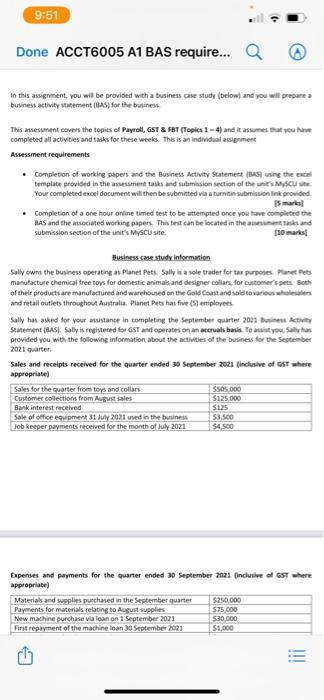

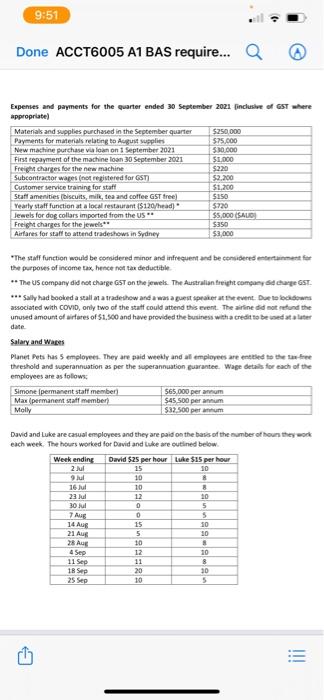

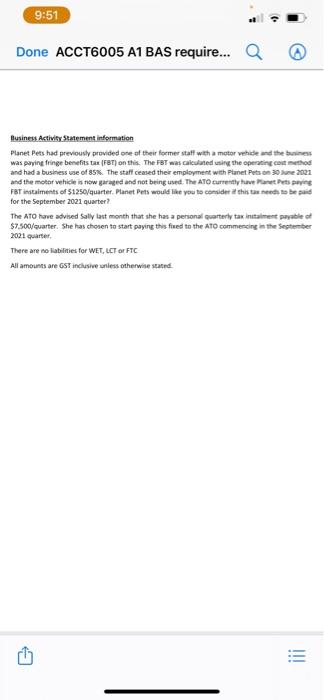

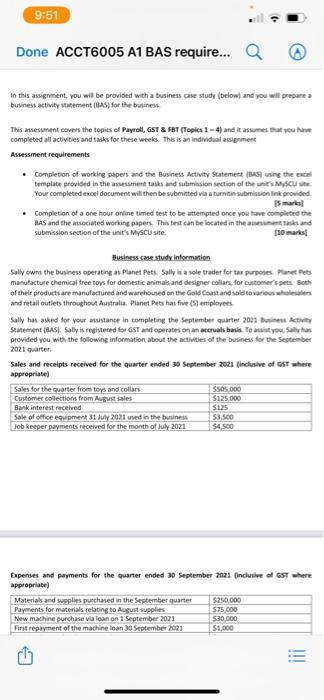

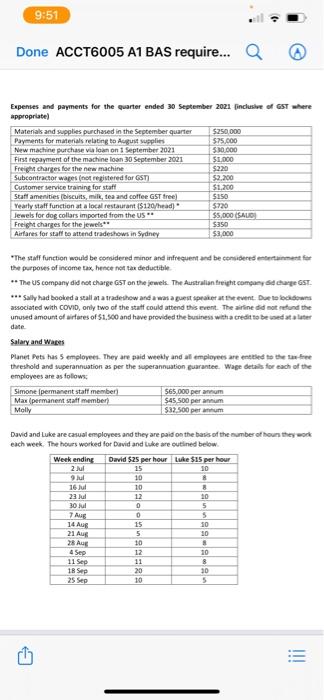

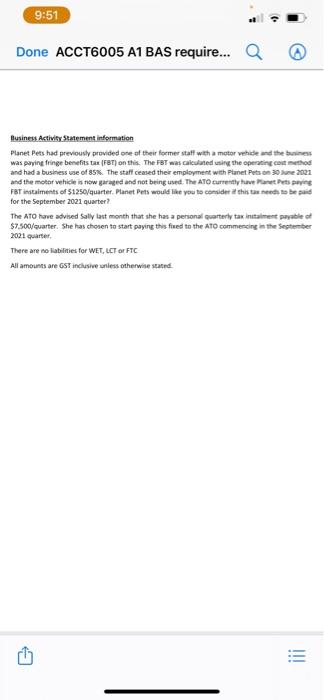

9:51 Done ACCT6005 A1 BAS require... In this assignment, you will be provided with a business case study (below and you will prepare a business activity Statement(BAS) for the business This assessment covers the topics of Payroll, GST & FAT (Topics 1 - 4 and it assumes that you have completed all activities and tasks for these weeks. This is an individual assignment Assessment requirements Completion of working papers and the Business Activity Statement Busing the excel template provided in the assessment tasks and submission section of the issue Your completed excel document will then be submitted via atumitin submission link provided Smarts Completion of a one hour online timed test to be attempted once you have completed the RAS and the sociated working papers. This test can be located in the sand submission section of the unit's Myscu site. 10 mars Business case study Information Sally owns the business operating as Planet Peti. Sally is a sole trader for the purposes. Puneet manufacture chemical free toys for domestic animals and designer collars for customer's pets Both of their products are manufactured and warehoused on the Gold Coast and sold to various when and retail outlets throughout Australia. Planet Pets hat five (5) employees Sally has asked for your stance in completing the Septembet quarter 2021 sec Sement(BAS) Sally is registered for GST and operates on an accrual basis To assist you Sayfa provided you with the following information about the activities of the business for the September 2021 Quarter Sales and receipts received for the quarter ended 30 September 2021 (inclusive of GST where appropriate Sales for the quarter from toys and collars SSOS.000 Customer collections from August sales $125.000 Bank interest received 5125 Sale of office equipment 31 July 2021 used in the business $3,500 Job keeper payments received for the month of July 2021 $4500 Expenses and payments for the quarter ended 30 September 2021 finclusive of GST where appropriate Materials and supplies purchased in the September quarter $250.000 Payments for materials relating to August Supplies $75.000 New machine purchase loan on 1 September 2021 $30.000 First repayment of the machine loan 30 September 2021 51.000 !!! 9:51 Done ACCT6005 A1 BAS require... In this assignment, you will be provided with a business case study (below and you will prepare a business activity Statement(BAS) for the business This assessment covers the topics of Payroll, GST & FAT (Topics 1 - 4 and it assumes that you have completed all activities and tasks for these weeks. This is an individual assignment Assessment requirements Completion of working papers and the Business Activity Statement Busing the excel template provided in the assessment tasks and submission section of the issue Your completed excel document will then be submitted via atumitin submission link provided Smarts Completion of a one hour online timed test to be attempted once you have completed the RAS and the sociated working papers. This test can be located in the sand submission section of the unit's Myscu site. 10 mars Business case study Information Sally owns the business operating as Planet Peti. Sally is a sole trader for the purposes. Puneet manufacture chemical free toys for domestic animals and designer collars for customer's pets Both of their products are manufactured and warehoused on the Gold Coast and sold to various when and retail outlets throughout Australia. Planet Pets hat five (5) employees Sally has asked for your stance in completing the Septembet quarter 2021 