Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(b) Assume a bank makes a loan commitment to the value of $10 million at a fixed interest rate of 10% per annum for

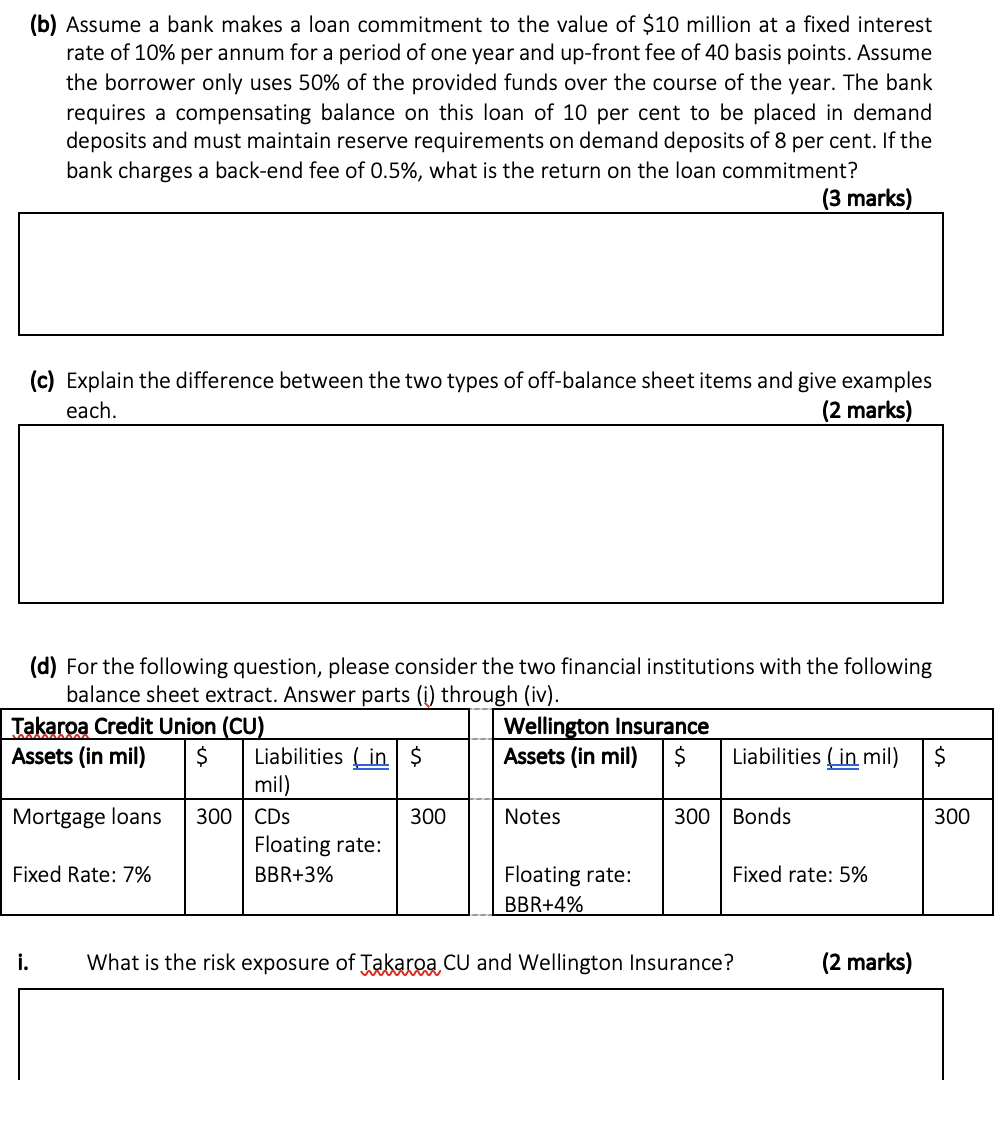

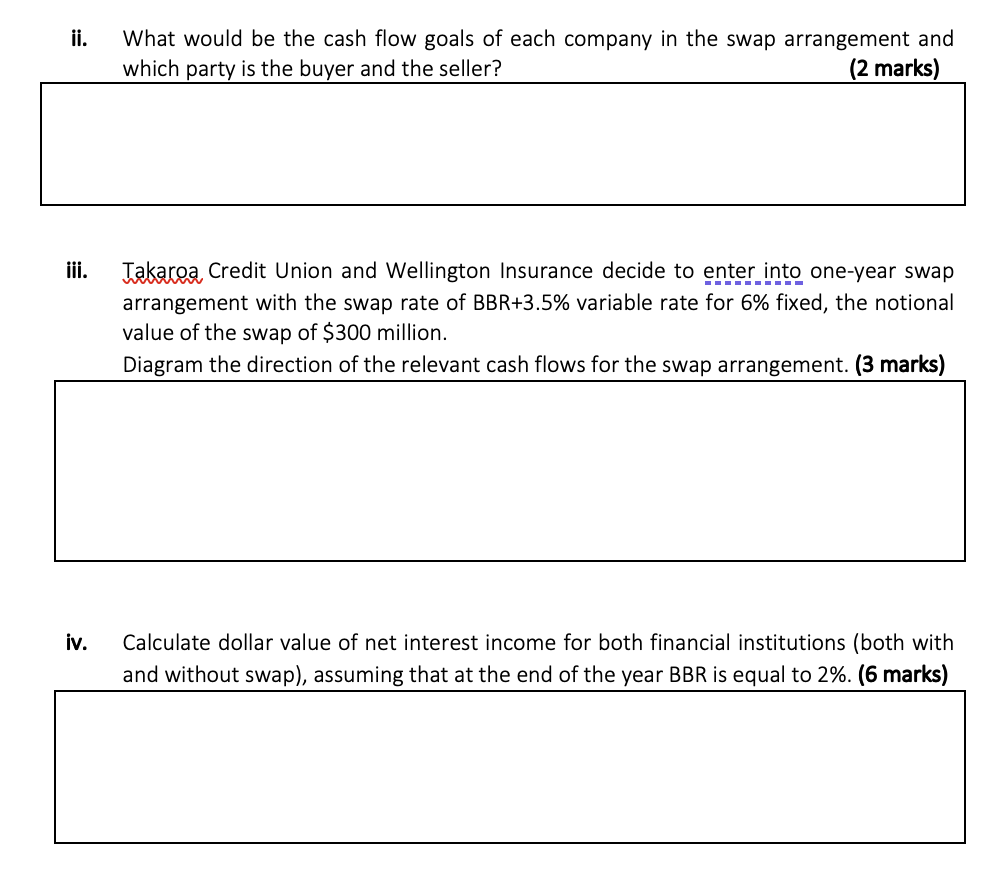

(b) Assume a bank makes a loan commitment to the value of $10 million at a fixed interest rate of 10% per annum for a period of one year and up-front fee of 40 basis points. Assume the borrower only uses 50% of the provided funds over the course of the year. The bank requires a compensating balance on this loan of 10 per cent to be placed in demand deposits and must maintain reserve requirements on demand deposits of 8 per cent. If the bank charges a back-end fee of 0.5%, what is the return on the loan commitment? (3 marks) (c) Explain the difference between the two types of off-balance sheet items and give examples each. (2 marks) (d) For the following question, please consider the two financial institutions with the following balance sheet extract. Answer parts (i) through (iv). Takaroa Credit Union (CU) Assets (in mil) $ Liabilities in $ Wellington Insurance Assets (in mil) $ Liabilities (in mil) $ Mortgage loans mil) 300 CDs 300 Notes 300 Bonds 300 Fixed Rate: 7% Floating rate: BBR+3% Floating rate: BBR+4% Fixed rate: 5% i. What is the risk exposure of Takaroa CU and Wellington Insurance? (2 marks) ii. What would be the cash flow goals of each company in the swap arrangement and which party is the buyer and the seller? (2 marks) iii. Takaroa Credit Union and Wellington Insurance decide to enter into one-year swap arrangement with the swap rate of BBR+3.5% variable rate for 6% fixed, the notional value of the swap of $300 million. Diagram the direction of the relevant cash flows for the swap arrangement. (3 marks) iv. Calculate dollar value of net interest income for both financial institutions (both with and without swap), assuming that at the end of the year BBR is equal to 2%. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started