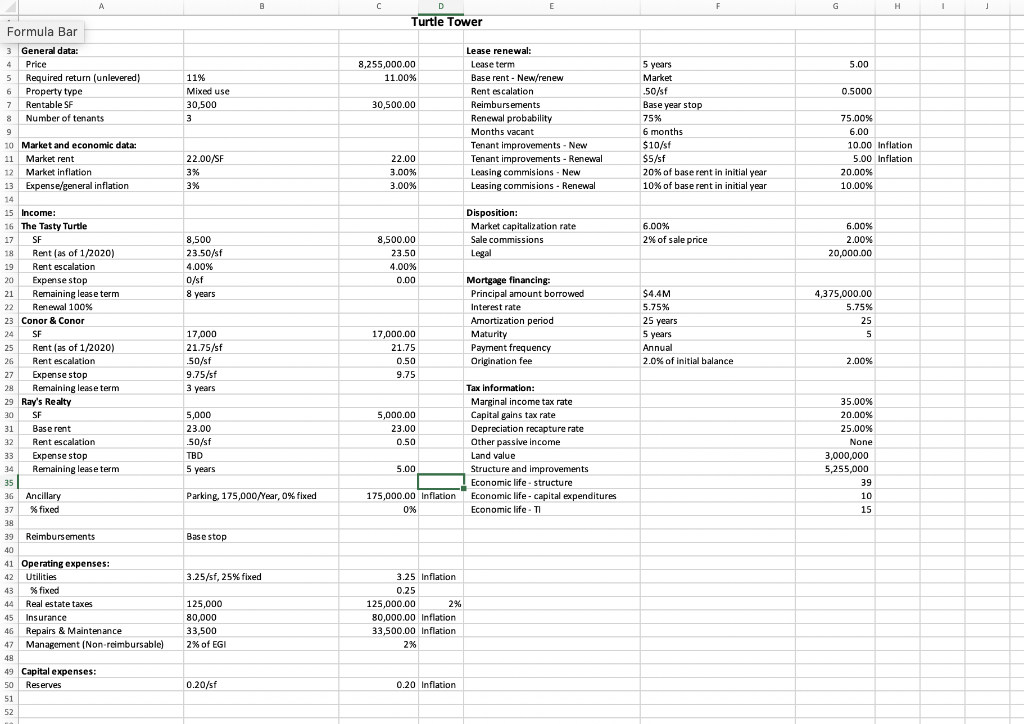

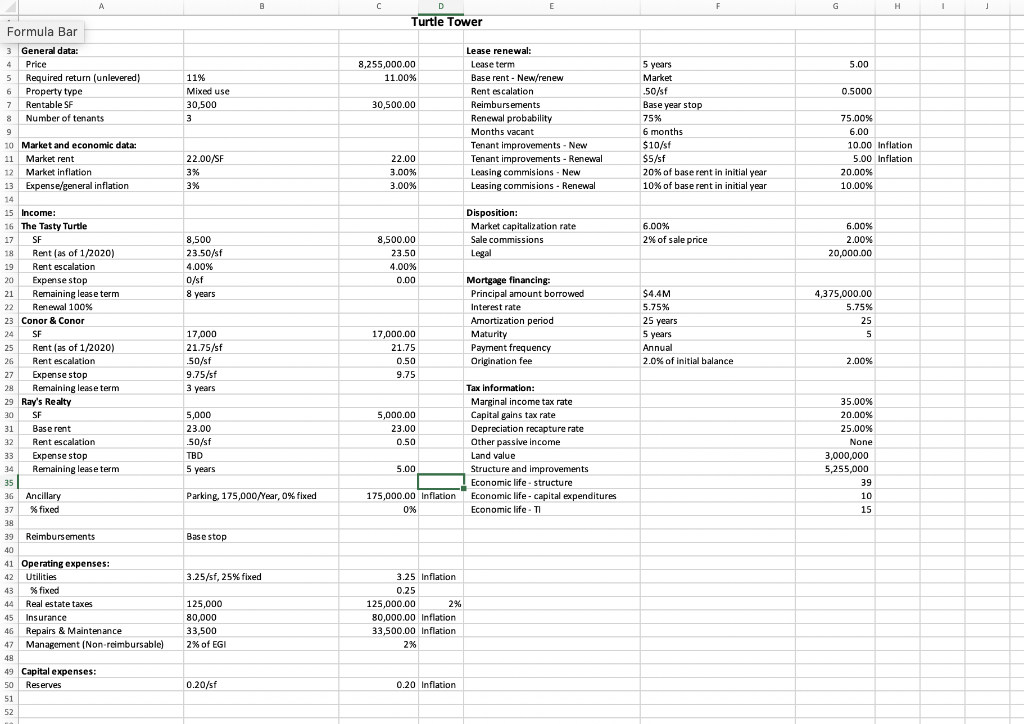

B C E G G H H 1 J D Turtle Tower Formula Bar 5.00 8,255,000.00 11.00% 11% Mixed use 30,500 0.5000 30,500.00 3 Lease renewal: Lease term Base rent - New/renew Rent escalation Reimbursements Renewal probability Months vacant Tenant improvements - New Tenant improvements - Renewal Leasing commisions - New Leasing commisions - Renewal 5 years Market .50/sf Base year stop 75% 6 months $10/st $5/sf 20% of base rent in initial year 10% of base rent in initial year 75.00% 6.00 10.00 Inflation 5.00 Inflation 20.00% 10.00% 22.00/SF 3% 3% 22.00 3.00% 3.00% Disposition: Market capitalization rate Sale commissions Legal 6.00% 2% of sale price 6.00% 2.00% 20,000.00 8,500 23.50/sf 4.00% 0/sf 8 years 8,500.00 23.50 4.00% 0.00 Mortgage financing: Principal amount borrowed Interest rate Amortization period Maturity Payment frequency Origination fee $4,4M 5.75% 25 years 4,375,000.00 5.75% 25 5 5 5 years 17,000 21.75/sf / 50/sf 9.75/st 3 years 17,000.00 21.75 0.50 9.75 Annual 2.0% of initial balance 3 General data: 4 Price 5 Required return (unlevered) 6 Property type 7 Rentable SF 8 Number of tenants 9 10 Market and economic data: 11 Market rent 12 Market inflation 13 Expense/general inflation 14 15 Income: 16 The Tasty Turtle 17 SF 18 Rent (as of 1/2020) 19 Rent escalation 20 Expense stop 21 Remaining lease term 22 Renewal 100% 23 Conor & Conor 24 SE 25 Rent (as of 1/2020) 26 Rent escalation 27 Expense stop 28 Remaining lease term 29 Ray's Realty 30 SF 31 Base rent 32 Rent escalation 33 Expense stop 34 Remaining lease term 35 36 Ancillary 37 % fixed 38 39 Reimbursements 40 41 Operating expenses: 42 Utilities 43 % fixed 44 Real estate taxes 45 Insurance 46 Repairs & Maintenance 47 Management (Non-reimbursable) 48 49 Capital expenses: 50 Reserves 51 52 2.00% 5,000 23.00 .50/sf TBD 5 years 5,000.00 23.00 0.50 Tax information: Marginal income tax rate Capital gains tax rate Depreciation recapture rate Other passive income Land value Structure and improvements Economic life-structure Economic