Answered step by step

Verified Expert Solution

Question

1 Approved Answer

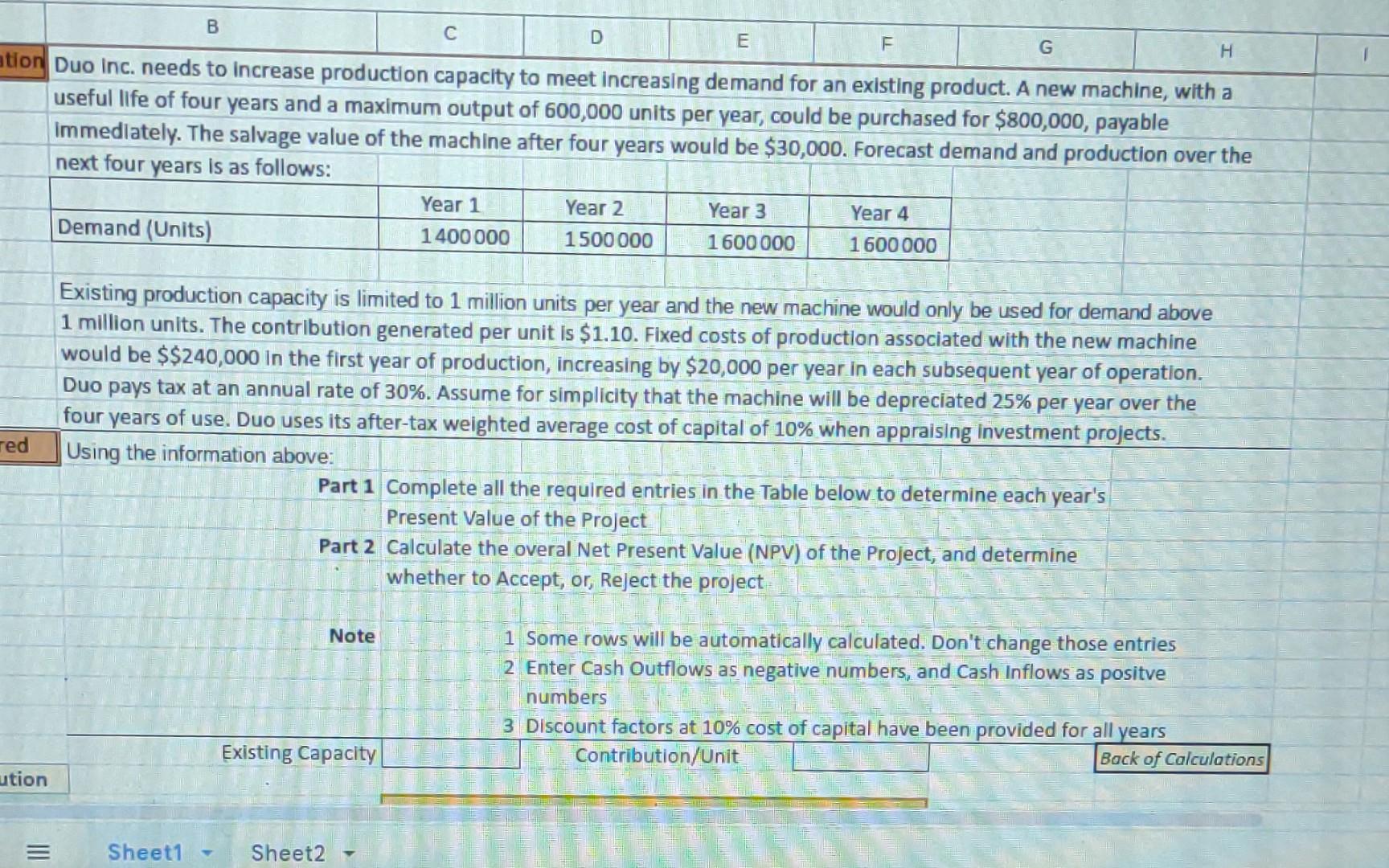

B C D E F G H tion Duo Inc. needs to increase production capacity to meet increasing demand for an existing product. A

