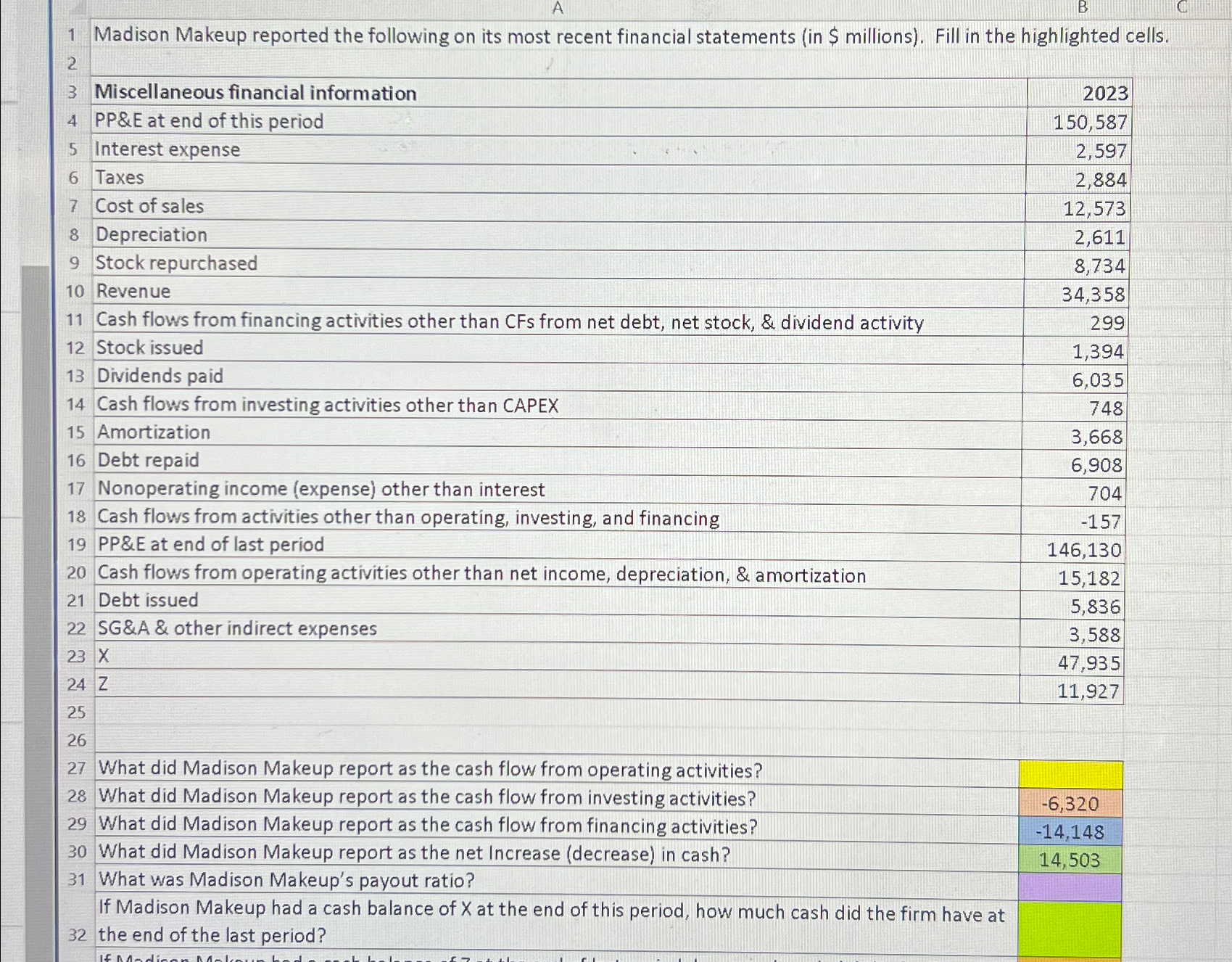

B 1 Madison Makeup reported the following on its most recent financial statements (in $ millions). Fill in the highlighted cells. 2 3 Miscellaneous

B 1 Madison Makeup reported the following on its most recent financial statements (in $ millions). Fill in the highlighted cells. 2 3 Miscellaneous financial information 4 PP&E at end of this period 5 Interest expense 6 Taxes 7 Cost of sales 2023 150,587 2,597 2,884 12,573 8 Depreciation 2,611 9 Stock repurchased 8,734 10 Revenue 34,358 11 Cash flows from financing activities other than CFs from net debt, net stock, & dividend activity 12 Stock issued 299 1,394 13 Dividends paid 6,035 14 Cash flows from investing activities other than CAPEX 748 15 Amortization 16 Debt repaid 17 Nonoperating income (expense) other than interest 18 Cash flows from activities other than operating, investing, and financing 3,668 6,908 704 -157 19 PP&E at end of last period 146,130 20 Cash flows from operating activities other than net income, depreciation, & amortization 21 Debt issued 15,182 5,836 22 SG&A & other indirect expenses 3,588 23 X 47,935 11,927 24 Z 25 26 27 What did Madison Makeup report as the cash flow from operating activities? 28 What did Madison Makeup report as the cash flow from investing activities? 29 What did Madison Makeup report as the cash flow from financing activities? 30 What did Madison Makeup report as the net Increase (decrease) in cash? 31 What was Madison Makeup's payout ratio? If Madison Makeup had a cash balance of X at the end of this period, how much cash did the firm have at 32 the end of the last period? If Medican Me -6,320 -14,148 14,503

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started