sec Sement(BAS) Sally is registered for GST and operates on an accrual basis To assist you Sayfa provided you with the following information about the activities of the business for the September 2021 Quarter Sales and receipts received for the quarter ended 30 September 2021 (inclusive of GST where appropriate Sales for the quarter from toys and collars SSOS.000 Customer collections from August sales $125.000 Bank interest received 5125 Sale of office equipment 31 July 2021 used in the business $3,500 Job keeper payments received for the month of July 2021 $4500 Expenses and payments for the quarter ended 30 September 2021 finclusive of GST where appropriate Materials and supplies purchased in the September quarter $250.000 Payments for materials relating to August Supplies $75.000 New machine purchase loan on 1 September 2021 $30.000 First repayment of the machine loan 30 September 2021 51.000 !!! 9:51 Done ACCT6005 A1 BAS require... Q Expenses and payments for the quarter ended 30 September 2021 [inclusive of GST where appropriate) Materials and supplies purchased in the September quarter $250.000 Payments for materials relating to August Supplies $75,000 New machine purchase va loan on 1 September 2021 50.000 First repayment of the machine loan 30 September 2021 $1.000 Freight charges for the new machine $220 Subcontractor wages (not registered for GST) 52.200 Customer service training for staff $1.200 Staff amenities biscuits, milk, tea and coffee GST free) $150 Yearly staff function at a local restaurant S120/head) 5720 Jewels for dog collars imported from the US $5,000 (SAUD Freight charges for the jewels $350 Airfares for staff to attend tradeshows in Sydney $3.000 "The staff function would be considered minor and infrequent and be considered to the purposes of income tax, hence of tax deductible "The company did not charge GST on the jewels. The Australian freight company change GST. *** Sally had booked a sallan a tradeshow and was a guest speaker at the event. Due to focowns associated with COVID, only two of the staff could attend this event. The airline did not refund the unused amount of airfares of $1.500 and have provided the business with a credit to be used at a later date Salary and Wapes Planet Pets has 5 employees. They are paid weekly and employees are entitled to the three threshold and superannuation as per the superannuation guarantee. Wage details for each of the employees are as follows Simone permanent staff member 565.000 per annum Max (permanent staff member) 545 500 per annum Molly $32.500 per annum David and Luke are casual employees and they are paid on the basis of the number of how they work each week. The hours worked for David and Luke are outlined below Werk ending David $25 per hour Luke $15 per hour 2. 15 10 ul 10 8 16 Jul 10 8 23 12 20 30 Jul 5 7 Aug 5 14 Aug 15 10 21 Aug 5 10 8 4 Sep 12 10 11 Sep 8 18 Sep 20 30 25 Sep 5 Sala Sala 10 28 Aug 11 = 9:51 Done ACCT6005 A1 BAS require... Q Business Activity Statement information Planet Pets had previously provided one of their former staff with a motor vehide and the business was paying fringe benefits tax (FBT) on this. The FBT was calculated using the operating cost method and had a business use of 85%. The staff ceased their employment with Planet Peis on 30 2021 and the motor vehicle is now garaged and not being used. The ATO currently have an espring For installments of $1250/quarter. Planet Pets would like you to consider this tas needs to be paid for the September 2021 quarter? The ATO have advised Sally last month that she has a personal quarterly tax intiment payable of $7.500/quarter. She has chosen to start paying this fived to the ATO commencing in the September 2021 quarter There are no liabilities for WET, LCTOFFTC All amounts are GST inclusive unless otherwise stated