life- capital expenditures Economic life - TI 35.00% 20.00% 25.00% None 3,000,000 5,255,000 39 10 15 5.00 moeten Parking, 175,000/Year 0% fixed 175,000.00 Inflation 0% Base stop 3.25/sf, 25% fixed 125,000 80,000 33,500 2% of EGI 3.25 Inflation 0.25 125,000.00 2% 80,000.00 Inflation 33,500.00 Inflation 2% 0.20/sf 0.20 Inflation A B C D E F G 1 H O 5 Market Rent 6 Turtle 7 C&C 8 Ray's 9 10 Potential rental income: 44 11 Turtle 12 C&C 4 13 Ray's 14 Potential gross income (PGI) 15 16 Vacancy allowance 17 Turtle 18 C&C 18 ce 19 Ray's 20 Total allowance 21 22 Vacancy 23 Occupancy 24 25 Effective gross income (EGI) 26 27 Reimbursements: 28 Turtle 29 Base stop 30 Reimbursement 31 C&C 32 Base stop 33 Reimbursement 34 Ray's 35 Base stop 36 Reimbursement 37 Total reimbursements 38 Parking 39 40 Total operating income 41 42 Expense information: 43 Utilities/st 44 Utilities 45 Real estate taxes 46 Insurance 47 Repairs & Maintenance 48 Total reimbursable expense 49 Total reimbursable expense/sf 50 51 Management expenses 52 53 Total operating expenses 54 Net operating income (NOI) 55 B C E G G H H 1 J D Turtle Tower Formula Bar 5.00 8,255,000.00 11.00% 11% Mixed use 30,500 0.5000 30,500.00 3 Lease renewal: Lease term Base rent - New/renew Rent escalation Reimbursements Renewal probability Months vacant Tenant improvements - New Tenant improvements - Renewal Leasing commisions - New Leasing commisions - Renewal 5 years Market .50/sf Base year stop 75% 6 months $10/st $5/sf 20% of base rent in initial year 10% of base rent in initial year 75.00% 6.00 10.00 Inflation 5.00 Inflation 20.00% 10.00% 22.00/SF 3% 3% 22.00 3.00% 3.00% Disposition: Market capitalization rate Sale commissions Legal 6.00% 2% of sale price 6.00% 2.00% 20,000.00 8,500 23.50/sf 4.00% 0/sf 8 years 8,500.00 23.50 4.00% 0.00 Mortgage financing: Principal amount borrowed Interest rate Amortization period Maturity Payment frequency Origination fee $4,4M 5.75% 25 years 4,375,000.00 5.75% 25 5 5 5 years 17,000 21.75/sf / 50/sf 9.75/st 3 years 17,000.00 21.75 0.50 9.75 Annual 2.0% of initial balance 3 General