Answered step by step

Verified Expert Solution

Question

1 Approved Answer

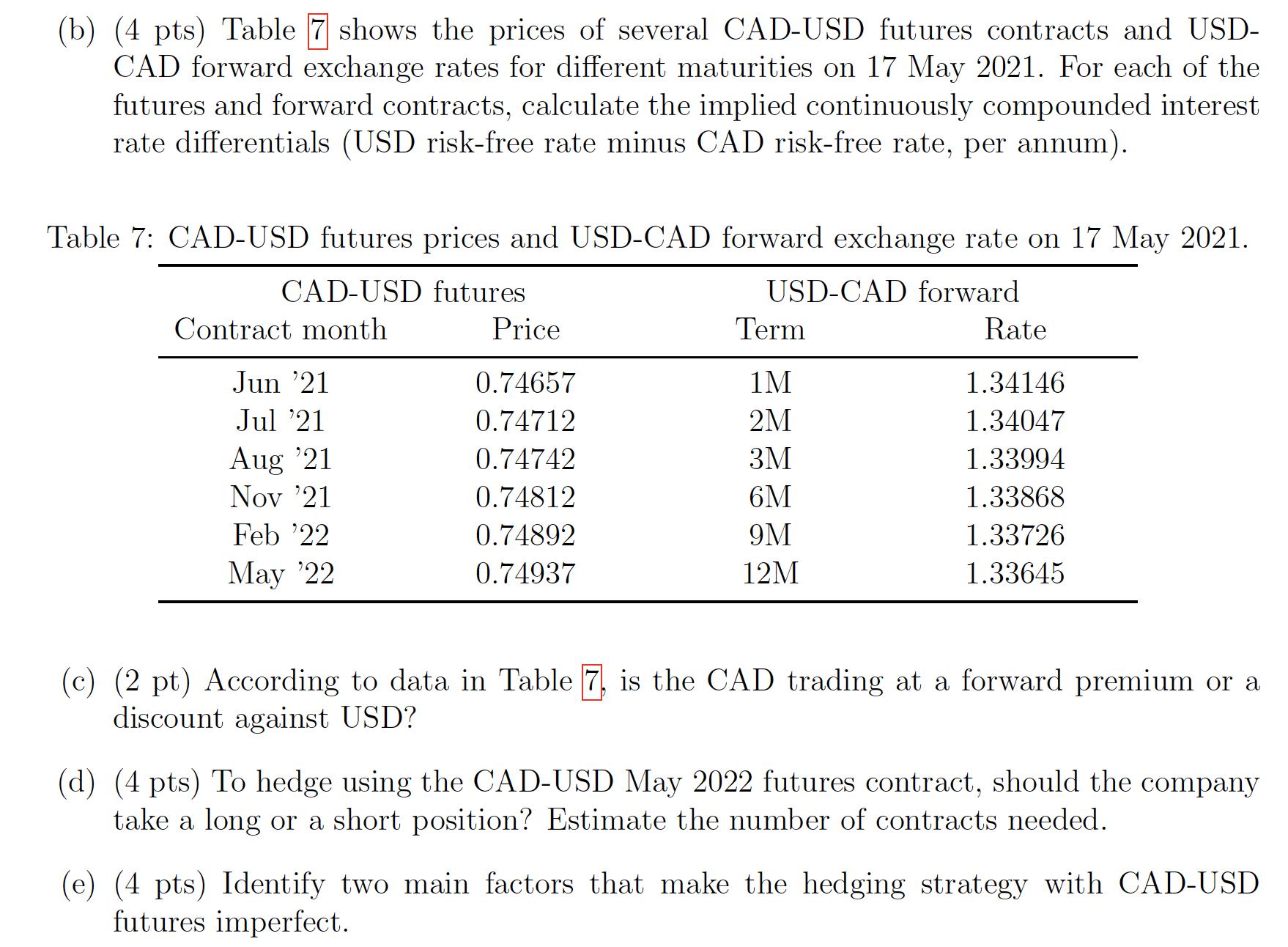

(b) (4 pts) Table 7 shows the prices of several CAD-USD futures contracts and USD- CAD forward exchange rates for different maturities on 17

(b) (4 pts) Table 7 shows the prices of several CAD-USD futures contracts and USD- CAD forward exchange rates for different maturities on 17 May 2021. For each of the futures and forward contracts, calculate the implied continuously compounded interest rate differentials (USD risk-free rate minus CAD risk-free rate, per annum). Table 7: CAD-USD futures prices and USD-CAD forward exchange rate on 17 May 2021. CAD-USD futures USD-CAD forward Contract month Jun '21 Jul '21 Aug '21 Nov 21 Feb '22 May '22 Price 0.74657 0.74712 0.74742 0.74812 0.74892 0.74937 Term 1M 2M 3M 6M 9M 12M Rate 1.34146 1.34047 1.33994 1.33868 1.33726 1.33645 (c) (2 pt) According to data in Table 7, is the CAD trading at a forward premium or a discount against USD? (d) (4 pts) To hedge using the CAD-USD May 2022 futures contract, should the company take a long or a short position? Estimate the number of contracts needed. (e) (4 pts) Identify two main factors that make the hedging strategy with CAD-USD futures imperfect.

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

b To calculate the implied continuously compounded interest rate differentials we can use the formula Implied interest rate differential lnSpot rate F...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started