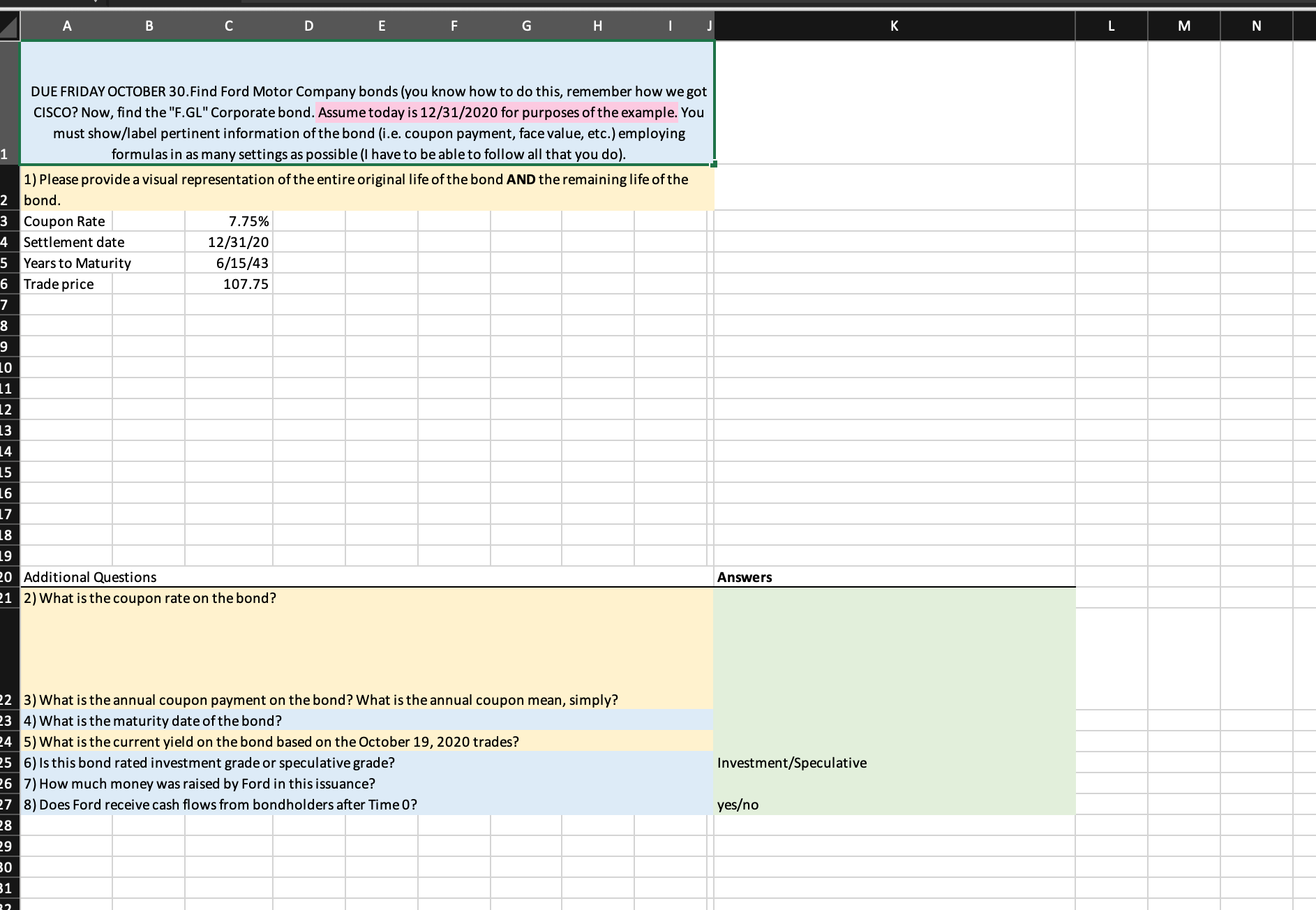

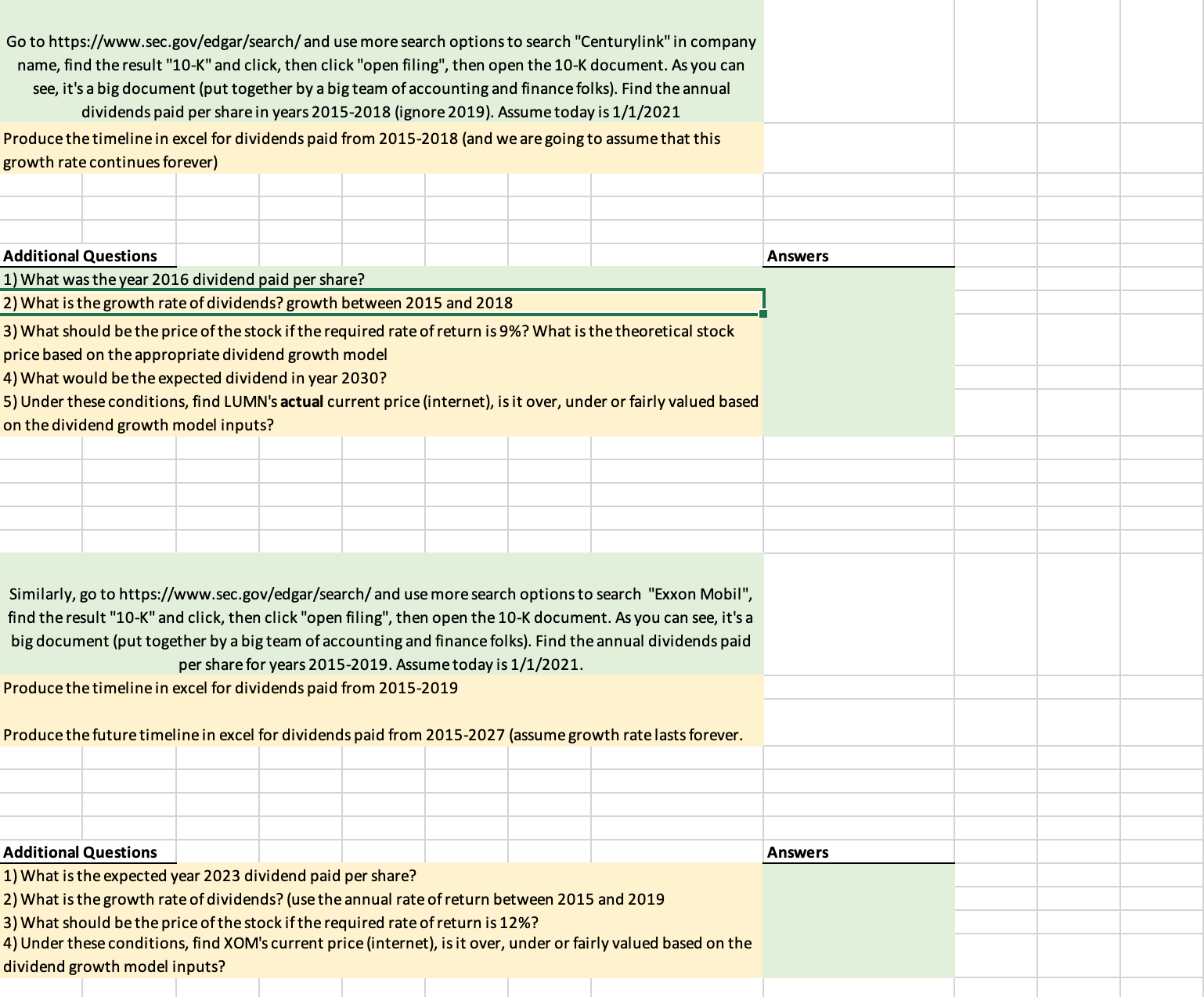

B C D E F G H M N DUE FRIDAY OCTOBER 30. Find Ford Motor Company bonds (you know how to do this, remember how we got CISCO? Now, find the "F.GL" Corporate bond. Assume today is 12/31/2020 for purposes of the example. You must show/label pertinent information of the bond (i.e. coupon payment, face value, etc.) employing formulas in as many settings as possible (I have to be able to follow all that you do). 1) Please provide a visual representation of the entire original life of the bond AND the remaining life of the bond. Coupon Rate 7.75% Settlement date 12/31/20 Years to Maturity 6/15/43 Trade price 107.75 Additional Questions Answers 2) What is the coupon rate on the bond? 3) What is the annual coupon payment on the bond? What is the annual coupon mean, simply? 4) What is the maturity date of the bond? 5) What is the current yield on the bond based on the October 19, 2020 trades? 6) Is this bond rated investment grade or speculative grade? Investment/Speculative 7) How much money was raised by Ford in this issuance? 8) Does Ford receive cash flows from bondholders after Time 0? yesoGo to https://www.sec.gov/edgar/search/ and use more search options to search "Centurylink" in company name, find the result "10-K" and click, then click "open filing", then open the 10-K document. As you can see, it's a big document (put together by a big team of accounting and finance folks). Find the annual dividends paid per share in years 2015-2018 (ignore 2019). Assume today is 1/1/2021 Produce the timeline in excel for dividends paid from 2015-2018 (and we are going to assume that this growth rate continues forever) Additional Questions Answers 1) What was the year 2016 dividend paid per share? 2) What is the growth rate of dividends? growth between 2015 and 2018 3) What should be the price of the stock if the required rate of return is 9%? What is the theoretical stock price based on the appropriate dividend growth model 4) What would be the expected dividend in year 2030? 5) Under these conditions, find LUMN's actual current price (internet), is it over, under or fairly valued based on the dividend growth model inputs? Similarly, go to https://www.sec.gov/edgar/search/ and use more search options to search "Exxon Mobil", find the result "10-K" and click, then click "open filing", then open the 10-K document. As you can see, it's a big document (put together by a big team of accounting and finance folks). Find the annual dividends paid per share for years 2015-2019. Assume today is 1/1/2021. Produce the timeline in excel for dividends paid from 2015-2019 Produce the future timeline in excel for dividends paid from 2015-2027 (assume growth rate lasts forever. Additional Questions Answers 1) What is the expected year 2023 dividend paid per share? 2) What is the growth rate of dividends? (use the annual rate of return between 2015 and 2019 3) What should be the price of the stock if the required rate of return is 12%? 4) Under these conditions, find XOM's current price (internet), is it over, under or fairly valued based on the dividend growth model inputs