data: 4 Price 5 Required return (unlevered) 6 Property type 7 Rentable SF 8 Number of tenants 9 10 Market and economic data: 11 Market rent 12 Market inflation 13 Expense/general inflation 14 15 Income: 16 The Tasty Turtle 17 SF 18 Rent (as of 1/2020) 19 Rent escalation 20 Expense stop 21 Remaining lease term 22 Renewal 100% 23 Conor & Conor 24 SE 25 Rent (as of 1/2020) 26 Rent escalation 27 Expense stop 28 Remaining lease term 29 Ray's Realty 30 SF 31 Base rent 32 Rent escalation 33 Expense stop 34 Remaining lease term 35 36 Ancillary 37 % fixed 38 39 Reimbursements 40 41 Operating expenses: 42 Utilities 43 % fixed 44 Real estate taxes 45 Insurance 46 Repairs & Maintenance 47 Management (Non-reimbursable) 48 49 Capital expenses: 50 Reserves 51 52 2.00% 5,000 23.00 .50/sf TBD 5 years 5,000.00 23.00 0.50 Tax information: Marginal income tax rate Capital gains tax rate Depreciation recapture rate Other passive income Land value Structure and improvements Economic life-structure Economic life- capital expenditures Economic life - TI 35.00% 20.00% 25.00% None 3,000,000 5,255,000 39 10 15 5.00 moeten Parking, 175,000/Year 0% fixed 175,000.00 Inflation 0% Base stop 3.25/sf, 25% fixed 125,000 80,000 33,500 2% of EGI 3.25 Inflation 0.25 125,000.00 2% 80,000.00 Inflation 33,500.00 Inflation 2% 0.20/sf 0.20 Inflation A B C D E F G 1 H O 5 Market Rent 6 Turtle 7 C&C 8 Ray's 9 10 Potential rental income: 44 11 Turtle 12 C&C 4 13 Ray's 14 Potential gross income (PGI) 15 16 Vacancy allowance 17 Turtle 18 C&C 18 ce 19 Ray's 20 Total allowance 21 22 Vacancy 23 Occupancy 24 25 Effective gross income (EGI) 26 27 Reimbursements: 28 Turtle 29 Base stop 30 Reimbursement 31 C&C 32 Base stop 33 Reimbursement 34 Ray's 35 Base stop 36 Reimbursement 37 Total reimbursements 38 Parking 39 40 Total operating income 41 42 Expense information: 43 Utilities/st 44 Utilities 45 Real estate taxes 46 Insurance 47 Repairs & Maintenance 48 Total reimbursable expense 49 Total reimbursable expense/sf 50 51 Management expenses 52 53 Total operating expenses 54 Net operating income (NOI) 55