Answered step by step

Verified Expert Solution

Question

1 Approved Answer

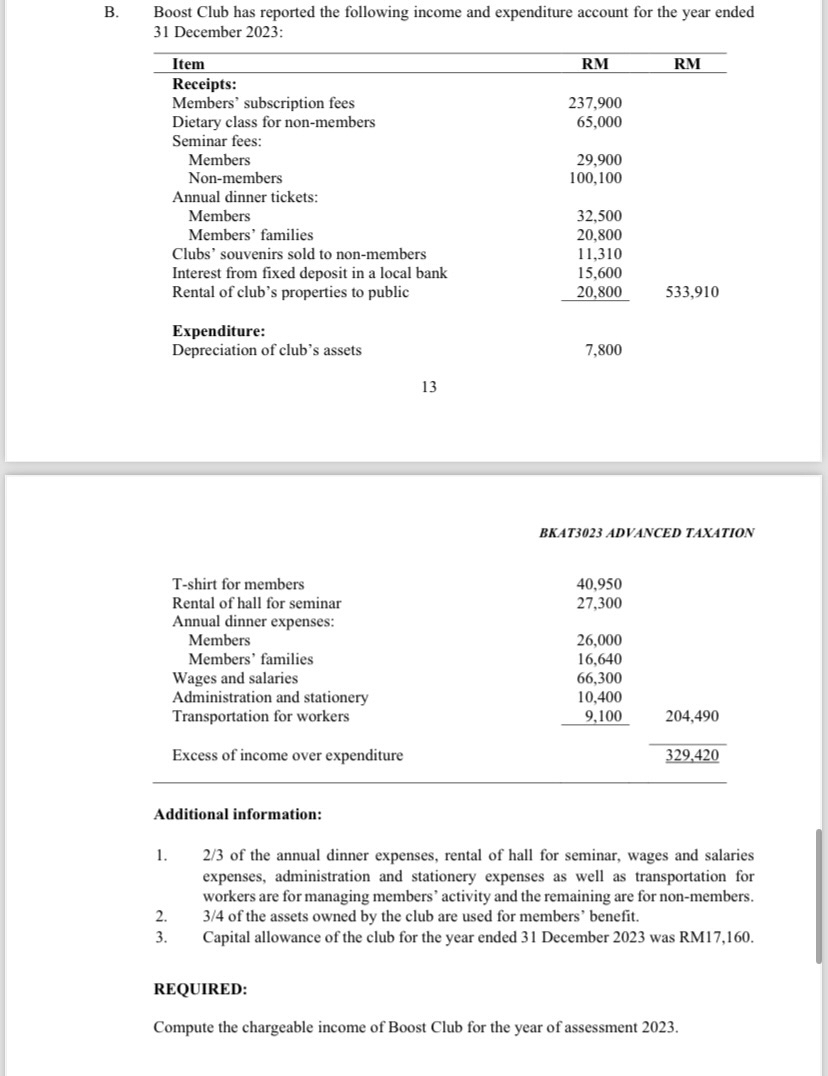

B. Boost Club has reported the following income and expenditure account for the year ended 31 December 2023: 1. Item Receipts: Members' subscription fees

B. Boost Club has reported the following income and expenditure account for the year ended 31 December 2023: 1. Item Receipts: Members' subscription fees Dietary class for non-members Seminar fees: 2. 3. Members Non-members Annual dinner tickets: Members Members' families Clubs' souvenirs sold to non-members Interest from fixed deposit in a local bank Rental of club's properties to public Expenditure: Depreciation of club's assets T-shirt for members Rental of hall for seminar Annual dinner expenses: Members Members' families Additional information: Wages and salaries Administration and stationery Transportation for workers Excess of income over expenditure 13 REQUIRED: RM 237,900 65,000 29,900 100,100 32,500 20,800 11,310 15,600 20,800 7,800 40,950 27,300 RM BKAT3023 ADVANCED TAXATION 26,000 16,640 66,300 10,400 9,100 533,910 204,490 329,420 2/3 of the annual dinner expenses, rental of hall for seminar, wages and salaries expenses, administration and stationery expenses as well as transportation for workers are for managing members' activity and the remaining are for non-members. 3/4 of the assets owned by the club are used for members' benefit. Capital allowance of the club for the year ended 31 December 2023 was RM17,160. Compute the chargeable income of Boost Club for the year of assessment 2023.

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To compute the chargeable income of Boost Club for the year of assessment 2023 we need to follow these steps 1 Calculate Gross Income Members subscription fees RM237900 Dietary class for nonmembers RM...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started