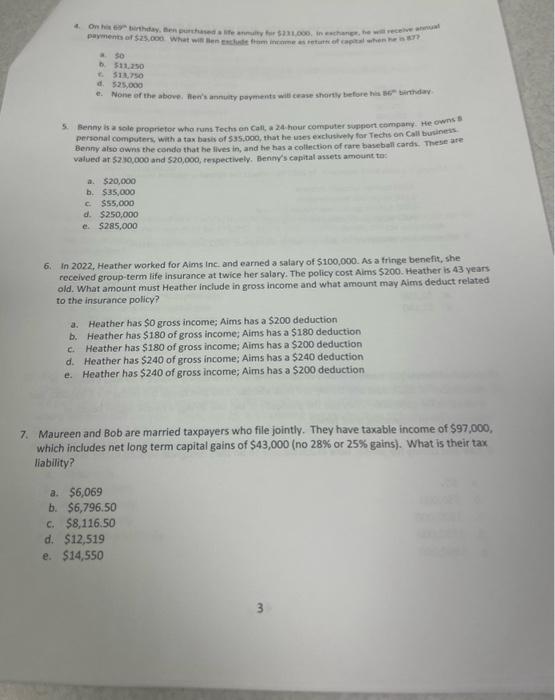

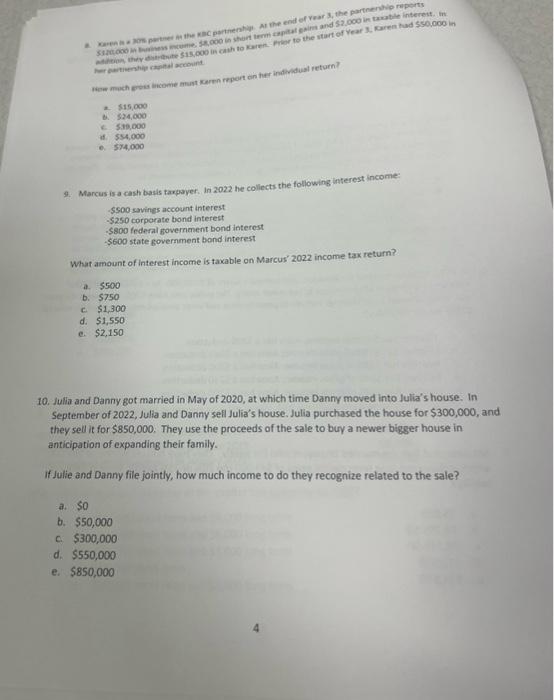

b. 511.250 c. 512,750 d. $25000 e. Nore of the above. Aen's annuty poyment wat crase shortly before has se" birthdar. 5. Benny is a sole propnetor who runs Techs an Cafl, a 24. hour computer support campamy. He owns s. peraonal computers, whin a tax bavi of 535,000 , that he vies excluthelly for Techis on Call business Genny also owns the conde that he lives in, and he has a collection of care baseball cardh. These ate: valued at 5210,000 and 520,000 , teppectively. Dlenny's capitil assets amount to: a. $20,000 b. $35,000 c. $55,000 d. $250,000 e. $285,000 6. In 2022, Heather worked for Aims inc. and earned a salary of $100,000. As a fringe beinefit, she received group-term life insurance at twice her salary. The policy cost Aims $200. Heather is 43 years old. What amount must Heather include in gross income and what amount may Aims deduct related to the insurance policy? a. Heather has $0 gross income; Aims has a $200 deduction b. Heather has $180 of gross income; Alms has a $180 deduction c. Heather has $180 of gross income; Aims has a $200 deduction d. Heather has $240 of gross income; Aims has a $240 deduction e. Heather has $240 of gross income; Alms has a $200 deduction 7. Maureen and Bob are married taxpayers who file jointly. They have taxable income of $97,000, which includes net long term capital gains of $43,000 (no 28% or 25% gains). What is their tax liability? a. $6,069 b. $6,796.50 c. $8,116.50 d. $12,519 e. $14,550 terence reant on her indurduat return? a. 524,000 c. St. 5.000 af 53,000 e. 514,000 9. Marcus is a cash basis raxpayer. In 2022 he collects the following interest income: - S500 savines account interest - \$250 corporate bond interest - $800 federal fovermment bond interest. $600 state govermment bond interest What amount of interest income is taxable on Marcus' 2022 income tax return? a. $500 b. $750 c. $1,300 d. $1,550 e. $2,150 10. Julla and Danny got married in May of 2020, at which time Danny moved into Julia's house. In September of 2022, Julia and Danny sell Julia's house. Julia purchased the house for $300,000, and they sell it for $850,000. They use the proceeds of the sale to bury a newer bigger house in anticipation of expanding their family. If Julie and Danny file jointly, how much income to do they recognize related to the sale? a. $0 b. $50,000 c. $300,000 d. $550,000 e. $850,000