Answered step by step

Verified Expert Solution

Question

1 Approved Answer

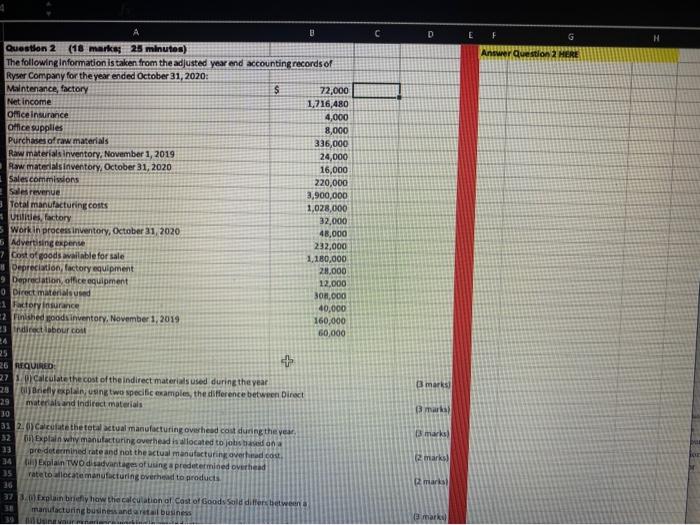

B C D E F Question 2 (18 marks; 25 minutes) The following information is taken from the adjusted year end accounting records of

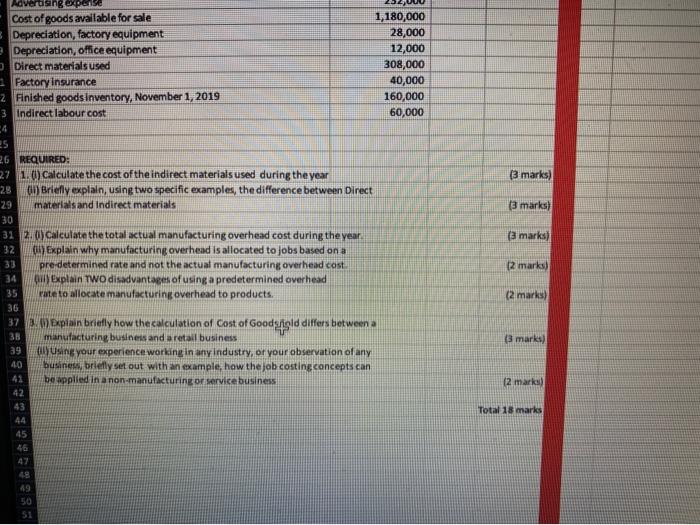

B C D E F Question 2 (18 marks; 25 minutes) The following information is taken from the adjusted year end accounting records of Ryser Company for the year ended October 31, 2020: Maintenance, factory Net income Office insurance Office supplies Purchases of raw materials Raw materials inventory, November 1, 2019 S 72,000 1,716,480 4,000 8,000 336,000 24,000 Raw materials inventory, October 31, 2020 Sales commissions 16,000 220,000 Sales revenue 3,900,000 Total manufacturing costs 1,028,000 Utilities, factory 32,000 5 Work in process inventory, October 31, 2020 48,000 Advertising expense 232,000 7 Cost of goods available for sale 1,180,000 Depreciation, factory equipment 9 Depreciation, office equipment 0 Direct materials used: 1 Factory Insurance 28,000 12,000 308,000 40,000 160,000 2 Finished goods inventory, November 1, 2019 3 indirect labour cost 60,000 24 25 + 26 REQUIRED: 2710)Calculate the cost of the indirect materials used during the year! marks) 28 Briefly explain, using two specific examples, the difference between Direct 29 materials and Indirect materials B marks) 30 32 33 31 2.0) Calculate the total actual manufacturing overhead cost during the year. Bi) Explain why manufacturing overhead is allocated to jobs based on a pre-determined rate and not the actual manufacturing overhead cost. (3 marks) (2 marks) 34 (i) Explain TWO disadvantages of using a predetermined overhead 35 rate to allocate manufacturing overhead to products (2 marks) 36 37 3.0) Explain briefly how the calculation of Cost of Goods Sold differs between a 38 manufacturing business and a retail business 39 marks) G Answer Question 2 HERE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started