Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b) Book Ltd has a total market value of 125 lakhs (5 lakh shares of Rs.25 market value per share). Pencil Ltd has a

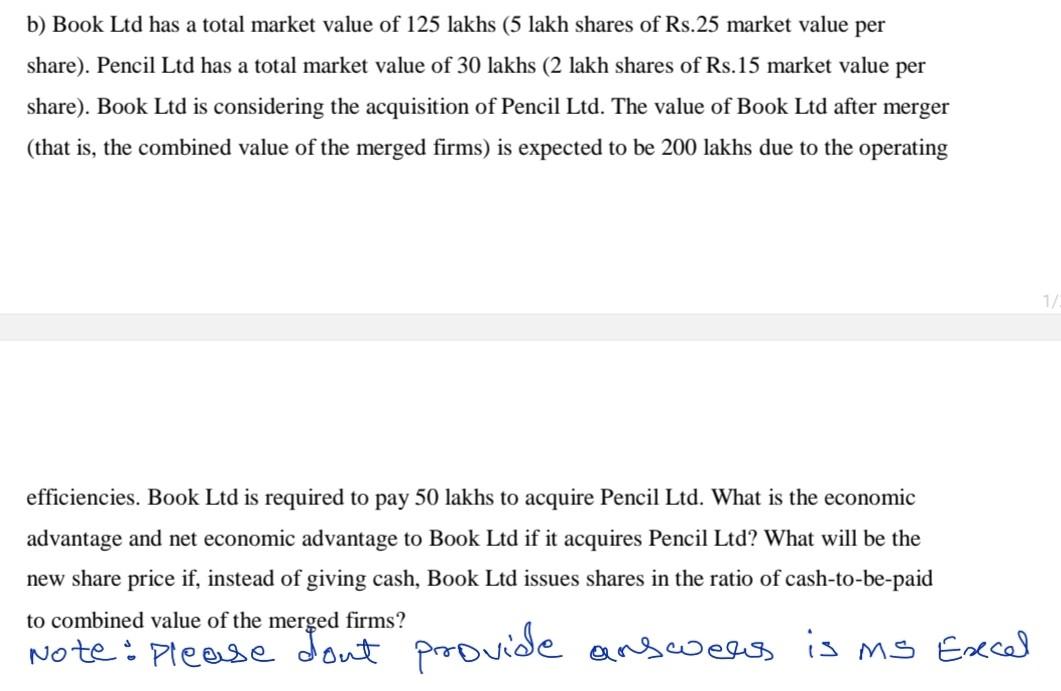

b) Book Ltd has a total market value of 125 lakhs (5 lakh shares of Rs.25 market value per share). Pencil Ltd has a total market value of 30 lakhs (2 lakh shares of Rs.15 market value per share). Book Ltd is considering the acquisition of Pencil Ltd. The value of Book Ltd after merger (that is, the combined value of the merged firms) is expected to be 200 lakhs due to the operating efficiencies. Book Ltd is required to pay 50 lakhs to acquire Pencil Ltd. What is the economic advantage and net economic advantage to Book Ltd if it acquires Pencil Ltd? What will be the new share price if, instead of giving cash, Book Ltd issues shares in the ratio of cash-to-be-paid to combined value of the merged firms? Note: Please dont provide answers is ms Excel

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the value of Pencil Ltd after the merger with Book Ltd we need to consider the relative ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started