Answered step by step

Verified Expert Solution

Question

1 Approved Answer

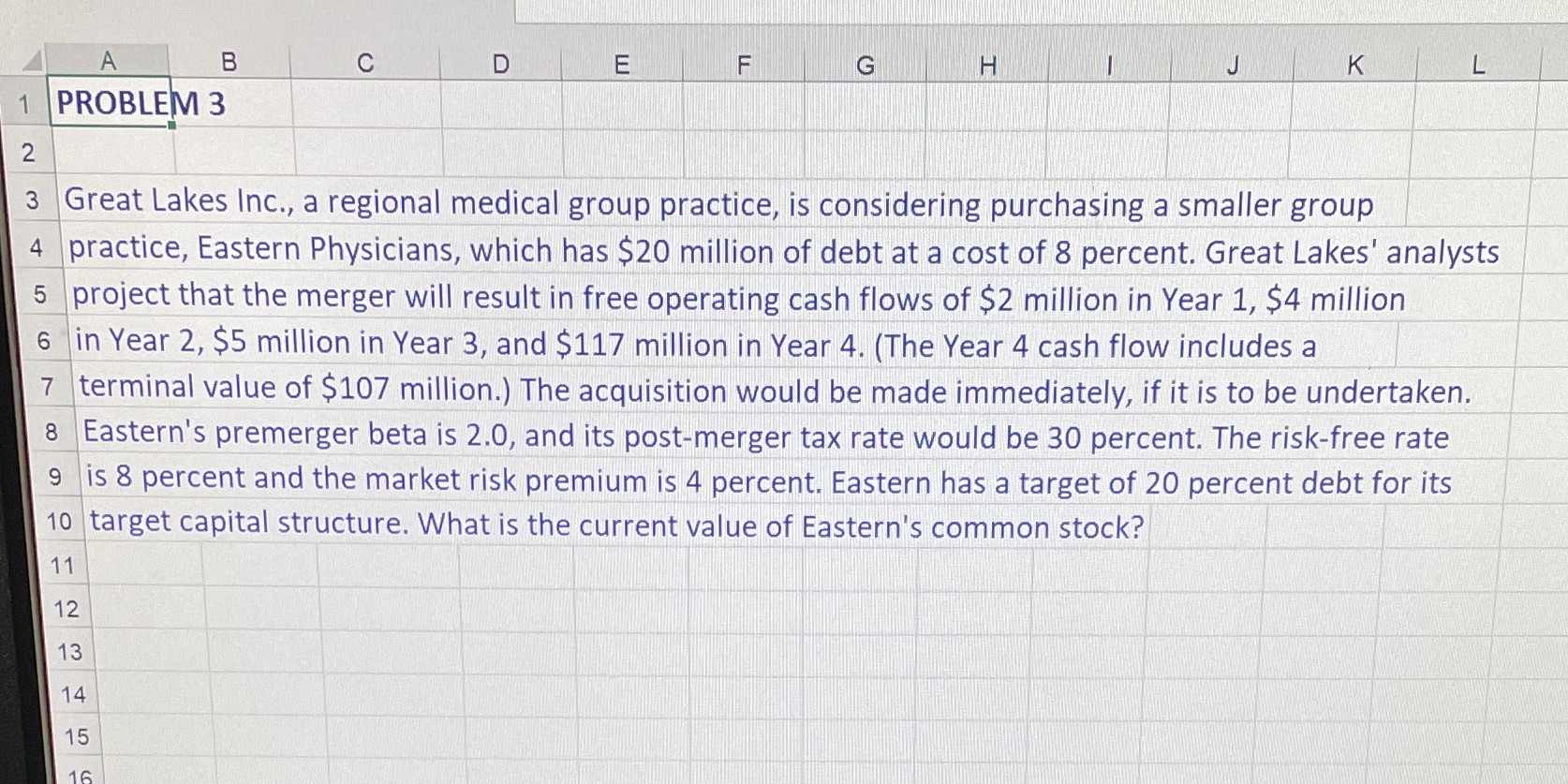

B 1 PROBLEM 3 2 C D E FL G H K L 3 Great Lakes Inc., a regional medical group practice, is considering

B 1 PROBLEM 3 2 C D E FL G H K L 3 Great Lakes Inc., a regional medical group practice, is considering purchasing a smaller group 4 practice, Eastern Physicians, which has $20 million of debt at a cost of 8 percent. Great Lakes' analysts 5 project that the merger will result in free operating cash flows of $2 million in Year 1, $4 million 6 in Year 2, $5 million in Year 3, and $117 million in Year 4. (The Year 4 cash flow includes a 7 terminal value of $107 million.) The acquisition would be made immediately, if it is to be undertaken. 8 Eastern's premerger beta is 2.0, and its post-merger tax rate would be 30 percent. The risk-free rate 9 is 8 percent and the market risk premium is 4 percent. Eastern has a target of 20 percent debt for its 10 target capital structure. What is the current value of Eastern's common stock? 11 12 13 14 15 16 56

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started