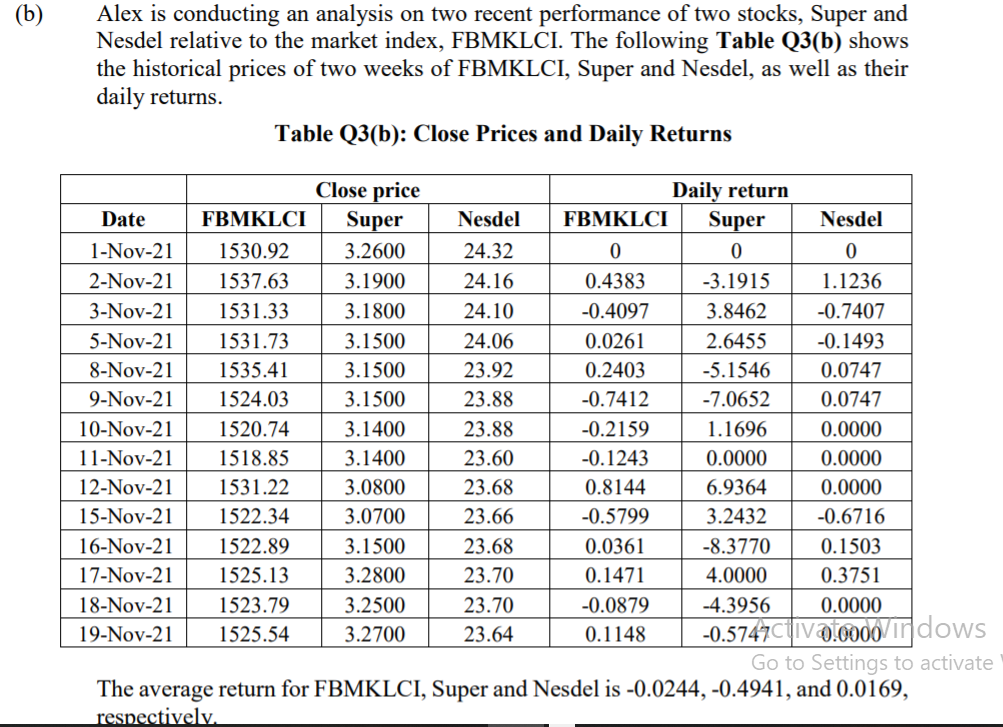

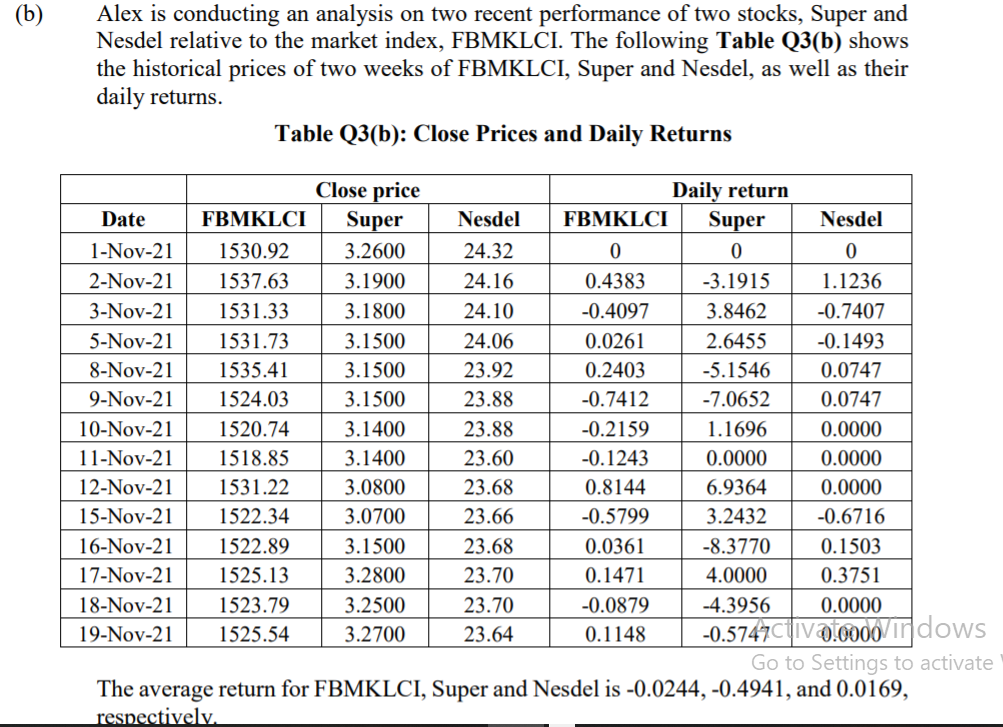

(b) Alex is conducting an analysis on two recent performance of two stocks, Super and Nesdel relative to the market index, FBMKLCI. The following Table Q3(b) shows the historical prices of two weeks of FBMKLCI, Super and Nesdel, as well as their daily returns. Table Q3(b): Close Prices and Daily Returns Close price Daily return Date FBMKLCI Super Nesdel FBMKLCI Super Nesdel 1-Nov-21 1530.92 3.2600 24.32 0 0 0 2-Nov-21 1537.63 3.1900 24.16 0.4383 -3.1915 1.1236 3-Nov-21 1531.33 3.1800 24.10 -0.4097 3.8462 -0.7407 5-Nov-21 1531.73 3.1500 24.06 0.0261 2.6455 -0.1493 8-Nov-21 1535.41 3.1500 23.92 0.2403 -5.1546 0.0747 9-Nov-21 1524.03 3.1500 23.88 -0.7412 -7.0652 0.0747 10-Nov-21 1520.74 3.1400 23.88 -0.2159 1.1696 0.0000 11-Nov-21 1518.85 3.1400 23.60 -0.1243 0.0000 0.0000 12-Nov-21 1531.22 3.0800 23.68 0.8144 6.9364 0.0000 15-Nov-21 1522.34 3.0700 23.66 -0.5799 3.2432 -0.6716 16-Nov-21 1522.89 3.1500 23.68 0.0361 -8.3770 0.1503 17-Nov-21 1525.13 3.2800 23.70 0.1471 4.0000 0.3751 18-Nov-21 1523.79 3.2500 23.70 -0.0879 -4.3956 0.0000 19-Nov-21 1525.54 3.2700 23.64 0.1148 Go to Settings to activate The average return for FBMKLCI, Super and Nesdel is -0.0244,-0.4941, and 0.0169, respectively. -0.5747ctiv.000/ indows (ii) Compute the beta coefficient of each stock relative to the FBMKLCI. (a) Super and FBMKLCI (b) Nesdel and FBMKLCI 3 (iii) Recommend which stock would Alex prefer to invest based on