Question

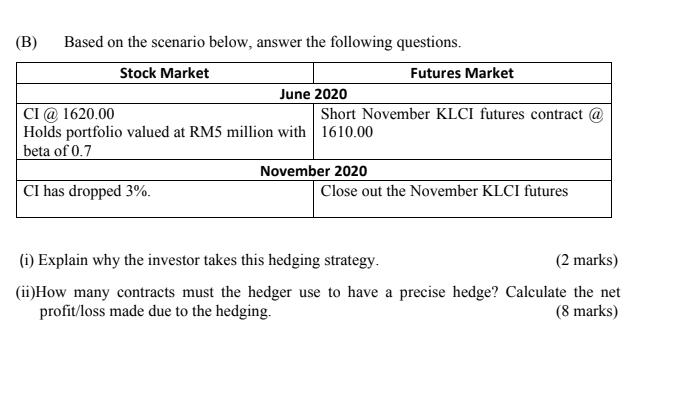

(B) Based on the scenario below, answer the following questions. Stock Market Futures Market June 2020 CI @ 1620.00 Holds portfolio valued at RM5

(B) Based on the scenario below, answer the following questions. Stock Market Futures Market June 2020 CI @ 1620.00 Holds portfolio valued at RM5 million with 1610.00 beta of 0.7 Short November KLCI futures contract @ November 2020 CI has dropped 3%. Close out the November KLCI futures (i) Explain why the investor takes this hedging strategy. (2 marks) (ii)How many contracts must the hedger use to have a precise hedge? Calculate the net profit/loss made due to the hedging. (8 marks)

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer The invetor has RM 5Million with beta of 070 To have a Precise hedge or complete hedge the In...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Business Essentials

Authors: Ronald J. Ebert, Ricky W. Griffin

10th edition

978-0133454420, 133454428, 978-0133771558

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App