Question

b. A 2x leveraged product on Hang Seng Index has net value of $16,000,000+ $200,000 x Y. Hang Seng Index is currently at 29,000.

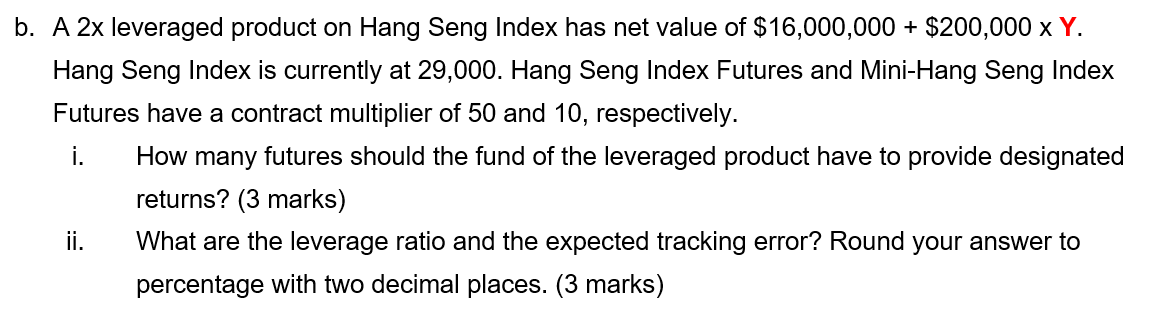

b. A 2x leveraged product on Hang Seng Index has net value of $16,000,000+ $200,000 x Y. Hang Seng Index is currently at 29,000. Hang Seng Index Futures and Mini-Hang Seng Index Futures have a contract multiplier of 50 and 10, respectively. i. How many futures should the fund of the leveraged product have to provide designated returns? (3 marks) ii. What are the leverage ratio and the expected tracking error? Round your answer to percentage with two decimal places. (3 marks)

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

i To calculate the number of futures contracts needed to provide the designated returns we first nee...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Practical Business Statistics

Authors: Andrew Siegel

6th Edition

0123852080, 978-0123852083

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App