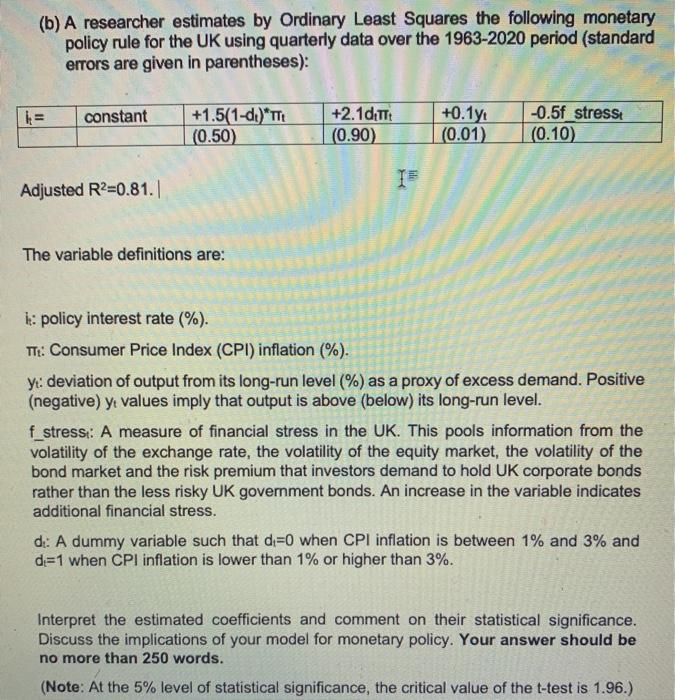

(b) A researcher estimates by Ordinary Least Squares the following monetary policy rule for the UK using quarterly data over the 1963-2020 period (standard errors are given in parentheses): = constant +1.5(1-d)"TT (0.50) +2.1dTT (0.90) +0.1y! (0.01) -0.5f_stress (0.10 IF Adjusted R2=0.81. The variable definitions are: 1: policy interest rate (%). TTE: Consumer Price Index (CPI) inflation (%). y: deviation of output from its long-run level (%) as a proxy of excess demand. Positive (negative) y values imply that output is above (below) its long-run level. f_stress: A measure of financial stress in the UK. This pools information from the volatility of the exchange rate, the volatility of the equity market, the volatility of the bond market and the risk premium that investors demand to hold UK corporate bonds rather than the less risky UK government bonds. An increase in the variable indicates additional financial stress. di: A dummy variable such that di=0 when CPI inflation is between 1% and 3% and d=1 when CPI inflation is lower than 1% or higher than 3%. Interpret the estimated coefficients and comment on their statistical significance. Discuss the implications of your model for monetary policy. Your answer should be no more than 250 words. (Note: At the 5% level of statistical significance, the critical value of the t-test is 1.96.) (b) A researcher estimates by Ordinary Least Squares the following monetary policy rule for the UK using quarterly data over the 1963-2020 period (standard errors are given in parentheses): = constant +1.5(1-d)"TT (0.50) +2.1dTT (0.90) +0.1y! (0.01) -0.5f_stress (0.10 IF Adjusted R2=0.81. The variable definitions are: 1: policy interest rate (%). TTE: Consumer Price Index (CPI) inflation (%). y: deviation of output from its long-run level (%) as a proxy of excess demand. Positive (negative) y values imply that output is above (below) its long-run level. f_stress: A measure of financial stress in the UK. This pools information from the volatility of the exchange rate, the volatility of the equity market, the volatility of the bond market and the risk premium that investors demand to hold UK corporate bonds rather than the less risky UK government bonds. An increase in the variable indicates additional financial stress. di: A dummy variable such that di=0 when CPI inflation is between 1% and 3% and d=1 when CPI inflation is lower than 1% or higher than 3%. Interpret the estimated coefficients and comment on their statistical significance. Discuss the implications of your model for monetary policy. Your answer should be no more than 250 words. (Note: At the 5% level of statistical significance, the critical value of the t-test is 1.96.)