Answered step by step

Verified Expert Solution

Question

1 Approved Answer

B. Builder (Pty.) Ltd. is a construction company whose year end is 31 December. Contract no. 100 was started on 1 May 2006 and

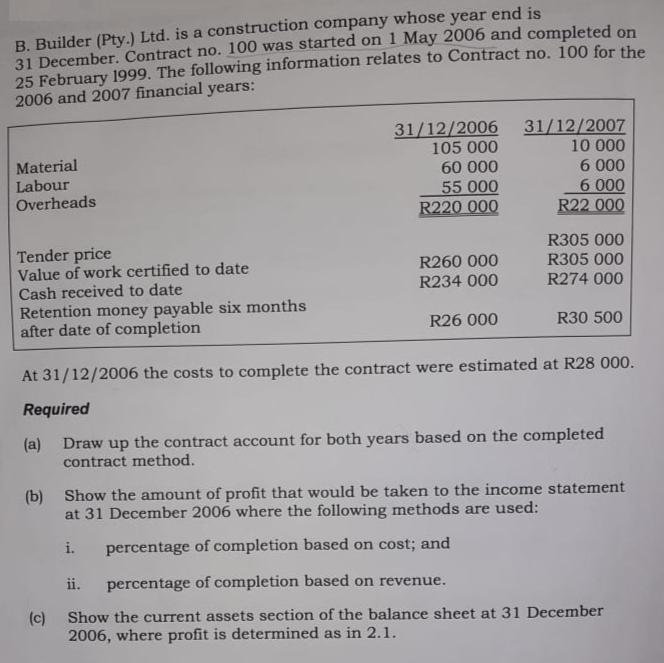

B. Builder (Pty.) Ltd. is a construction company whose year end is 31 December. Contract no. 100 was started on 1 May 2006 and completed on 25 February 1999. The following information relates to Contract no. 100 for the 2006 and 2007 financial years: Material Labour Overheads Tender price Value of work certified to date Cash received to date Retention money payable six months after date of completion 31/12/2006 105 000 60 000 55 000 R220 000 R260 000 R234 000 R26 000 31/12/2007 10 000 6 000 6 000 R22 000 R305 000 R305 000 R274 000 R30 500 At 31/12/2006 the costs to complete the contract were estimated at R28 000. Required (a) Draw up the contract account for both years based on the completed contract method. (b) Show the amount of profit that would be taken to the income statement at 31 December 2006 where the following methods are used: i. percentage of completion based on cost; and ii. percentage of completion based on revenue. (c) Show the current assets section of the balance sheet at 31 December 2006, where profit is determined as in 2.1.

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a CONTRACT 100 2006 Jan 1 Balance bd May 1 Material 105000 Labour 60000 Overheads 55000 Nov 1 Value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started