Answered step by step

Verified Expert Solution

Question

1 Approved Answer

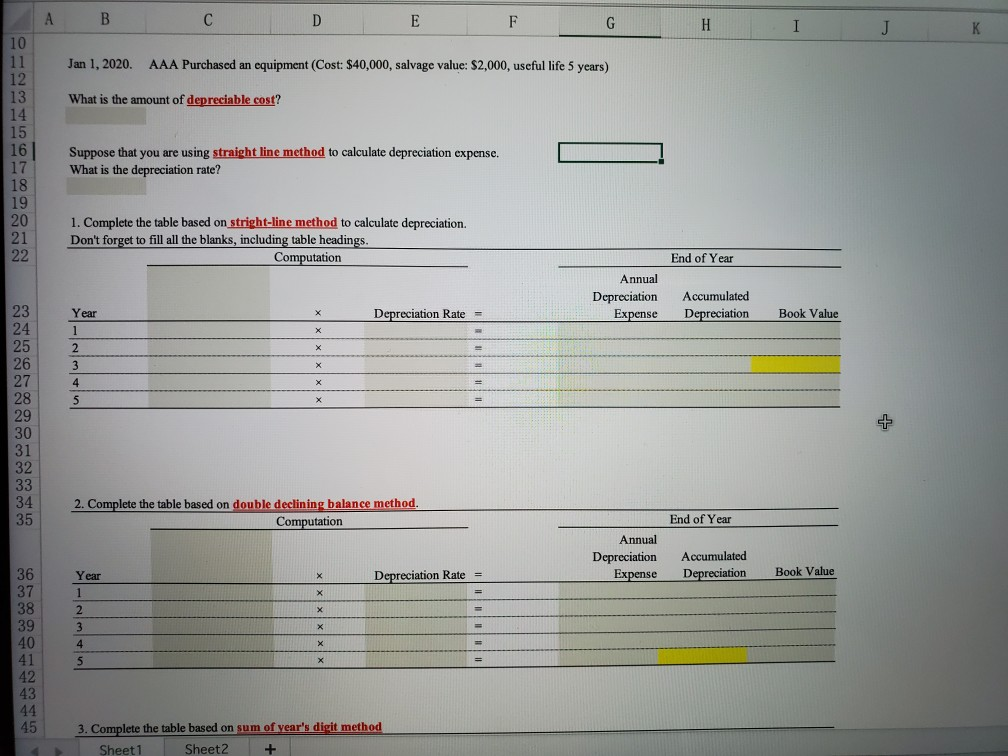

B C D E F G H I K Jan 1, 2020. AAA Purchased an equipment (Cost: $40,000, salvage value: $2,000, useful life 5 years)