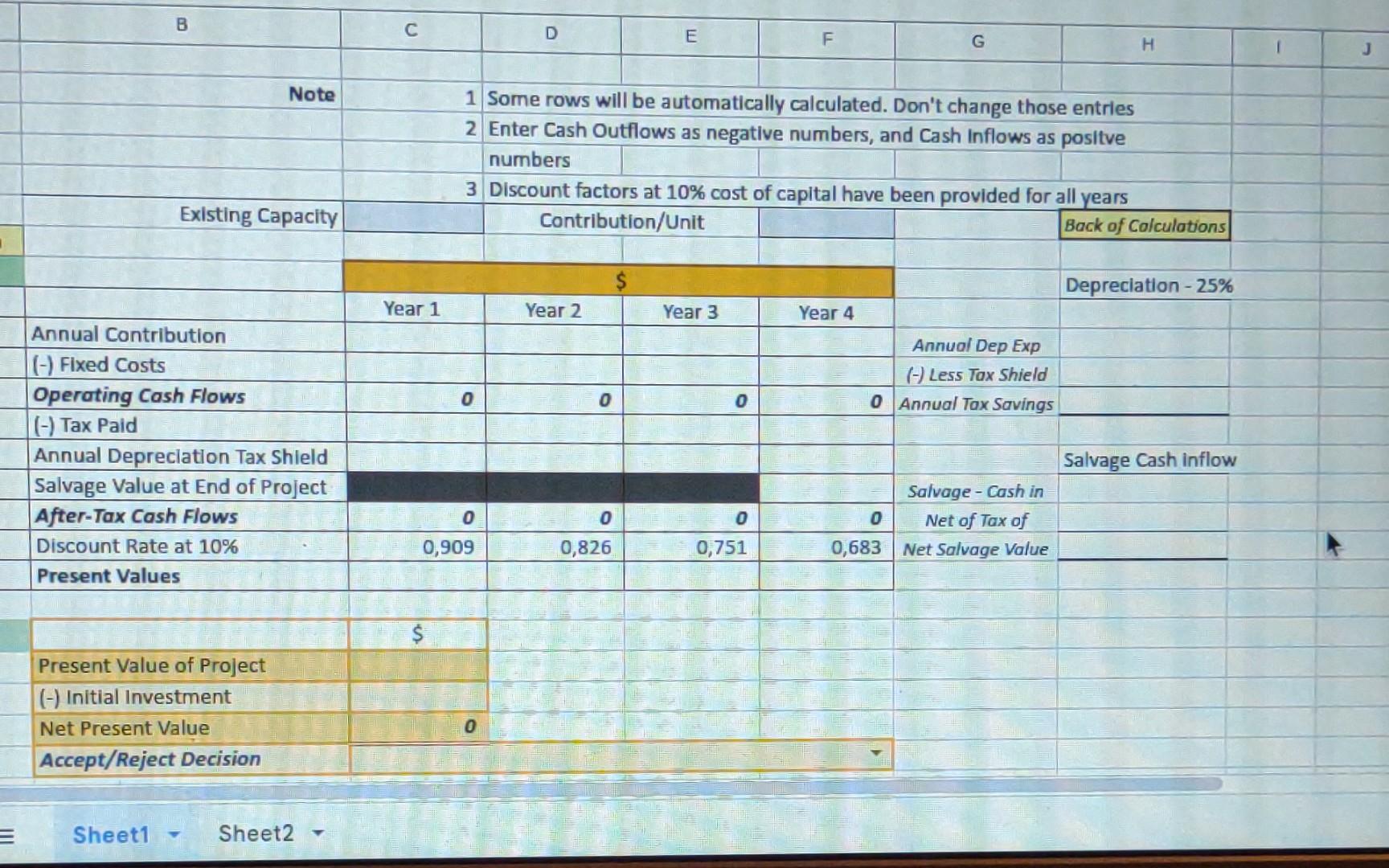

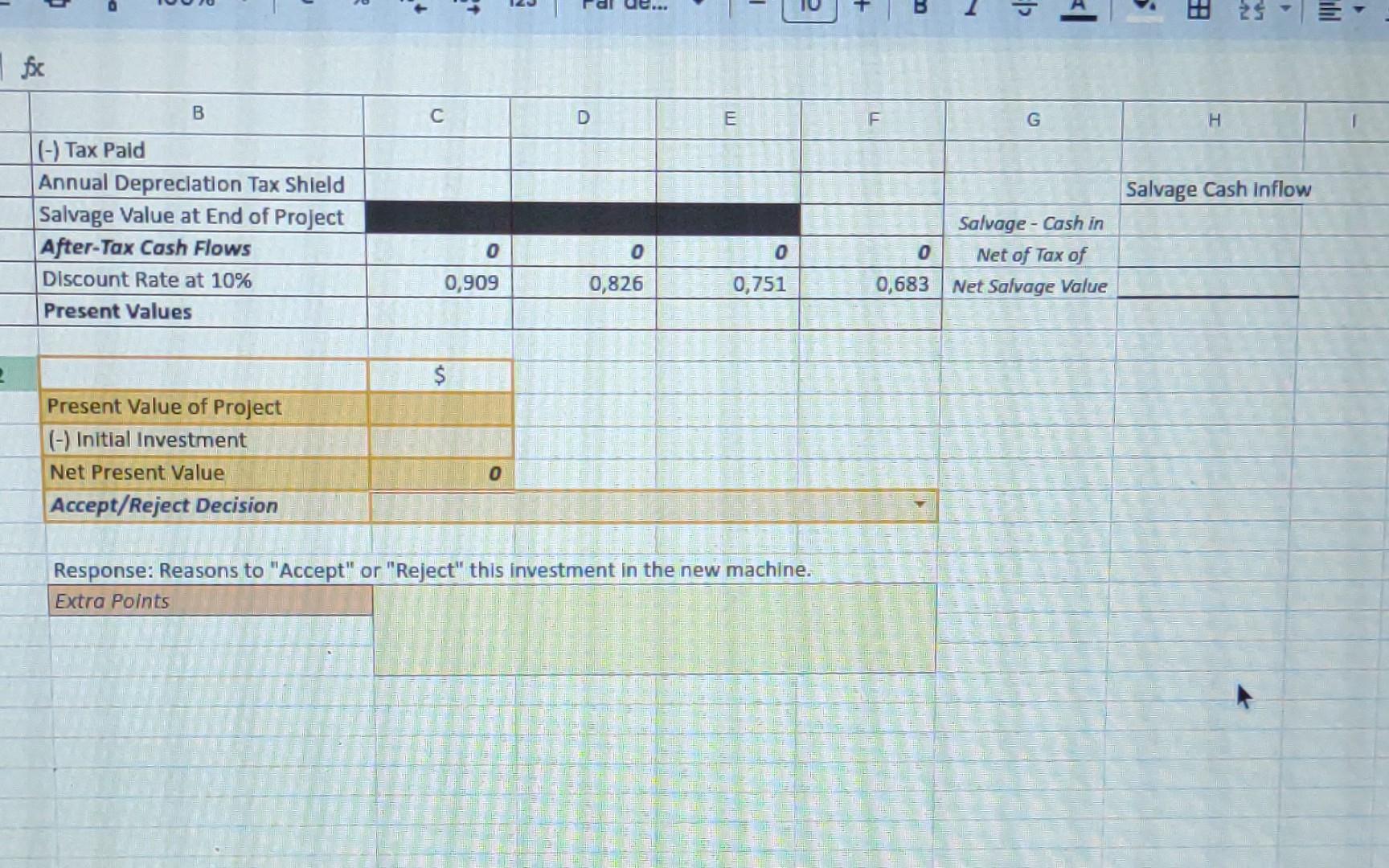

B C D E F G H tion Duo Inc. needs to increase production capacity to meet increasing demand for an existing product. A new machine, with a useful life of four years and a maximum output of 600,000 units per year, could be purchased for $800,000, payable Immediately. The salvage value of the machine after four years would be $30,000. Forecast demand and production over the next four years is as follows: Demand (Units) Year 1 1400000 Year 2 1500000 Year 3 1600000 Year 4 1600000 red Existing production capacity is limited to 1 million units per year and the new machine would only be used for demand above 1 million units. The contribution generated per unit is $1.10. Fixed costs of production associated with the new machine would be $$240,000 in the first year of production, increasing by $20,000 per year in each subsequent year of operation. Duo pays tax at an annual rate of 30%. Assume for simplicity that the machine will be depreciated 25% per year over the four years of use. Duo uses its after-tax weighted average cost of capital of 10% when appraising investment projects. Using the information above: Part 1 Complete all the required entries in the Table below to determine each year's Present Value of the Project Part 2 Calculate the overal Net Present Value (NPV) of the Project, and determine whether to Accept, or, Reject the project Note Existing Capacity 1 Some rows will be automatically calculated. Don't change those entries 2 