Answered step by step

Verified Expert Solution

Question

1 Approved Answer

B. A small firm introduces its start-up project where it will sell a new product. The life of the project is 5 years. The project

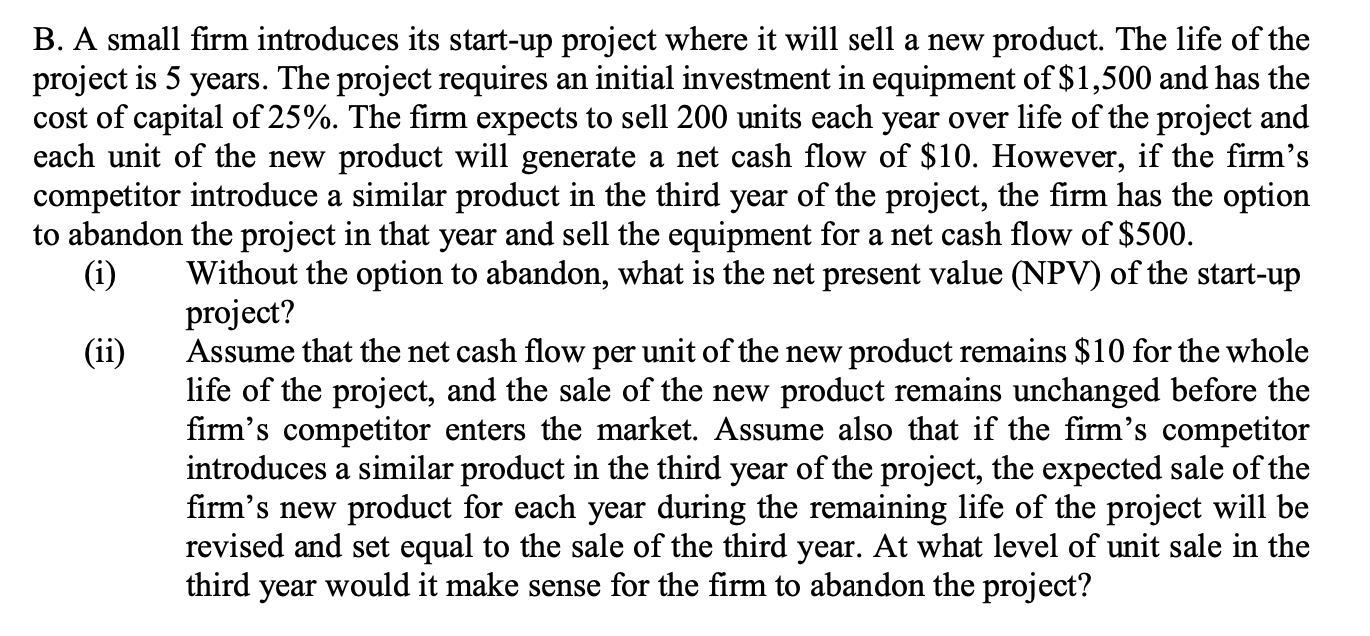

B. A small firm introduces its start-up project where it will sell a new product. The life of the project is 5 years. The project requires an initial investment in equipment of $1,500 and has the cost of capital of 25%. The firm expects to sell 200 units each year over life of the project and each unit of the new product will generate a net cash flow of $10. However, if the firm's competitor introduce a similar product in the third year of the project, the firm has the option to abandon the project in that year and sell the equipment for a net cash flow of $500. (i) Without the option to abandon, what is the net present value (NPV) of the start-up project? (ii) Assume that the net cash flow per unit of the new product remains $10 for the whole life of the project, and the sale of the new product remains unchanged before the firm's competitor enters the market. Assume also that if the firm's competitor introduces a similar product in the third year of the project, the expected sale of the firm's new product for each year during the remaining life of the project will be revised and set equal to the sale of the third year. At what level of unit sale in the third year would it make sense for the firm to abandon the project

B. A small firm introduces its start-up project where it will sell a new product. The life of the project is 5 years. The project requires an initial investment in equipment of $1,500 and has the cost of capital of 25%. The firm expects to sell 200 units each year over life of the project and each unit of the new product will generate a net cash flow of $10. However, if the firm's competitor introduce a similar product in the third year of the project, the firm has the option to abandon the project in that year and sell the equipment for a net cash flow of $500. (i) Without the option to abandon, what is the net present value (NPV) of the start-up project? (ii) Assume that the net cash flow per unit of the new product remains $10 for the whole life of the project, and the sale of the new product remains unchanged before the firm's competitor enters the market. Assume also that if the firm's competitor introduces a similar product in the third year of the project, the expected sale of the firm's new product for each year during the remaining life of the project will be revised and set equal to the sale of the third year. At what level of unit sale in the third year would it make sense for the firm to abandon the project Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started