Answered step by step

Verified Expert Solution

Question

1 Approved Answer

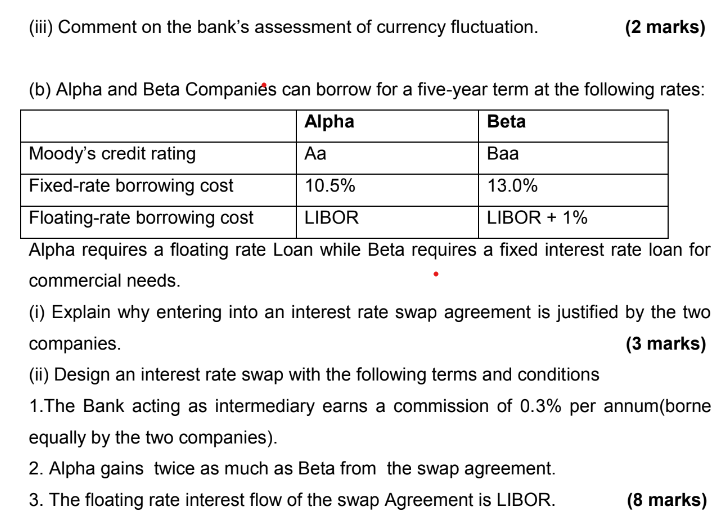

( b ) Alpha and Beta Compani s can borrow for a five - year term at the following rates: Alpha Beta Moody s credit

b Alpha and Beta Companis can borrow for a fiveyear term at the following rates:

Alpha Beta

Moodys credit rating Aa Baa

Fixedrate borrowing cost

Floatingrate borrowing cost LIBOR LIBOR

Alpha requires a floating rate Loan while Beta requires a fixed interest rate loan for

commercial needs.

i Explain why entering into an interest rate swap agreement is justified by the two companies.

marks

ii Design an interest rate swap with the following terms and conditions

The Bank acting as intermediary earns a commission of per annumborne equally by the two companies

Alpha gains twice as much as Beta from the swap agreement.

The floating rate interest flow of the swap Agreement is LIBOR.

marks

iii Comment on the bank's assessment of currency fluctuation.

marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started