Answered step by step

Verified Expert Solution

Question

1 Approved Answer

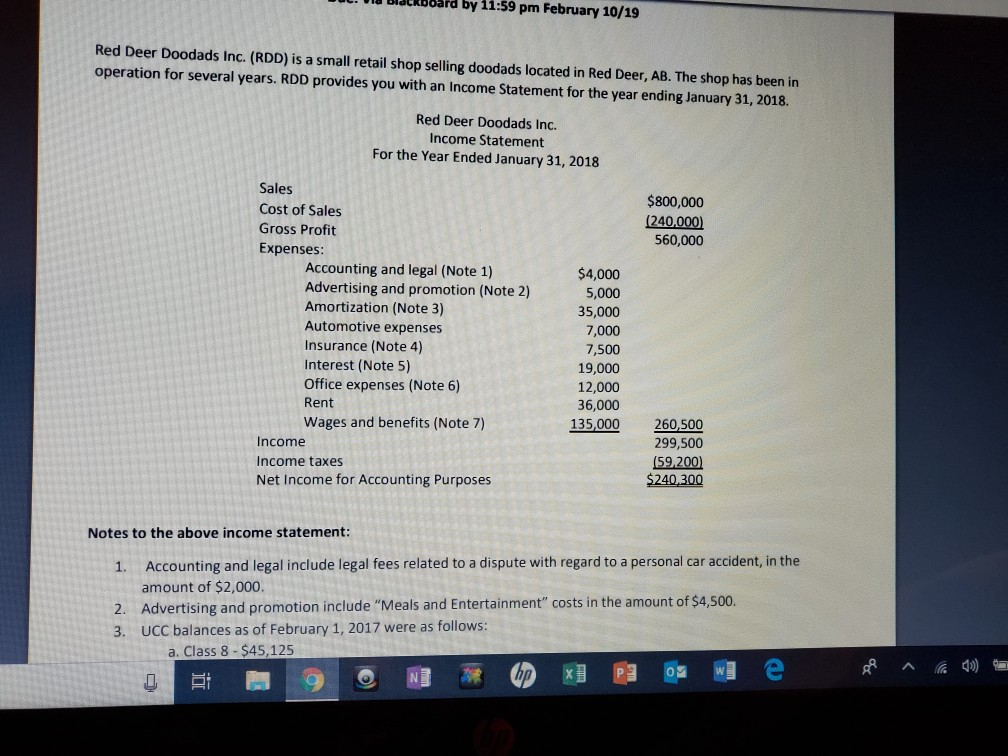

B by pm February 10/19 ackboard a 11:59 Red Deer Doodads Inc. (RDD) is a small retail shop selling doodads located in Red Deer, AB.

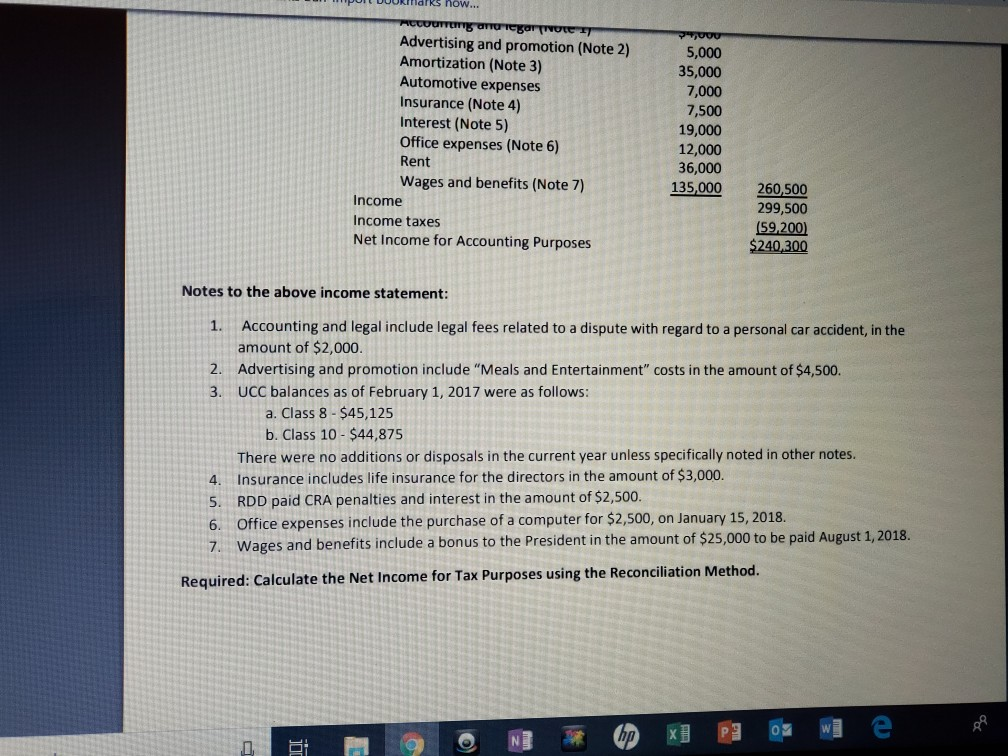

B by pm February 10/19 ackboard a 11:59 Red Deer Doodads Inc. (RDD) is a small retail shop selling doodads located in Red Deer, AB. The shop has been in operation for several years. RDD provides you with an Income Statement for the year ending January 31, 2018. Red Deer Doodads Inc. Income Statement For the Year Ended January 31, 2018 Sales Cost of Sales Gross Profit Expenses $800,000 (240,000 560,000 Accounting and legal (Note 1) Advertising and promotion (Note 2) Amortization (Note 3) Automotive expenses Insurance (Note 4) Interest (Note 5) Office expenses (Note 6) Rent Wages and benefits (Note 7) $4,000 5,000 35,000 7,000 7,500 19,000 12,000 36,000 135,000 Income Income taxes Net Income for Accounting Purposes 260,500 299,500 (59,200 $240,300 Notes to the above income statement Accounting and legal include legal fees related to a dispute with regard to a personal car accident, in the amount of $2,000. Advertising and promotion include "Meals and Entertainment" costs in the amount of $4,500. UCC balances as of February 1, 2017 were as follows: 1. 2. 3. a. Class 8 $45,125 gi DUURTldFRS how... Advertising and promotion (Note 2) Amortization (Note 3) Automotive expenses Insurance (Note 4) Interest (Note 5) Office expenses (Note 6) Rent Wages and benefits (Note 7) 5,000 35,000 7,000 7,500 19,000 12,000 36,000 Income Income taxes Net Income for Accounting Purposes 135,000 260,500 299,500 (59.200) $240,300 Notes to the above income statement: Accounting and legal include legal fees related to a dispute with regard to a personal car accident, in the amount of $2,000. Advertising and promotion include "Meals and Entertainment" costs in the amount of $4,500. UCC balances as of February 1, 2017 were as follows: 1. 2. 3. a. Class 8-$45,125 4. 5. 6. 7. b. Class 10-$44,875 There were no additions or disposals in the current year unless specifically noted in other notes. Insurance includes life insurance for the directors in the amount of $3,000. RDD paid CRA penalties and interest in the amount of $2,500 Office expenses include the purchase of a computer for $2,500, on January 15, 2018. Wages and benefits include a bonus to the President in the amount of $25,000 to be paid August 1, 2018. Required: Calculate the Net Income for Tax Purposes using the Reconciliation Method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started