Answered step by step

Verified Expert Solution

Question

1 Approved Answer

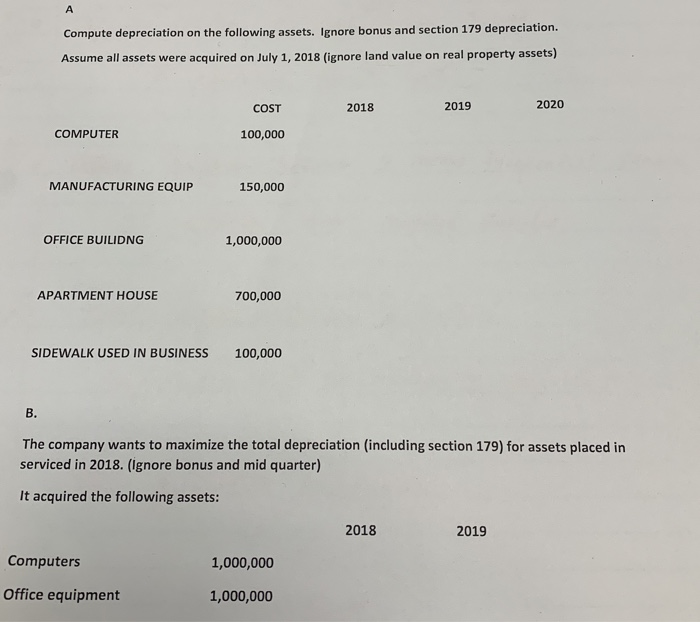

B. A Compute depreciation on the following assets. Ignore bonus and section 179 depreciation. Assume all assets were acquired on July 1, 2018 (ignore

B. A Compute depreciation on the following assets. Ignore bonus and section 179 depreciation. Assume all assets were acquired on July 1, 2018 (ignore land value on real property assets) COMPUTER COST 2018 2019 2020 100,000 MANUFACTURING EQUIP 150,000 OFFICE BUILIDNG APARTMENT HOUSE 1,000,000 700,000 SIDEWALK USED IN BUSINESS 100,000 The company wants to maximize the total depreciation (including section 179) for assets placed in serviced in 2018. (Ignore bonus and mid quarter) It acquired the following assets: 2018 2019 Computers 1,000,000 Office equipment 1,000,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A To compute depreciation for each asset acquired on July 1 2018 you can use the straightline de...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started