Answered step by step

Verified Expert Solution

Question

1 Approved Answer

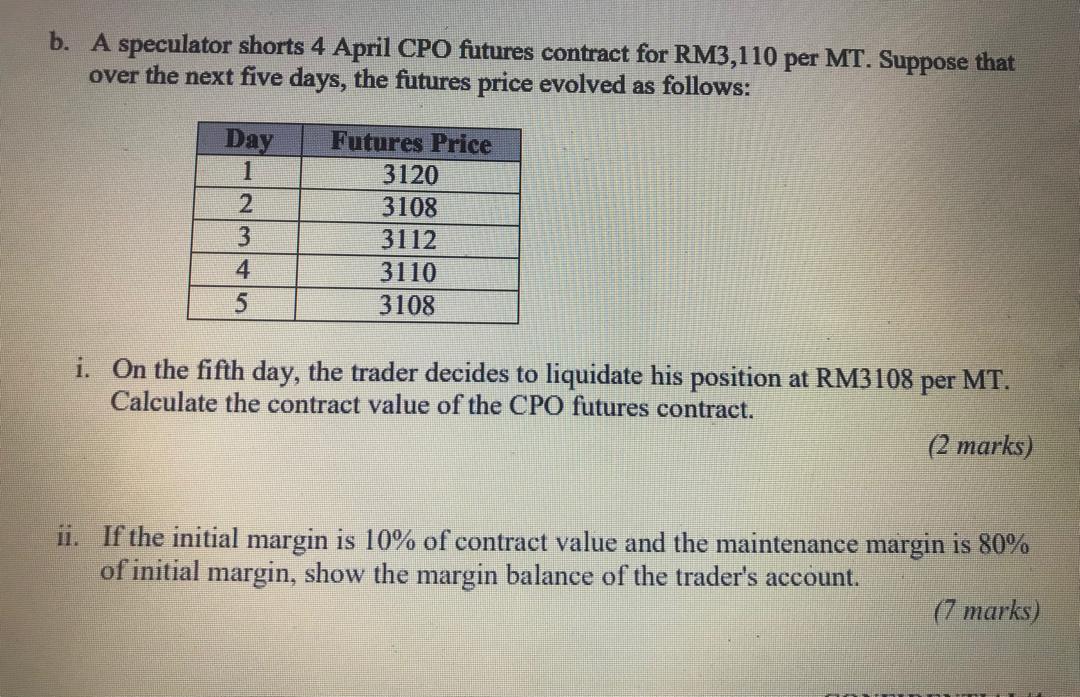

b. A speculator shorts 4 April CPO futures contract for RM3,110 per MT. Suppose that over the next five days, the futures price evolved

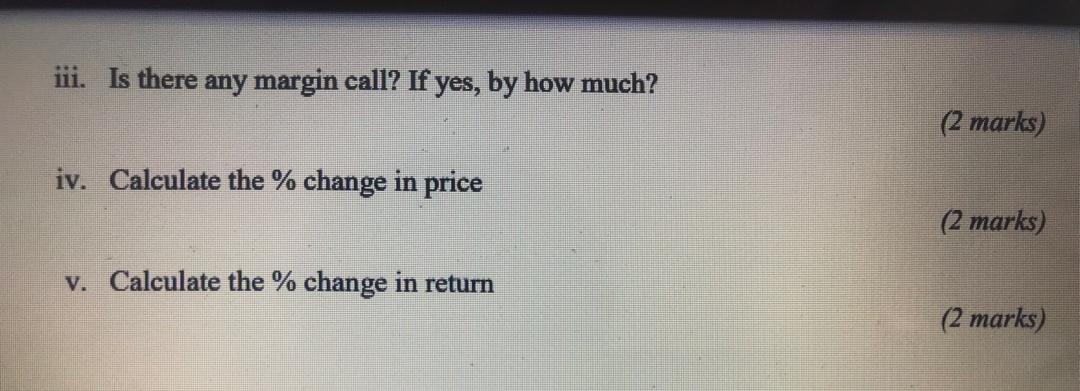

b. A speculator shorts 4 April CPO futures contract for RM3,110 per MT. Suppose that over the next five days, the futures price evolved as follows: Day 1 2 3 4 5 Futures Price 3120 3108 3112 3110 3108 i. On the fifth day, the trader decides to liquidate his position at RM3108 per MT. Calculate the contract value of the CPO futures contract. (2 marks) ii. If the initial margin is 10% of contract value and the maintenance margin is 80% of initial margin, show the margin balance of the trader's account. (7 marks) iii. Is there any margin call? If yes, by how much? iv. Calculate the % change in price v. Calculate the % change in return (2 marks) (2 marks) (2 marks)

Step by Step Solution

★★★★★

3.50 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

i To calculate the contract value of the CPO futures contract we need to multiply the futures price by the contract size The contract size for CPO fut...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started