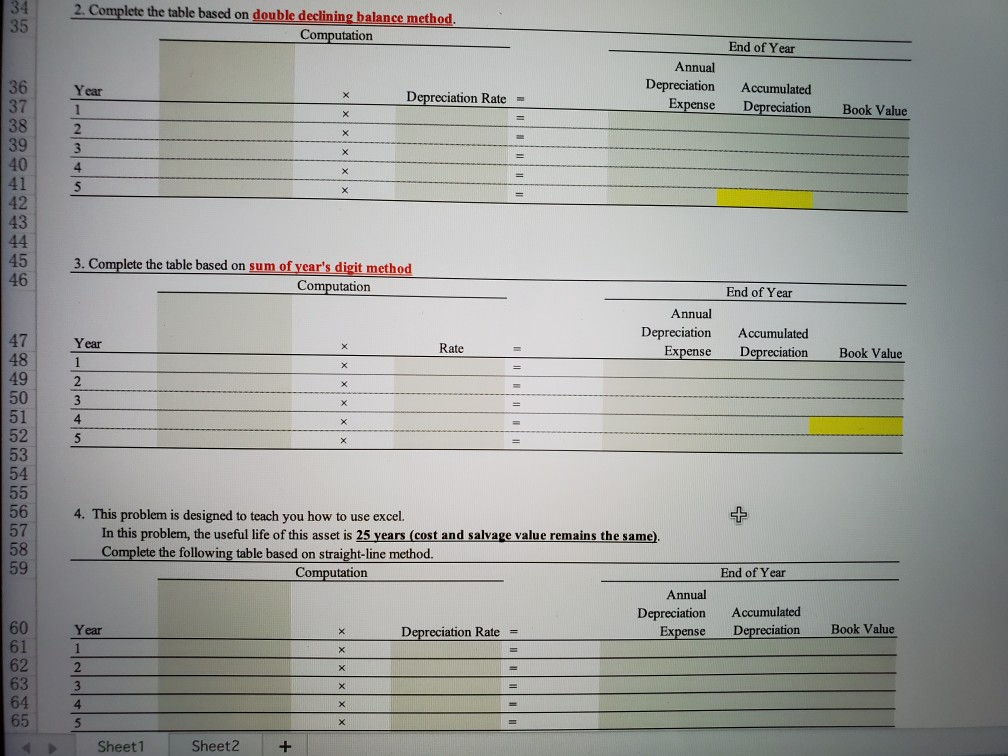

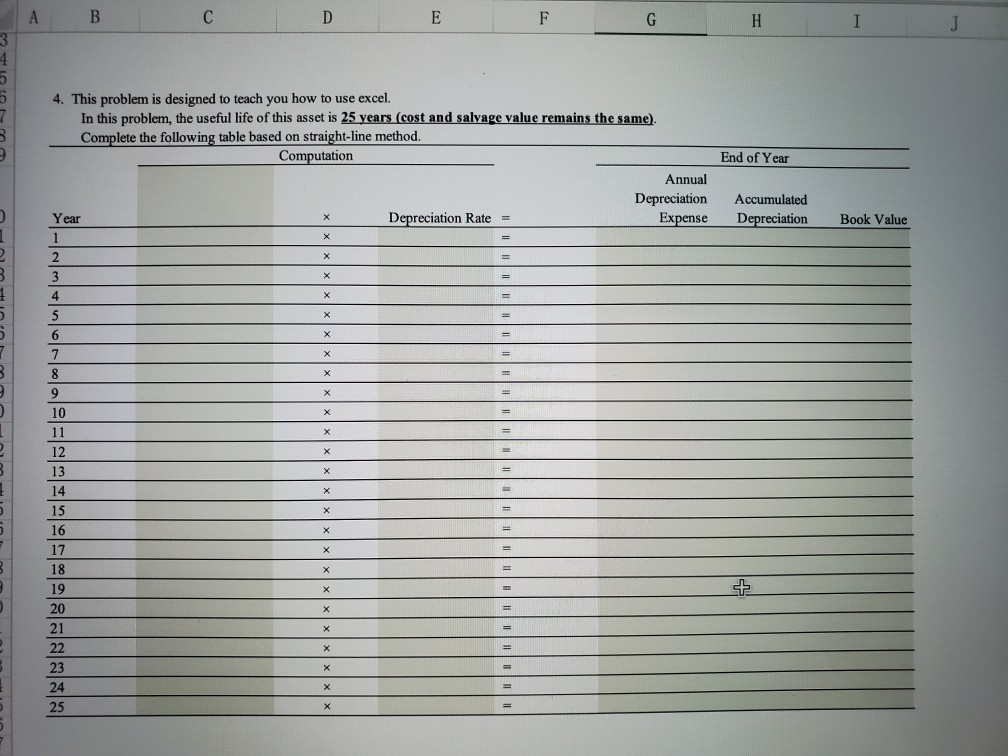

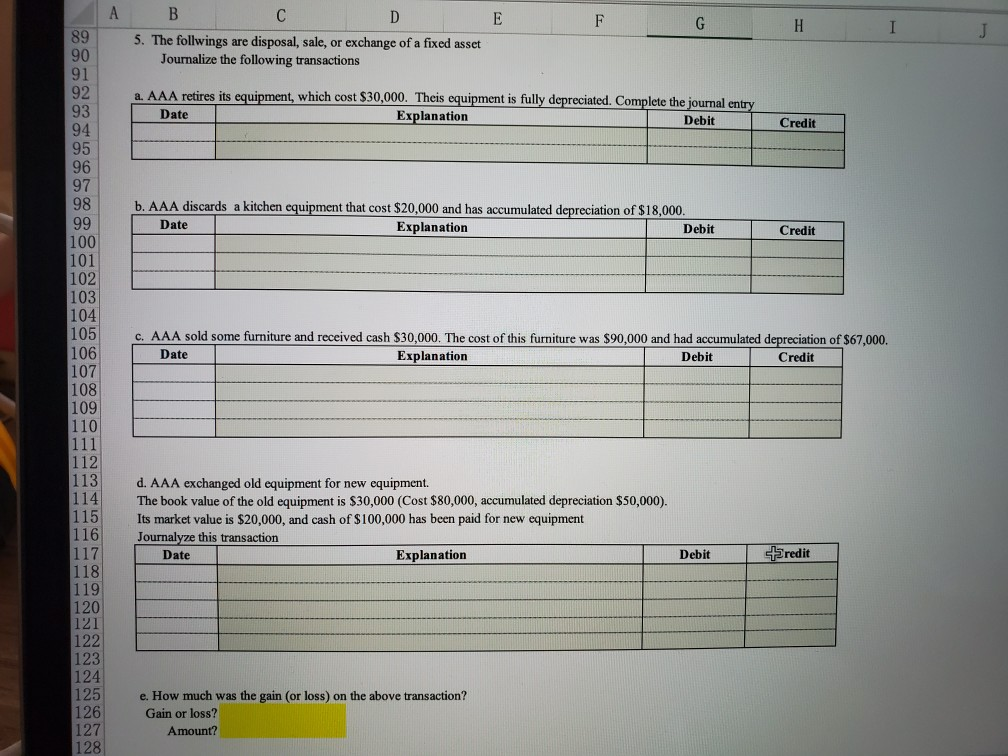

B C D E F G H I K Jan 1, 2020. AAA Purchased an equipment (Cost: $40,000, salvage value: $2,000, useful life 5 years) What is the amount of depreciable cost? 10 11 12 13 14 15 16 17 18 19 20 21 22 Suppose that you are using straight line method to calculate depreciation expense. What is the depreciation rate? 1. Complete the table based on stright-line method to calculate depreciation. Don't forget to fill all the blanks, including table headings. Computation End of Year Annual Depreciation Expense Accumulated Depreciation Year Depreciation Rate = Book Value 23 24 25 26 27 x lult/w/N-K X 28 X 29 30 31 32 33 34 35 2. Complete the table based on double declining balance method. Computation End of Year Annual Depreciation Expense Accumulated Depreciation Year X Depreciation Rate = Book Value 1 X = X X 36 37 38 39 40 41 42 43 44 45 2 3 4 5 3. Complete the table based on sum of year's digit method Sheet1 Sheet2 + 34 35 2. Complete the table based on double declining balance method. Computation End of Year Year Annual Depreciation Expense X Depreciation Rate = Accumulated Depreciation Book Value X X 2 3 4 X - 36 37 38 39 40 41 42 43 44 45 46 5 3. Complete the table based on sum of year's digit method Computation End of Year Annual Depreciation Expense Year Rate Accumulated Depreciation Book Value X 2 3 4 5 X 47 48 49 50 51 52 53 54 55 56 57 58 59 4. This problem is designed to teach you how to use excel. In this problem, the useful life of this asset is 25 years (cost and salvage value remains the same). Complete the following table based on straight-line method. Computation Annual Depreciation