Enter Cash Outflows as negative numbers, and Cash Inflows as positve numbers 3 Discount factors at 10% cost of capital have been provided for all years Contribution/Unit Back of Calculations ution = Sheet1 4 Sheet2 B Note Existing Capacity Annual Contribution (-) Fixed Costs Operating Cash Flows (-) Tax Paid Annual Depreciation Tax Shield Salvage Value at End of Project After-Tax Cash Flows Discount Rate at 10% Present Values Present Value of Project (-) Initial Investment Net Present Value Accept/Reject Decision Sheet1 Sheet2 C D E F G H J 1 Some rows will be automatically calculated. Don't change those entries 2 Enter Cash Outflows as negative numbers, and Cash Inflows as positve numbers 3 Discount factors at 10% cost of capital have been provided for all years Contribution/Unit $ Back of Calculations Year 1 Year 2 Depreciation-25% Year 3 Year 4 Annual Dep Exp 0 0 0 0 0,909 0,826 96 $ O 0 0,751 (-) Less Tax Shield 0 Annual Tax Savings 0 Salvage-Cash in Net of Tax of 0,683 Net Salvage Value Salvage Cash inflow D fxx (-) Tax Paid B Annual Depreciation Tax Shield Salvage Value at End of Project After-Tax Cash Flows Discount Rate at 10% Present Values C t Z P E 0 0,909 0,826 0,751 2 $ Present Value of Project (-) Initial Investment Net Present Value 0 Accept/Reject Decision Response: Reasons to "Accept" or "Reject" this investment in the new machine. Extra Points + F E | 7 G 0 Salvage-Cash in Net of Tax of 0,683 Net Salvage Value S H H 2 L Salvage Cash Inflow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started