Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b). ( 45 marks ) Find one bond for each of the above 10 companies, and fill in the information in Table 2: Bond Level

b). (45 marks) Find one bond for each of the above 10 companies, and fill in the information in Table 2: Bond Level information. You should calculate the number of years until maturity.

Here are the requirements:

- All the 10 bonds should be bullet bonds (callable, puttable, extendable bonds are not allowed)

- All the 10 bonds should have similar time to maturity (You cannot have one bond maturing in half year, but the other ones maturing in 10 years). You dont need to make them have the exact same maturity, but you should try your best to find the closest matches.

- The Number of years until maturity is the difference between the maturity date and the current time you obtain the bond information, rounded to one digit after the decimal point.

Table 2: Bond Level Information

|

| Company Name | Bond CUSIP | S&P bond level rating | Outstanding Amount | Maturity Date | Number of years until Maturity | Coupon Rate | Coupon Frequency | Last Trade Price | Last Trade Yield | Last Trade Date |

| 1 |

|

|

|

|

|

|

|

|

|

|

|

| 2 |

|

|

|

|

|

|

|

|

|

|

|

| 3 |

|

|

|

|

|

|

|

|

|

|

|

| 4 |

|

|

|

|

|

|

|

|

|

|

|

| 5 |

|

|

|

|

|

|

|

|

|

|

|

| 6 |

|

|

|

|

|

|

|

|

|

|

|

| 7 |

|

|

|

|

|

|

|

|

|

|

|

| 8 |

|

|

|

|

|

|

|

|

|

|

|

| 9 |

|

|

|

|

|

|

|

|

|

|

|

| 10 |

|

|

|

|

|

|

|

|

|

|

|

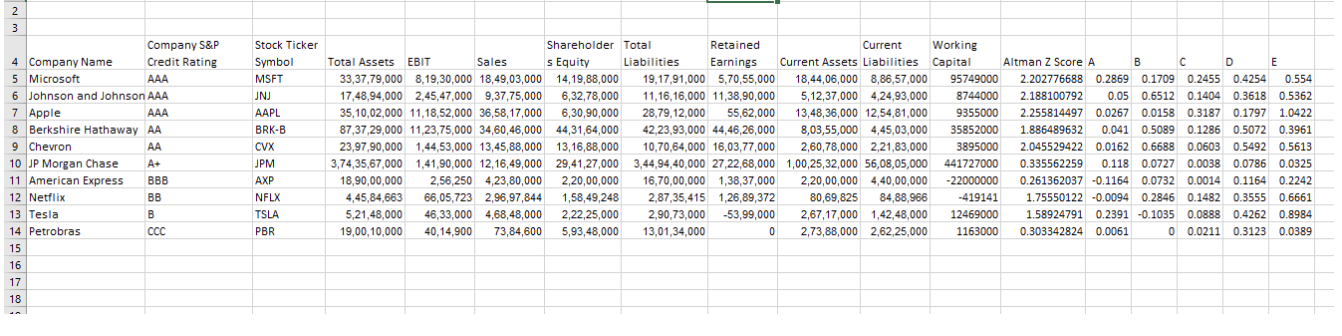

2 3 Company S&P 4 Company Name Credit Rating 5 Microsoft AAA 6 Johnson and Johnson AAA 7 Apple AAA 8 Berkshire Hathaway AA 9 Chevron AA 10 JP Morgan Chase A. 11 American Express BBB 12 Netflix BB 13 Tesla B 14 Petrobras 15 16 17 18 Stock Ticker Symbol MSFT JNJ AAPL BRK-B CVX JPM AXP NFLX TSLA PBR Shareholder Total Retained Current Working Total Assets EBIT Sales s Equity Liabilities Earnings Current Assets Liabilities Capital Altman Z Score A B B D E 33,37,79,000 8,19,30,000 18,49,03,000 14,19,88,000 19,17,91,000 5,70,55,000 18,44,06,000 8,86,57,000 95749000 2.202776688 0.2869 0.1709 0.2455 0.4254 0.554 17,48,94,000 2,45,47,000 9,37,75,000 6,32,78,000 11,16,16,000 11,38,90,000 5,12,37,000 4,24,93,000 8744000 2.188100792 0.05 0.6512 0.1404 0.6512 0.1404 0.3618 0.5362 35,10,02,000 11,18,52,000 36,58,17,000 6,30,90,000 28.79,12,000 55,62,000 13,48,36,000 12,54,81,000 9355000 2.255814497 0.0267 0.0158 0.3187 0.1797 1.0422 87,37,29,000 11,23,75,000 34,60,46,000 44,31,64,000 42,23,93,000 44,46,26,000 8,03,55,000 4,45,03,000 35852000 1.886489632 0.041 0.5089 0.1286 0.5072 0.3961 23,97,90,000 1,44,53,000 13,45,88,000 13,16,88,000 10,70,64,000 16,03,77,000 2,60,78,000 2,21,83,000 3895000 2.045529422 