Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b. A bank offers a corporate client a choice between borrowing cash at 9% per annum and borrowing Bitcoin at -5% per annum. The

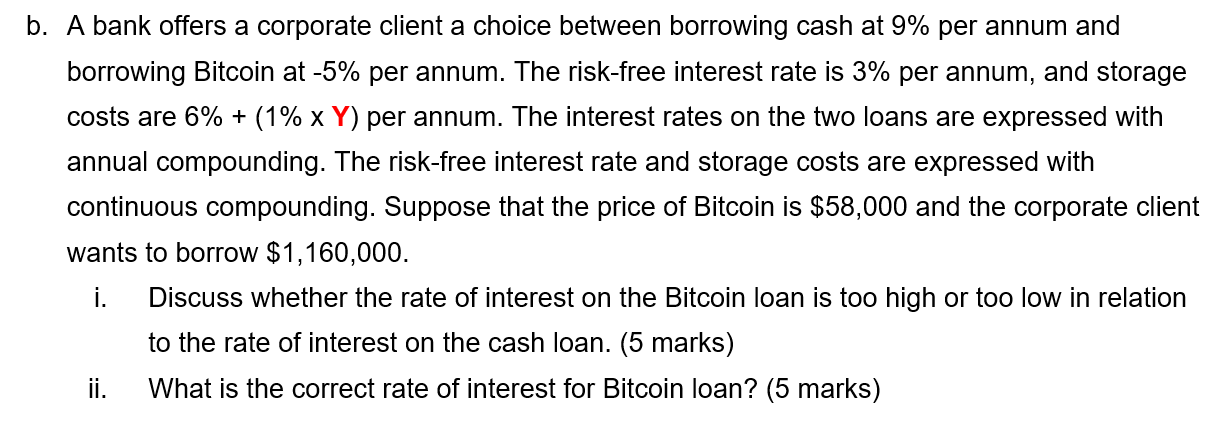

b. A bank offers a corporate client a choice between borrowing cash at 9% per annum and borrowing Bitcoin at -5% per annum. The risk-free interest rate is 3% per annum, and storage costs are 6% + (1% x Y) per annum. The interest rates on the two loans are expressed with annual compounding. The risk-free interest rate and storage costs are expressed with continuous compounding. Suppose that the price of Bitcoin is $58,000 and the corporate client wants to borrow $1,160,000. i. Discuss whether the rate of interest on the Bitcoin loan is too high or too low in relation to the rate of interest on the cash loan. (5 marks) ii. What is the correct rate of interest for Bitcoin loan? (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION i The rate of interest on the Bitcoin loan 5 per annum is too low in relation to the rate o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started