your calculations in Q3(b)(ii). (2 marks) (b) Alex is conducting an analysis on two recent performance of two stocks, Super and Nesdel relative to the market index, FBMKLCI. The following Table Q3(b) shows the historical prices of two weeks of FBMKLCI, Super and Nesdel, as well as their daily returns. Table Q3(b): Close Prices and Daily Returns Close price Daily return Date FBMKLCI Super Nesdel FBMKLCI Super Nesdel 1-Nov-21 1530.92 3.2600 24.32 0 0 0 2-Nov-21 1537.63 3.1900 24.16 0.4383 -3.1915 1.1236 3-Nov-21 1531.33 3.1800 24.10 -0.4097 3.8462 -0.7407 5-Nov-21 1531.73 3.1500 24.06 0.0261 2.6455 -0.1493 8-Nov-21 1535.41 3.1500 23.92 0.2403 -5.1546 0.0747 9-Nov-21 1524.03 3.1500 23.88 -0.7412 -7.0652 0.0747 10-Nov-21 1520.74 3.1400 23.88 -0.2159 1.1696 0.0000 11-Nov-21 1518.85 3.1400 23.60 -0.1243 0.0000 0.0000 12-Nov-21 1531.22 3.0800 23.68 0.8144 6.9364 0.0000 15-Nov-21 1522.34 3.0700 23.66 -0.5799 3.2432 -0.6716 16-Nov-21 1522.89 3.1500 23.68 0.0361 -8.3770 0.1503 17-Nov-21 1525.13 3.2800 23.70 0.1471 4.0000 0.3751 18-Nov-21 1523.79 3.2500 23.70 -0.0879 -4.3956 0.0000 19-Nov-21 1525.54 3.2700 23.64 0.1148 Go to Settings to activate The average return for FBMKLCI, Super and Nesdel is -0.0244,-0.4941, and 0.0169, respectively. -0.5747ctiv.000/ indows (ii) Compute the beta coefficient of each stock relative to the FBMKLCI. (a) Super and FBMKLCI (b) Nesdel and FBMKLCI 3 (iii) Recommend which stock would Alex prefer to invest based on your calculations in Q3(b)(ii). (2 marks)