0.0162 0.6688 0.0603 0.5492 0.5613 3,74,35,67,000 1,41,90,000 12,16,49,000 29,41,27,000 3,44,94,40,000 27,22,68,000 1,00,25,32,000 56,08,05,000 441727000 0.335562259 0.118 0.0727 0.0038 0.0786 0.0325 18,90,00,000 2,56,250 4,23,80,000 2,20,00,000 16.70,00,000 1,38,37,000 2,20,00,000 4,40,00,000 -22000000 0.261362037 -0.1164 0.0732 0.0014 0.1164 0.2242 4,45,84.663 66,05,723 2,96,97,844 1,58,49,248 2,87,35,415 1,26,89,372 80,69,825 84,88,966 -419141 1.75550122 -0.0094 0.2846 0.1482 0.3555 0.6661 5,21,48,000 46,33,000 4,68,48,000 2,22,25,000 2,90,73,000 -53,99,000 2,67,17,000 1,42,48,000 12469000 1.58924791 0.2391 -0.1035 0.0888 0.4262 0.8984 19,00,10,000 40,14,900 73,84,600 5,93,48,000 13,01,34,000 0 2,73,88,000 2,62,25,000 1163000 0.303342824 0.0061 0 0.0211 0.3123 0.0389 2 3 Company S&P 4 Company Name Credit Rating 5 Microsoft AAA 6 Johnson and Johnson AAA 7 Apple AAA 8 Berkshire Hathaway AA 9 Chevron AA 10 JP Morgan Chase A. 11 American Express BBB 12 Netflix BB 13 Tesla B 14 Petrobras 15 16 17 18 Stock Ticker Symbol MSFT JNJ AAPL BRK-B CVX JPM AXP NFLX TSLA PBR Shareholder Total Retained Current Working Total Assets EBIT Sales s Equity Liabilities Earnings Current Assets Liabilities Capital Altman Z Score A B B D E 33,37,79,000 8,19,30,000 18,49,03,000 14,19,88,000 19,17,91,000 5,70,55,000 18,44,06,000 8,86,57,000 95749000 2.202776688 0.2869 0.1709 0.2455 0.4254 0.554 17,48,94,000 2,45,47,000 9,37,75,000 6,32,78,000 11,16,16,000 11,38,90,000 5,12,37,000 4,24,93,000 8744000 2.188100792 0.05 0.6512 0.1404 0.6512 0.1404 0.3618 0.5362 35,10,02,000 11,18,52,000 36,58,17,000 6,30,90,000 28.79,12,000 55,62,000 13,48,36,000 12,54,81,000 9355000 2.255814497 0.0267 0.0158 0.3187 0.1797 1.0422 87,37,29,000 11,23,75,000 34,60,46,000 44,31,64,000 42,23,93,000 44,46,26,000 8,03,55,000 4,45,03,000 35852000 1.886489632 0.041 0.5089 0.1286 0.5072 0.3961 23,97,90,000 1,44,53,000 13,45,88,000 13,16,88,000 10,70,64,000 16,03,77,000 2,60,78,000 2,21,83,000 3895000 2.045529422 0.0162 0.6688 0.0603 0.5492 0.5613 3,74,35,67,000 1,41,90,000 12,16,49,000 29,41,27,000 3,44,94,40,000 27,22,68,000 1,00,25,32,000 56,08,05,000 441727000 0.335562259 0.118 0.0727 0.0038 0.0786 0.0325 18,90,00,000 2,56,250 4,23,80,000 2,20,00,000 16.70,00,000 1,38,37,000 2,20,00,000 4,40,00,000 -22000000 0.261362037 -0.1164 0.0732 0.0014 0.1164 0.2242 4,45,84.663 66,05,723 2,96,97,844 1,58,49,248 2,87,35,415 1,26,89,372 80,69,825 84,88,966 -419141 1.75550122 -0.0094 0.2846 0.1482 0.3555 0.6661 5,21,48,000 46,33,000 4,68,48,000 2,22,25,000 2,90,73,000 -53,99,000 2,67,17,000 1,42,48,000 12469000 1.58924791 0.2391 -0.1035 0.0888 0.4262 0.8984 19,00,10,000 40,14,900 73,84,600 5,93,48,000 13,01,34,000 0 2,73,88,000 2,62,25,000 1163000 0.303342824 0.0061 0 0.0211 0.3123 0.0389

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started