Year Depreciation Rate = Expense End of Year Accumulated Depreciation Book Value 1 X X 60 61 62 63 64 65 X = 2 3 4 5 X Sheet1 Sheet2 + B D E F G H I J 3 4 4. This problem is designed to teach you how to use excel. In this problem, the useful life of this asset is 25 years (cost and salvage value remains the same). Complete the following table based on straight-line method. Computation Annual Depreciation Year Depreciation Rate = Expense End of Year Accumulated Depreciation X Book Value 1 X = X 2 3 X = 1 4 x = 5 X 6 X 3 x X X X 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 X X X X X X X X A E F G H I B C D 5. The follwings are disposal, sale, or exchange of a fixed asset Journalize the following transactions J a. AAA retires its equipment, which cost $30,000. Theis equipment is fully depreciated. Complete the journal entry Date Explanation Debit Credit 89 90 91 92 93 94 95 96 97 98 99 100 101 102 b. AAA discards a kitchen equipment that cost $20,000 and has accumulated depreciation of $18,000. Date Explanation Debit Credit 103 104 105 106 c. AAA sold some furniture and received cash $30,000. The cost of this furniture was $90,000 and had accumulated depreciation of $67,000. Date Explanation Debit Credit 107 108 109 110 111 112 113 114 115 d. AAA exchanged old equipment for new equipment. The book value of the old equipment is $30,000 (Cost $80,000, accumulated depreciation $50,000). Its market value is $20,000, and cash of $100,000 has been paid for new equipment Journalyze this transaction Date Explanation Debit redit 116 117 118 119 120 121 122 123 124 125 126 127 128 e. How much was the gain (or loss) on the above transaction? Gain or loss? Amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started